Proposed GOP Retirement Changes: A $420,000 Hit To Millennials?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Proposed GOP Retirement Changes: A $420,000 Hit to Millennials?

The Republican Party's proposed changes to retirement savings plans have sparked a firestorm of debate, with many analysts predicting a significant negative impact on younger generations, particularly Millennials. Could these changes translate to a potential $420,000 loss for the average Millennial over their lifetime? Let's delve into the details and examine the potential consequences.

The GOP's proposed changes, often framed as tax reforms, primarily focus on adjustments to retirement account contribution limits and tax benefits associated with 401(k)s and IRAs. While specific proposals vary, the core concern revolves around limiting or eliminating certain tax advantages currently enjoyed by those saving for retirement.

What are the proposed changes?

While the exact details are subject to change depending on the specific legislative proposals, the general concerns include:

- Reduced Contribution Limits: Some proposals suggest lowering the maximum annual contribution limits for 401(k)s and IRAs. This directly impacts the amount individuals can save tax-advantaged, hindering long-term growth.

- Tax Increases on Investment Growth: Another key concern is the potential increase in taxes on investment gains within retirement accounts. This effectively reduces the overall return on investment, impacting the final retirement nest egg.

- Elimination of Tax Deductions: Proposals to eliminate or reduce tax deductions associated with retirement contributions would further diminish the incentive to save aggressively. This makes saving less attractive, potentially leading to lower overall savings.

The $420,000 Question: How Will Millennials Be Affected?

Financial experts are warning that these changes could significantly impact Millennials' retirement prospects. The projected $420,000 loss is based on several factors, including:

- Lower Starting Savings: Millennials, already facing challenges such as student loan debt and a competitive housing market, may have lower initial savings compared to previous generations. Reductions in tax benefits will exacerbate this issue.

- Compounding Effect of Reduced Returns: The impact of reduced contribution limits and increased taxation is compounded over time due to the power of compound interest. Even small reductions in annual savings or returns can significantly affect the final retirement balance.

- Longer Retirement Spans: Millennials are expected to live longer than previous generations, necessitating larger retirement nest eggs to maintain their living standards. Reduced savings will amplify the risk of insufficient funds during retirement.

What Can Millennials Do?

Despite the potential negative impact of these proposed changes, Millennials are not powerless. Here are some strategies to mitigate the potential losses:

- Maximize Current Contributions: Before any changes are implemented, maximize contributions to tax-advantaged retirement accounts to take full advantage of current benefits.

- Diversify Investments: A diversified investment strategy can help mitigate the risk associated with potential tax increases. Consult a financial advisor for personalized advice.

- Engage in Political Discourse: Stay informed about legislative developments and voice your concerns to elected officials. Your active participation can influence future policy decisions.

Looking Ahead:

The proposed GOP retirement changes represent a significant potential challenge for Millennials' financial security. While the exact financial impact remains to be seen, the projected $420,000 loss underscores the urgency for both policymakers and individuals to address this issue proactively. Understanding the potential implications and taking appropriate steps now is crucial for securing a comfortable retirement in the future. It's vital to stay informed and engage in the ongoing discussion surrounding retirement planning and policy. This is a crucial topic impacting the future financial well-being of an entire generation.

(Note: The $420,000 figure is illustrative and based on projected scenarios. The actual impact will vary depending on individual circumstances and the specific details of any implemented legislation.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Proposed GOP Retirement Changes: A $420,000 Hit To Millennials?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

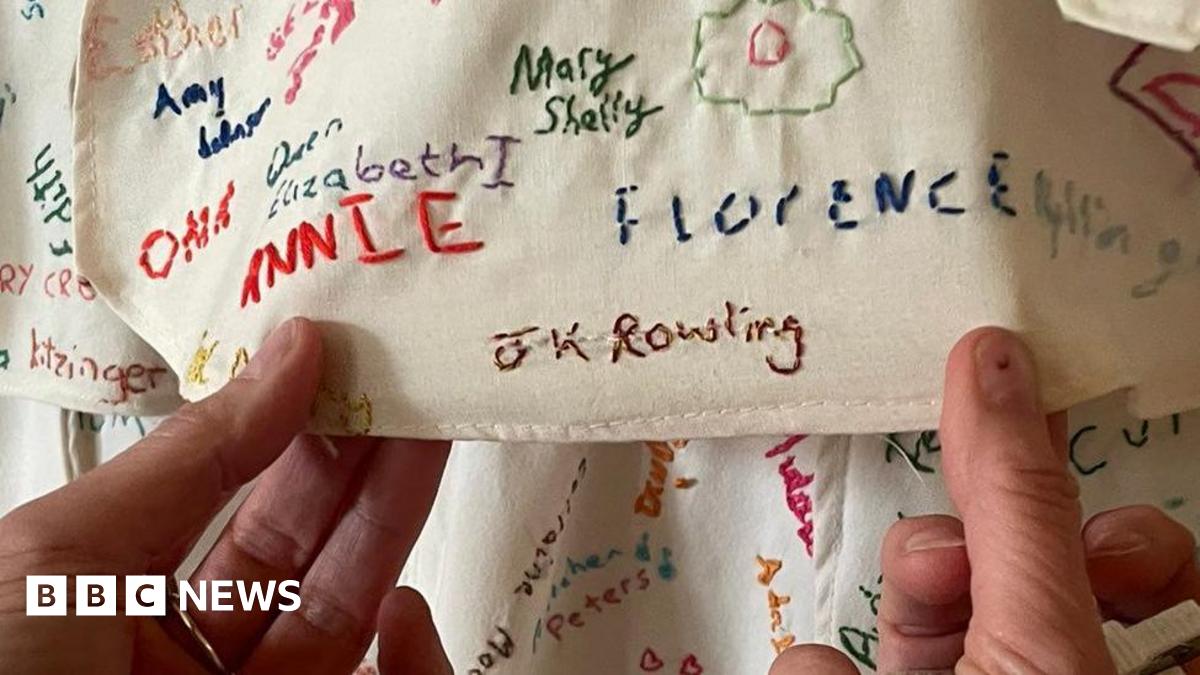

National Trust Responds To Allegations Of Concealed Damaged Artwork J K Rowling Connection

Jun 05, 2025

National Trust Responds To Allegations Of Concealed Damaged Artwork J K Rowling Connection

Jun 05, 2025 -

French Open 2025 Quarter Final Bubliks Las Vegas Boost Sets Up Sinner Showdown

Jun 05, 2025

French Open 2025 Quarter Final Bubliks Las Vegas Boost Sets Up Sinner Showdown

Jun 05, 2025 -

50 000 Theft Pontardawe Mother To Repay Stolen Funds From Daughters

Jun 05, 2025

50 000 Theft Pontardawe Mother To Repay Stolen Funds From Daughters

Jun 05, 2025 -

Lawsuit Update Blake Lively Discontinues Two Claims Against Justin Baldoni

Jun 05, 2025

Lawsuit Update Blake Lively Discontinues Two Claims Against Justin Baldoni

Jun 05, 2025 -

Portlands Energy Sector Instability Another Company Faces Closure

Jun 05, 2025

Portlands Energy Sector Instability Another Company Faces Closure

Jun 05, 2025

Latest Posts

-

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025 -

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025