Proposed GOP Retirement Cuts: How $420,000 Will Disappear For Millennials

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Proposed GOP Retirement Cuts: How $420,000 Could Vanish from Millennial Retirement Accounts

Millennials face a potential retirement crisis as proposed GOP cuts threaten to significantly reduce their retirement savings. A new wave of proposed Republican legislation aims to reshape the retirement landscape, and for younger generations like Millennials, the impact could be devastating. Experts predict that these cuts could lead to a loss of up to $420,000 per individual over a lifetime – a staggering blow to future financial security.

This article delves into the specifics of these proposed cuts, explores their potential consequences for Millennials, and offers strategies for navigating this uncertain financial future.

Understanding the Proposed Cuts

The core of the concern lies in proposed changes to various retirement savings plans. While the exact details vary depending on the specific legislative proposals, many focus on:

-

Reducing or eliminating tax benefits for retirement contributions: This could significantly diminish the incentive to save for retirement, especially for those already struggling with student loan debt and rising living costs. The current tax advantages offered on contributions to 401(k)s and IRAs are crucial for maximizing long-term growth. Reducing these benefits effectively shrinks the potential return on investment.

-

Increasing withdrawal penalties: Higher penalties for early withdrawals could discourage Millennials from accessing their retirement savings during emergencies, potentially jeopardizing their financial stability in unexpected situations.

-

Targeting specific retirement accounts: Some proposals directly target specific types of retirement accounts, potentially leaving certain demographics disproportionately affected.

These changes, if enacted, will have a ripple effect across the retirement system, impacting not only individual savings but also the overall economic outlook.

The $420,000 Question: A Millennial's Retirement at Risk

The figure of $420,000 represents a conservative estimate of the potential losses faced by Millennials due to these proposed cuts. This figure is based on projections factoring in reduced contribution incentives, lower investment returns due to decreased savings, and the increased impact of inflation over time. This loss represents a significant portion of a Millennial's projected retirement income, potentially leading to a significantly lower standard of living in retirement.

What Can Millennials Do?

While the legislative process unfolds, Millennials aren't powerless. There are proactive steps that can be taken to mitigate the potential impact of these cuts:

-

Maximize current contributions: Despite potential future changes, maximizing contributions to existing retirement accounts now is crucial. Even small increases can make a substantial difference over time.

-

Diversify investments: Spreading investments across various asset classes can help mitigate risk and potentially offset some of the impact of reduced tax benefits. Consult with a financial advisor to create a personalized investment strategy.

-

Explore alternative savings options: Consider exploring other savings vehicles, such as high-yield savings accounts or index funds, to supplement retirement savings.

-

Stay informed and engage: Stay updated on the legislative process and consider contacting your elected officials to express your concerns. Collective action can be a powerful tool in influencing policy decisions.

The Long-Term Impact

The long-term implications of these proposed cuts extend beyond individual finances. A less financially secure population of retirees could place a greater strain on social security and other government assistance programs, potentially impacting the entire economy. The proposed changes warrant careful consideration and thorough public debate.

Call to Action: Understanding the potential consequences of these proposed changes is the first step towards securing your financial future. Take the time to research the specific proposals affecting your state and engage in the political process to protect your retirement savings. Consider consulting a financial advisor to discuss your individual circumstances and develop a personalized plan.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Proposed GOP Retirement Cuts: How $420,000 Will Disappear For Millennials. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tom Daley Celebrating Identity From Diving Champion To Individual

Jun 04, 2025

Tom Daley Celebrating Identity From Diving Champion To Individual

Jun 04, 2025 -

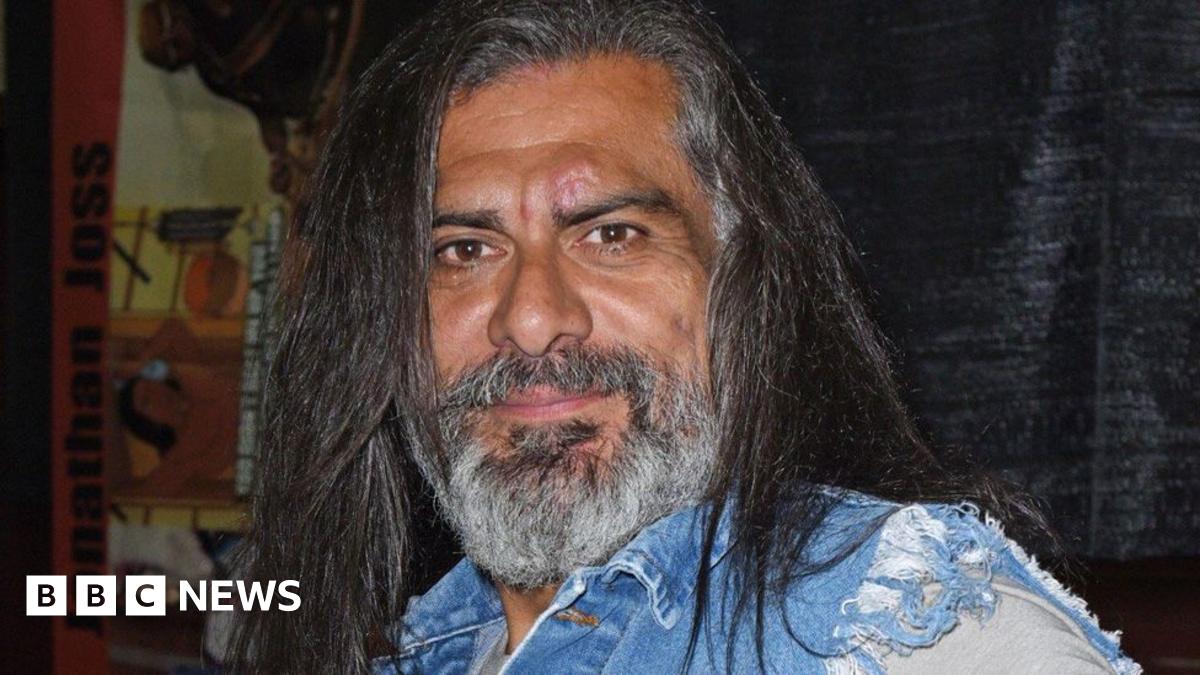

King Of The Hill Actor Jonathan Joss Dies After Shooting Incident

Jun 04, 2025

King Of The Hill Actor Jonathan Joss Dies After Shooting Incident

Jun 04, 2025 -

A1 Newcastle Police Investigate Crash Involving Detained Driver

Jun 04, 2025

A1 Newcastle Police Investigate Crash Involving Detained Driver

Jun 04, 2025 -

Tom Daley Opens Up About Growing Up Gay And Achieving Olympic Glory

Jun 04, 2025

Tom Daley Opens Up About Growing Up Gay And Achieving Olympic Glory

Jun 04, 2025 -

Lengthening Loan Terms Impact On First Time Homebuyers Mortgages

Jun 04, 2025

Lengthening Loan Terms Impact On First Time Homebuyers Mortgages

Jun 04, 2025

Latest Posts

-

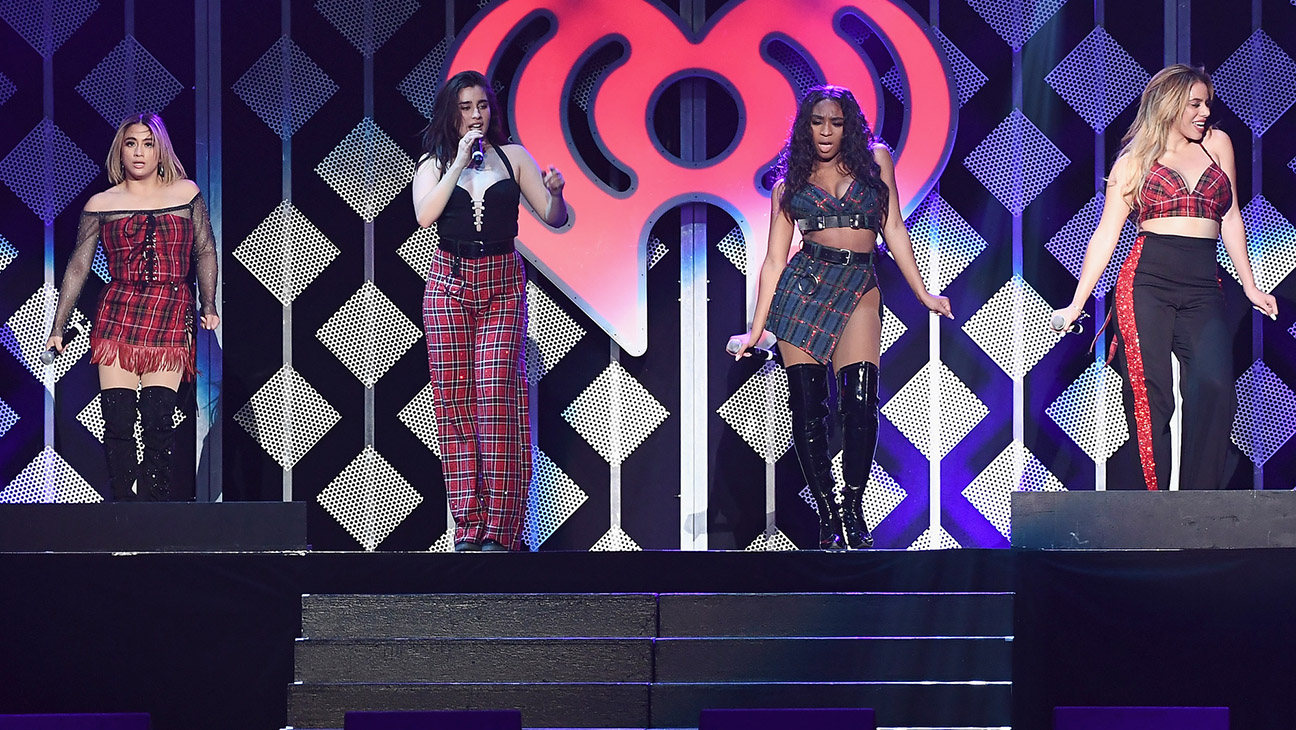

Exclusive Update Fifth Harmony Considering Reunion Without Cabello

Jun 06, 2025

Exclusive Update Fifth Harmony Considering Reunion Without Cabello

Jun 06, 2025 -

Applied Digitals Stock Soars 48 On Massive Ai Lease

Jun 06, 2025

Applied Digitals Stock Soars 48 On Massive Ai Lease

Jun 06, 2025 -

Sade Robinson Killing The Maxwell Anderson Trial And Its Implications

Jun 06, 2025

Sade Robinson Killing The Maxwell Anderson Trial And Its Implications

Jun 06, 2025 -

June 6th Maxwell Anderson Faces Charges In Sade Robinson Death

Jun 06, 2025

June 6th Maxwell Anderson Faces Charges In Sade Robinson Death

Jun 06, 2025 -

Investigation Launched Into 2 000 Gallon Diesel Spill In Baltimore Harbor

Jun 06, 2025

Investigation Launched Into 2 000 Gallon Diesel Spill In Baltimore Harbor

Jun 06, 2025