Protecting Consumers: Understanding The Changes To Buy Now, Pay Later Laws

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Protecting Consumers: Understanding the Changes to Buy Now, Pay Later Laws

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering a seemingly effortless way to purchase goods and services. But this convenience comes with potential pitfalls, leading to increased consumer debt and financial hardship for some. Recognizing these concerns, lawmakers across the globe are stepping in to introduce crucial changes to BNPL regulations, aiming to better protect consumers. This article breaks down the key changes and what they mean for you.

The Rise of BNPL and the Need for Regulation

BNPL services, offered by companies like Klarna, Afterpay (now a part of Square), and Affirm, have become increasingly integrated into online shopping experiences. Their ease of use – often requiring only a quick application and soft credit check – has made them attractive to millions. However, the lack of stringent initial regulations led to concerns about:

- High interest rates and hidden fees: While some BNPL services advertise "interest-free" payment plans, late fees and other charges can quickly accumulate, pushing borrowers into a cycle of debt.

- Overspending and debt accumulation: The ease of access can encourage impulsive purchases, leading to unsustainable levels of debt for some consumers.

- Impact on credit scores: While BNPL services don't always directly impact credit scores, missed payments can negatively affect credit reports, impacting future borrowing opportunities.

- Lack of consumer protection: Initially, many BNPL services operated with minimal oversight, leaving consumers vulnerable to unfair practices.

Key Changes in BNPL Laws: A Global Perspective

Several countries are now implementing significant changes to regulate BNPL services, focusing on enhanced consumer protection:

United States: The Consumer Financial Protection Bureau (CFPB) has taken a leading role, classifying BNPL services as consumer credit under the Truth in Lending Act (TILA). This means BNPL providers are now subject to stricter disclosure requirements, including clearly outlining interest rates and fees. Further regulations are expected, likely focusing on debt collection practices and responsible lending.

Australia: Australia has introduced stricter regulations requiring BNPL providers to conduct more thorough credit assessments and to provide clearer information to consumers about the risks involved. Late payment reporting to credit bureaus is also being considered.

United Kingdom: The UK's Financial Conduct Authority (FCA) has implemented similar measures, emphasizing responsible lending practices and improved transparency for consumers. They've also focused on ensuring BNPL providers are adequately assessing a customer's ability to repay.

European Union: The EU is working on comprehensive legislation to regulate BNPL services across the bloc, aiming for a harmonized approach to consumer protection and responsible lending. Expect detailed rules on creditworthiness assessments, debt collection, and transparency.

What Consumers Should Do

While these regulatory changes are underway, consumers can take proactive steps to protect themselves:

- Budget carefully: Before using BNPL, create a realistic budget to ensure you can comfortably afford the repayments.

- Compare providers: Don't just choose the first BNPL service you encounter. Compare fees, interest rates, and repayment terms.

- Read the terms and conditions: Carefully review all the terms and conditions before agreeing to a BNPL plan. Pay close attention to late payment fees and interest charges.

- Use BNPL responsibly: Avoid using BNPL for multiple purchases simultaneously, as this can quickly lead to overwhelming debt.

The Future of BNPL Regulation

The evolving landscape of BNPL regulations signals a move toward greater consumer protection. While the convenience of BNPL remains appealing, the focus is shifting toward responsible lending practices and enhanced transparency. Staying informed about these changes and using BNPL responsibly is crucial for avoiding potential financial difficulties. Keep an eye out for further updates as regulations continue to evolve.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Protecting Consumers: Understanding The Changes To Buy Now, Pay Later Laws. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pilotless Lufthansa Flight Co Pilots Fainting Triggers Safety Concerns

May 21, 2025

Pilotless Lufthansa Flight Co Pilots Fainting Triggers Safety Concerns

May 21, 2025 -

Narco Kitten Cat Busted Smuggling Drugs Into Costa Rican Jail

May 21, 2025

Narco Kitten Cat Busted Smuggling Drugs Into Costa Rican Jail

May 21, 2025 -

Controversy Erupts Family Challenges New Law Affecting Paedophiles Parental Rights

May 21, 2025

Controversy Erupts Family Challenges New Law Affecting Paedophiles Parental Rights

May 21, 2025 -

St Louis Tornado Assessing The Damage And Path To Recovery

May 21, 2025

St Louis Tornado Assessing The Damage And Path To Recovery

May 21, 2025 -

Putins Snub Demonstrating Trumps Diminished Global Influence

May 21, 2025

Putins Snub Demonstrating Trumps Diminished Global Influence

May 21, 2025

Latest Posts

-

Australian Ultramarathon Conquered William Goodges Record Breaking Run

May 21, 2025

Australian Ultramarathon Conquered William Goodges Record Breaking Run

May 21, 2025 -

Jeremy Bowen On Gaza Will International Pressure Force An End To The Offensive

May 21, 2025

Jeremy Bowen On Gaza Will International Pressure Force An End To The Offensive

May 21, 2025 -

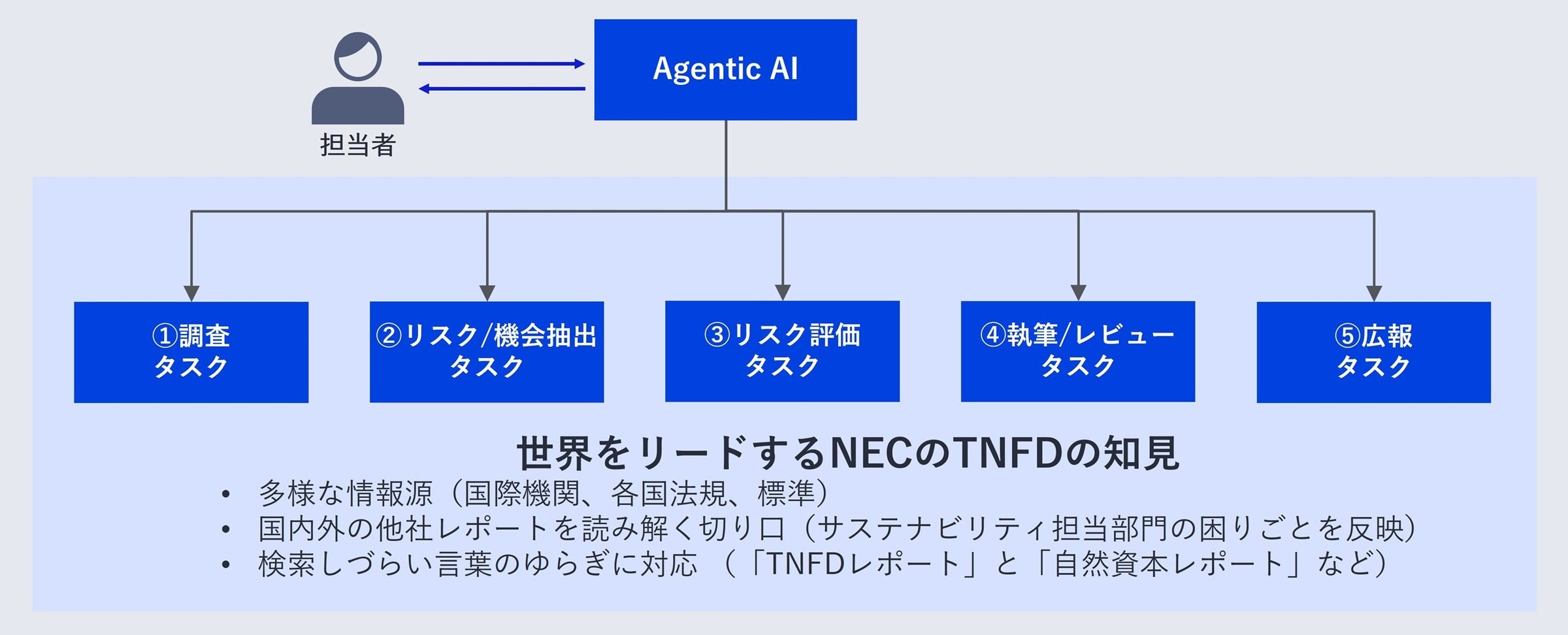

Agentic Ai Nec Tnfd

May 21, 2025

Agentic Ai Nec Tnfd

May 21, 2025 -

Manhunt Intensifies Fourth New Orleans Inmate Captured Das Office Evacuated

May 21, 2025

Manhunt Intensifies Fourth New Orleans Inmate Captured Das Office Evacuated

May 21, 2025 -

Sdgs 160

May 21, 2025

Sdgs 160

May 21, 2025