Public Sector Debt: April's Higher-Than-Expected Borrowing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Public Sector Debt: April's Higher-Than-Expected Borrowing Raises Concerns

April's public sector net borrowing figures have significantly exceeded forecasts, sparking concerns about the UK's burgeoning national debt. The unexpected surge in borrowing has reignited debate surrounding government spending and the country's fiscal outlook. Economists and analysts are now scrambling to understand the reasons behind this alarming trend and predict its potential impact on the economy.

The Office for National Statistics (ONS) released data revealing a net borrowing figure considerably higher than predicted by the Office for Budget Responsibility (OBR). This unexpected jump has immediately cast a shadow over the government's fiscal plans and raised questions about the sustainability of current spending policies. The implications are far-reaching, potentially affecting interest rates, inflation, and the overall economic stability of the UK.

Understanding the April Borrowing Figures

The ONS reported a net borrowing figure of [Insert Actual Figure Here] billion for April, significantly surpassing the OBR's forecast of [Insert OBR Forecast Here] billion. This represents a [Percentage Increase]% increase compared to the same period last year. Several factors are believed to have contributed to this unexpectedly high figure.

-

Higher-than-anticipated inflation: Persistent inflation has increased the cost of government services, leading to higher-than-budgeted expenditure. This is particularly impactful on areas like benefits payments and public sector pensions, which are often linked to inflation indices.

-

Increased interest payments: The Bank of England's efforts to combat inflation by raising interest rates have led to a substantial increase in the government's interest payments on its existing debt. This is a significant drain on public finances and adds further pressure to the budget.

-

Lower-than-expected tax revenues: While some sectors are thriving, others are struggling amidst the cost-of-living crisis. This has resulted in lower-than-projected tax revenues, exacerbating the borrowing problem. This could indicate a weakening in economic activity.

The Implications for the UK Economy

The higher-than-expected borrowing has several potential consequences for the UK economy:

-

Increased pressure on interest rates: The increased borrowing could force the Bank of England to maintain or even raise interest rates further to control inflation, potentially stifling economic growth and impacting household finances.

-

Higher national debt: The accumulation of debt adds to the long-term burden on taxpayers and limits the government's flexibility to respond to future economic shocks. Managing this escalating debt will be a key challenge for years to come.

-

Reduced government spending: To address the rising debt, the government may be forced to implement austerity measures, potentially cutting spending in crucial areas like healthcare and education. This could have serious social consequences.

What's Next?

The government is under increasing pressure to explain the reasons behind the higher-than-expected borrowing and outline a clear strategy to address the situation. Further analysis is needed to fully understand the underlying factors and assess the long-term implications. Experts are closely watching the situation and are likely to revise their economic forecasts in light of these new figures. The upcoming budget will be crucial in determining the government’s response and its plans for managing public finances in the future. This development warrants close monitoring from both economists and the public alike. Stay informed and follow developments as they unfold.

Keywords: Public sector debt, national debt, UK economy, borrowing, inflation, interest rates, government spending, fiscal policy, Office for National Statistics (ONS), Office for Budget Responsibility (OBR), economic forecast, austerity measures, cost of living crisis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Public Sector Debt: April's Higher-Than-Expected Borrowing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Allegheny County Under Flash Flood Warning Wednesday Night Update

May 24, 2025

Allegheny County Under Flash Flood Warning Wednesday Night Update

May 24, 2025 -

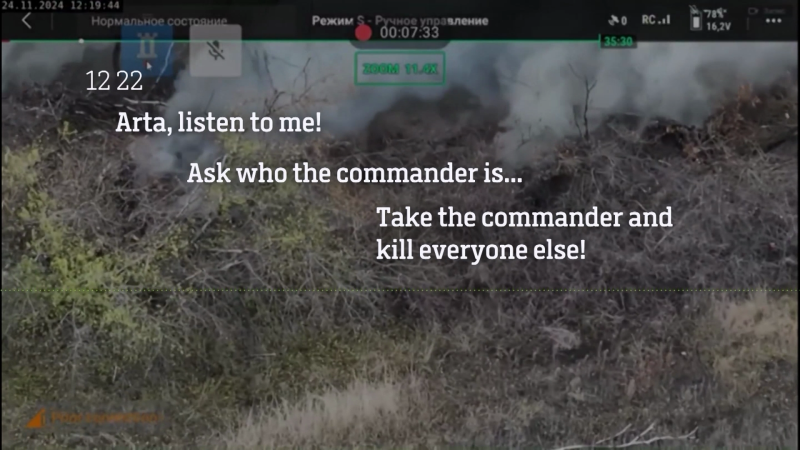

Revealed Disturbing Content Of Intercepted Russian Military Communications

May 24, 2025

Revealed Disturbing Content Of Intercepted Russian Military Communications

May 24, 2025 -

Remote Georgia Mountain Police Solve The Mystery Of The Deceased Twins

May 24, 2025

Remote Georgia Mountain Police Solve The Mystery Of The Deceased Twins

May 24, 2025 -

Phillies Winning Streak Continues Suarez Throws Another Gem

May 24, 2025

Phillies Winning Streak Continues Suarez Throws Another Gem

May 24, 2025 -

Exclusive Bbc Shares Footage And Audio Of Ocean Gate Titan Disaster

May 24, 2025

Exclusive Bbc Shares Footage And Audio Of Ocean Gate Titan Disaster

May 24, 2025

Latest Posts

-

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025 -

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025 -

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025 -

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025