RBA Holds Interest Rates Steady: Await Further Inflation Data

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

RBA Holds Interest Rates Steady: Await Further Inflation Data

Australia's central bank, the Reserve Bank of Australia (RBA), has opted to hold interest rates steady at 4.1% for the second consecutive month. This decision, announced on [Date of announcement], comes as policymakers closely monitor the trajectory of inflation and its impact on the Australian economy. The pause offers a moment of respite for homeowners and businesses grappling with the cumulative effect of previous rate hikes, but the underlying uncertainty surrounding inflation keeps the economic outlook fluid.

The RBA's decision to maintain the cash rate reflects a cautious approach, prioritizing a more comprehensive assessment of recent economic data before implementing further monetary policy adjustments. While inflation has shown signs of easing, it remains stubbornly above the RBA's target range of 2-3%. This cautious stance signals a potential shift towards a data-dependent approach, emphasizing the importance of incoming economic indicators in shaping future rate decisions.

Inflation Remains a Key Concern

The persistence of inflation continues to be the central challenge facing the RBA. Recent data reveals [cite specific inflation data and source, e.g., "the Consumer Price Index (CPI) rose by X% in the June quarter, according to the Australian Bureau of Statistics"]. While this figure shows a [describe trend, e.g., "slowdown" or "moderation"] compared to previous quarters, it still surpasses the RBA's target band. This elevated inflation necessitates further scrutiny before considering any further rate increases or cuts.

Several factors contribute to the ongoing inflationary pressures. These include:

- Global supply chain disruptions: Ongoing global uncertainties continue to impact the cost of imported goods.

- Strong domestic demand: Robust consumer spending and a tight labor market are contributing to upward price pressures.

- Rising energy prices: Fluctuations in global energy markets continue to affect the cost of fuel and electricity.

What This Means for the Australian Economy

The RBA's decision to hold rates steady provides a period of stability for the Australian economy. However, the uncertainty surrounding future rate movements creates challenges for businesses and consumers alike. Businesses will need to navigate the complexities of planning for investment and pricing strategies, while consumers may experience continued pressure on household budgets.

The housing market, particularly sensitive to interest rate changes, is likely to observe a period of watchful waiting. While the pause offers some relief to borrowers, the prospect of future rate hikes remains a significant consideration for prospective buyers and those considering refinancing their mortgages. This uncertainty emphasizes the importance of seeking expert financial advice before making major financial decisions.

Looking Ahead: What to Expect

The RBA Governor, Philip Lowe, indicated that the central bank will be closely monitoring upcoming inflation data, including the [mention upcoming key economic indicators, e.g., "September quarter CPI report" and "wage growth figures"]. These data points will be crucial in determining the future direction of monetary policy. The RBA's next meeting is scheduled for [date of next meeting], and market analysts will be keenly observing any shifts in the central bank's commentary.

In conclusion, the RBA's decision to hold interest rates steady reflects a data-driven approach to managing inflation. While this pause offers temporary relief, the ongoing inflationary pressures and the need for further data analysis signal that the Australian economy remains in a period of considerable uncertainty. Staying informed about economic developments and seeking professional financial guidance are crucial for navigating this complex environment.

Keywords: RBA, Reserve Bank of Australia, interest rates, inflation, Australian economy, monetary policy, cash rate, CPI, economic indicators, Philip Lowe, housing market, interest rate hike, data-dependent.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on RBA Holds Interest Rates Steady: Await Further Inflation Data. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Live Stream Space X Launches 28 Starlink Satellites From Cape Canaveral

Jul 09, 2025

Live Stream Space X Launches 28 Starlink Satellites From Cape Canaveral

Jul 09, 2025 -

Illegal Short Term Lets North Finchley Landlord Ordered To Pay 75 000

Jul 09, 2025

Illegal Short Term Lets North Finchley Landlord Ordered To Pay 75 000

Jul 09, 2025 -

Professionalism Vs Fun Navigating Humor In The Modern Workplace

Jul 09, 2025

Professionalism Vs Fun Navigating Humor In The Modern Workplace

Jul 09, 2025 -

King Charless View Of Sarah Ferguson Following Prince Andrews Separation

Jul 09, 2025

King Charless View Of Sarah Ferguson Following Prince Andrews Separation

Jul 09, 2025 -

Claim Your Free Spirit Empress The New Clash Royale Legendary Card

Jul 09, 2025

Claim Your Free Spirit Empress The New Clash Royale Legendary Card

Jul 09, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

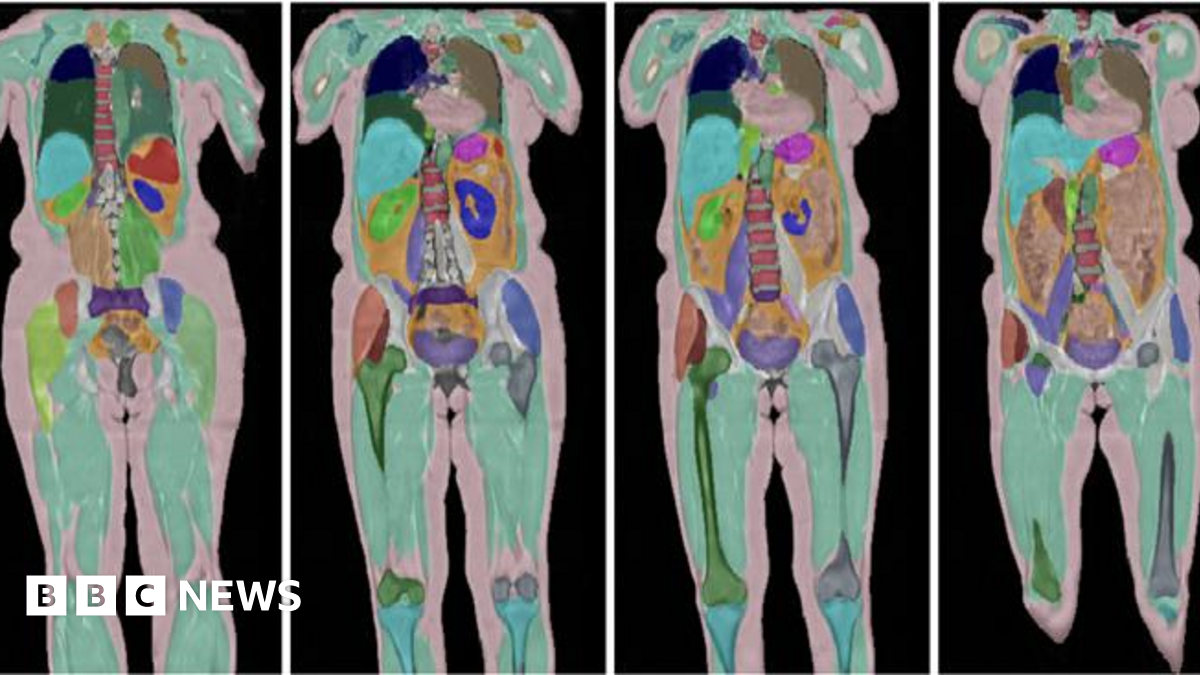

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025