RBA Holds Rates Steady: Await Inflation Data Before Next Move

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

RBA Holds Rates Steady: Await Inflation Data Before Next Move

Australia's central bank, the Reserve Bank of Australia (RBA), has opted to hold interest rates steady at 4.1% for a second consecutive month. This decision, announced earlier today, comes as policymakers await crucial inflation data before making any further adjustments to monetary policy. The move follows months of aggressive rate hikes aimed at curbing stubbornly high inflation, leaving many homeowners and businesses anxiously awaiting the next move.

The RBA's decision to pause reflects a cautious approach, prioritizing a clearer picture of the economic landscape before potentially resuming its tightening cycle. Governor Philip Lowe emphasized the need to assess the impact of previous rate increases and analyze the latest inflation figures, due for release next week.

Why the Hold? A Deep Dive into the RBA's Reasoning

The RBA's statement highlighted several key factors underpinning its decision to maintain the cash rate:

- Inflation Still Elevated, But Showing Signs of Slowing: While inflation remains above the RBA's target band of 2-3%, recent data suggests a potential moderation in price pressures. However, the central bank stressed the need for further evidence to confirm this trend. The upcoming inflation figures will be crucial in determining the future path of interest rates.

- Impact of Previous Rate Hikes: The cumulative effect of previous interest rate increases is still unfolding. The RBA is likely monitoring the impact on consumer spending, business investment, and overall economic activity before committing to further tightening. A lag effect is expected, meaning the full impact of past rate hikes may not be immediately apparent.

- Global Economic Uncertainty: Global economic headwinds, including persistent inflation in major economies and geopolitical uncertainty, are also influencing the RBA's decision-making process. The central bank is carefully considering the broader global economic environment and its potential impact on the Australian economy.

What Happens Next? The Importance of Upcoming Inflation Data

The upcoming inflation data will be closely scrutinized by economists and market analysts alike. A significant decline in inflation could embolden the RBA to maintain a pause or even signal a potential easing of monetary policy in the future. Conversely, persistent high inflation could prompt another rate hike in the coming months.

The RBA's commitment to price stability remains unwavering. The central bank has reiterated its intention to return inflation to the target range, and its future decisions will be data-dependent, with inflation figures playing a pivotal role in shaping the next steps.

Impact on the Australian Economy

The decision to hold rates has been met with a mixed response. While some welcome the pause, providing some relief to borrowers, others remain concerned about the persistent inflation and its potential long-term consequences. The impact on the Australian housing market, already grappling with higher interest rates, will also be closely monitored.

Looking Ahead: Staying Informed on RBA Policy

The RBA's monetary policy decisions significantly impact the Australian economy. Stay informed about upcoming announcements and economic data releases by regularly checking the RBA's official website and reputable financial news sources. Understanding the RBA's reasoning behind its decisions is crucial for individuals and businesses alike to effectively navigate the evolving economic landscape.

Keywords: RBA, Reserve Bank of Australia, interest rates, inflation, monetary policy, cash rate, Australian economy, Philip Lowe, economic outlook, inflation data, interest rate hike, housing market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on RBA Holds Rates Steady: Await Inflation Data Before Next Move. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Get The New Spirit Empress Legendary Card A Clash Royale Giveaway Guide

Jul 09, 2025

Get The New Spirit Empress Legendary Card A Clash Royale Giveaway Guide

Jul 09, 2025 -

The Vanishing Joke Readers Share Their Workplace Humor Experiences

Jul 09, 2025

The Vanishing Joke Readers Share Their Workplace Humor Experiences

Jul 09, 2025 -

The Jnim Threat Al Qaedas Impact On Instability In Mali

Jul 09, 2025

The Jnim Threat Al Qaedas Impact On Instability In Mali

Jul 09, 2025 -

Holiday Travel Chaos 5 000 Us Flights Disrupted Leaving Passengers Stranded

Jul 09, 2025

Holiday Travel Chaos 5 000 Us Flights Disrupted Leaving Passengers Stranded

Jul 09, 2025 -

Flash Flood In Texas House Swept Away By Raging River

Jul 09, 2025

Flash Flood In Texas House Swept Away By Raging River

Jul 09, 2025

Latest Posts

-

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

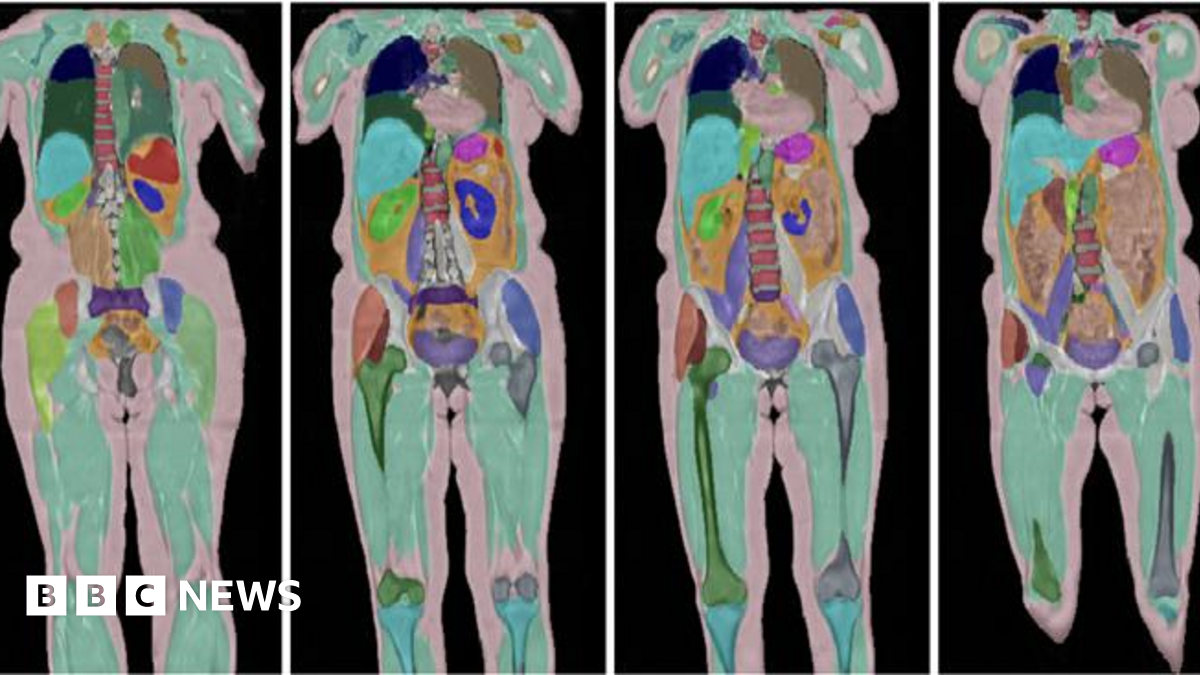

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025 -

Bbc Salaries 2024 Missing Stars And The Reasons Why

Jul 16, 2025

Bbc Salaries 2024 Missing Stars And The Reasons Why

Jul 16, 2025