Record Bitcoin ETF Investments: Directional Bets Fueling Market Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record Bitcoin ETF Investments: Directional Bets Fueling Market Growth

The cryptocurrency market is buzzing with excitement as Bitcoin exchange-traded funds (ETFs) witness record-breaking investment inflows. This surge isn't just about diversification; it's a clear indication of growing institutional confidence and directional bets on Bitcoin's future price. This unprecedented influx of capital is significantly impacting market growth and volatility, shaping the narrative for the digital asset's trajectory in the coming months.

Institutional Adoption Drives the Surge

The recent surge in Bitcoin ETF investments isn't driven by retail investors alone. Major institutional players are increasingly embracing these regulated vehicles to gain exposure to Bitcoin. This shift marks a pivotal moment for Bitcoin's legitimacy and mainstream adoption. Previously hesitant institutions are now seeing the value proposition of accessing Bitcoin through a regulated and transparent ETF structure, mitigating some of the risks associated with direct cryptocurrency ownership. This increased institutional participation is a crucial factor driving the current market growth.

Directional Bets: Bulls and Bears Weigh In

The record investments aren't simply a matter of accumulating Bitcoin; they represent directional bets, reflecting market sentiment and predictions about the future price. The bullish sentiment is palpable, fueled by factors like increasing regulatory clarity in certain jurisdictions (like the recent SEC approval of Bitcoin futures ETFs in the US), the growing adoption of blockchain technology, and the potential for Bitcoin to act as a hedge against inflation.

However, it's not all sunshine and rainbows. Bearish investors remain cautious, citing concerns over macroeconomic conditions, regulatory uncertainty in other regions, and the inherent volatility of the cryptocurrency market. This ongoing tension between bullish and bearish sentiment contributes to the market's dynamism and volatility, making it an exciting yet unpredictable space to navigate.

Understanding the Impact on Market Volatility

The significant influx of capital into Bitcoin ETFs is naturally influencing market volatility. While this increased liquidity can potentially stabilize prices in the long run, short-term fluctuations are expected. Large investment flows can create temporary price spikes or dips, providing both opportunities and risks for traders. Understanding these dynamics is crucial for investors navigating the Bitcoin market.

The Future of Bitcoin ETFs and Market Growth

The current trend of record Bitcoin ETF investments suggests a positive outlook for the cryptocurrency's future, at least in the medium term. As more institutional investors enter the market through regulated channels, the overall market maturity and liquidity are likely to improve. However, it’s essential to remember that the cryptocurrency market remains susceptible to external factors and regulatory developments.

Key Takeaways:

- Record investment inflows: Bitcoin ETFs are experiencing unprecedented investment levels.

- Institutional adoption: Major institutions are increasingly embracing Bitcoin ETFs.

- Directional bets: Investments reflect bullish and bearish sentiments regarding Bitcoin's future price.

- Market volatility: Increased investment flows contribute to both opportunities and risks.

- Future outlook: The trend suggests a positive outlook, though market volatility remains.

Further Reading:

For a deeper dive into Bitcoin's market dynamics, explore resources like and . Remember to conduct thorough research and consult with financial advisors before making any investment decisions. Investing in cryptocurrencies carries inherent risks, and past performance is not indicative of future results.

Disclaimer: This article provides informational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Bitcoin ETF Investments: Directional Bets Fueling Market Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bali Tourism Overhaul New Regulations Target Unacceptable Tourist Conduct

May 21, 2025

Bali Tourism Overhaul New Regulations Target Unacceptable Tourist Conduct

May 21, 2025 -

Corporate Value And Nature Conservation 160 Japanese Companies Adopt New Strategies Across 13 Industries

May 21, 2025

Corporate Value And Nature Conservation 160 Japanese Companies Adopt New Strategies Across 13 Industries

May 21, 2025 -

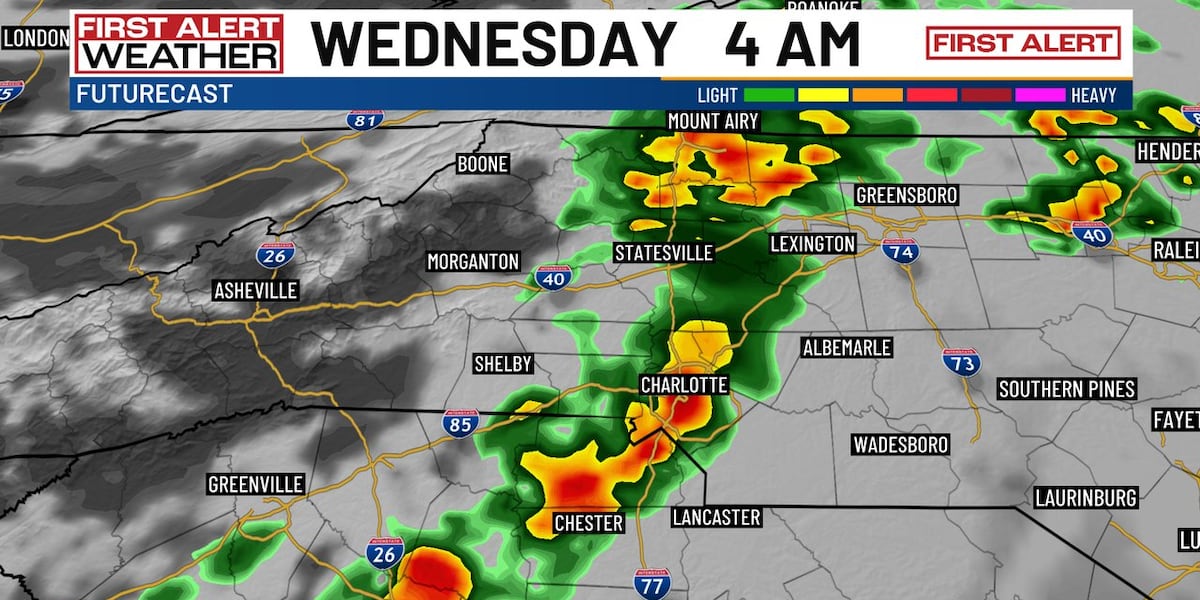

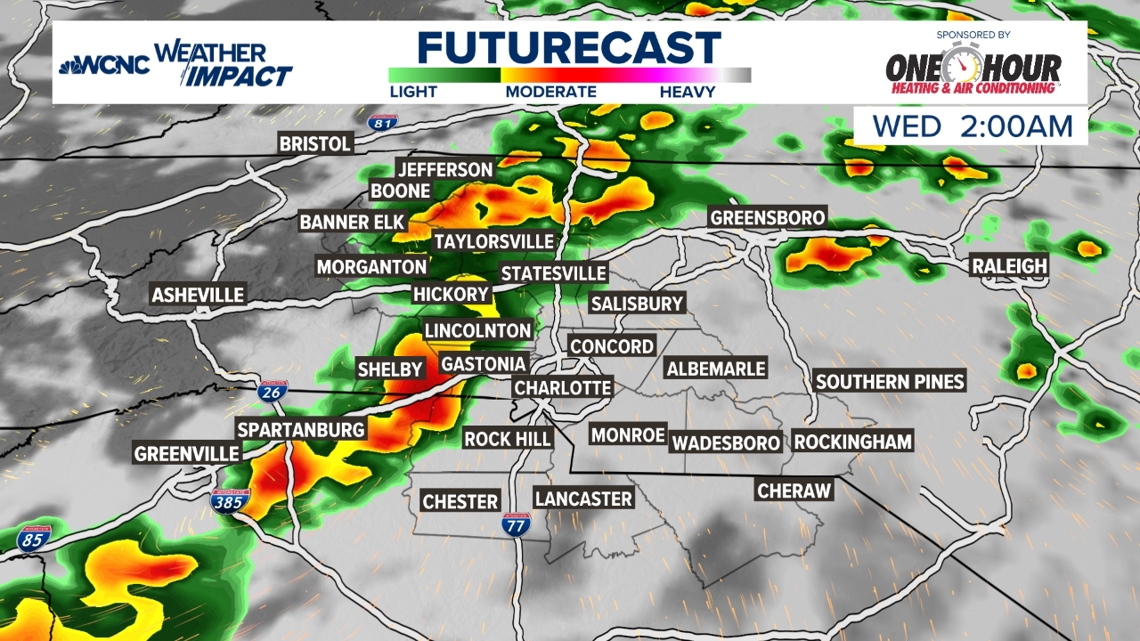

Charlotte Storm Forecast Overnight Showers And Significant Cooldown

May 21, 2025

Charlotte Storm Forecast Overnight Showers And Significant Cooldown

May 21, 2025 -

Jones Vs Aspinall Ufc Transparency Questioned After Jones Accusation

May 21, 2025

Jones Vs Aspinall Ufc Transparency Questioned After Jones Accusation

May 21, 2025 -

Buy Now Pay Later Crackdown Enhanced Consumer Safeguards Explained

May 21, 2025

Buy Now Pay Later Crackdown Enhanced Consumer Safeguards Explained

May 21, 2025

Latest Posts

-

Australian Ultramarathon William Goodge Sets New Record

May 21, 2025

Australian Ultramarathon William Goodge Sets New Record

May 21, 2025 -

Isolated Severe Storms Possible Late Tuesday What To Expect

May 21, 2025

Isolated Severe Storms Possible Late Tuesday What To Expect

May 21, 2025 -

Four New Orleans Inmates Captured After City Wide Manhunt

May 21, 2025

Four New Orleans Inmates Captured After City Wide Manhunt

May 21, 2025 -

Safe Sunscreen Selection Guide For 2025 A Familys Guide To Sun Safety

May 21, 2025

Safe Sunscreen Selection Guide For 2025 A Familys Guide To Sun Safety

May 21, 2025 -

The Eu Deal Chris Masons Perspective On A Complex Relationship

May 21, 2025

The Eu Deal Chris Masons Perspective On A Complex Relationship

May 21, 2025