Record Bitcoin ETF Investments: Over $5 Billion Reflects Growing Market Sentiment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record Bitcoin ETF Investments: Over $5 Billion Reflects Growing Market Sentiment

Bitcoin ETFs are experiencing a surge in popularity, with investments exceeding $5 billion, signaling a significant shift in market sentiment. This unprecedented inflow of capital into Bitcoin exchange-traded funds (ETFs) represents a major milestone for the cryptocurrency industry and suggests a growing acceptance of Bitcoin as a mainstream asset class. The recent approval of several Bitcoin ETFs in major markets has undoubtedly fueled this remarkable growth, opening the doors for institutional and retail investors alike.

This wave of investment underscores a significant change in how investors perceive Bitcoin. No longer relegated to the fringes of the financial world, Bitcoin is increasingly viewed as a viable investment option, offering diversification benefits and potential for significant returns. This newfound confidence is reflected not only in the sheer volume of investment but also in the sustained price performance of Bitcoin itself.

The Significance of the $5 Billion Milestone

The $5 billion figure represents a dramatic increase compared to previous years, signifying a major leap of faith from both institutional and retail investors. This surge in investment is not simply a fleeting trend; it points to a deeper, more fundamental shift in the market landscape. This significant capital injection validates Bitcoin's position as a credible asset and further strengthens its role within the broader financial ecosystem.

Several factors contribute to this record-breaking investment:

- Increased Regulatory Clarity: The approval of Bitcoin ETFs in key jurisdictions has reduced regulatory uncertainty, making it easier for investors to access Bitcoin exposure through regulated channels. This regulatory clarity is a crucial catalyst for institutional investment.

- Growing Institutional Adoption: Major financial institutions are increasingly incorporating Bitcoin into their investment portfolios, recognizing its potential as a hedge against inflation and a diversifier in a volatile market.

- Retail Investor Enthusiasm: The ease of access through ETFs has attracted a significant number of retail investors, further driving the increase in investment.

- Bitcoin's Growing Maturity: The Bitcoin network has matured significantly over the years, with enhanced security and scalability improvements building investor confidence.

What Does This Mean for the Future of Bitcoin?

The record-breaking investment in Bitcoin ETFs suggests a bullish outlook for the cryptocurrency. This influx of capital could potentially drive further price appreciation and increase Bitcoin's market dominance. However, it's crucial to remember that the cryptocurrency market remains volatile, and investors should always conduct thorough research before making any investment decisions.

Looking ahead, we can expect:

- Increased competition among Bitcoin ETF providers: The success of existing ETFs will likely attract new entrants to the market, offering investors more choices and potentially lower fees.

- Further institutional adoption: As regulatory frameworks become clearer and investor confidence grows, we can anticipate more institutional investors allocating a larger portion of their portfolios to Bitcoin.

- Continued price volatility: While the overall trend may be positive, Bitcoin's price is still subject to fluctuations driven by various market factors.

This record-breaking investment in Bitcoin ETFs is a testament to the growing maturity and acceptance of Bitcoin as a legitimate asset class. The future of Bitcoin remains uncertain, but the current market sentiment, reflected in these record investments, certainly paints a positive picture. However, remember to always conduct your own research and consider seeking financial advice before investing in any cryptocurrency. Learn more about the risks and rewards of Bitcoin investment by exploring resources like [link to a reputable financial news source].

Keywords: Bitcoin ETF, Bitcoin Exchange-Traded Fund, Cryptocurrency Investment, Bitcoin Investment, Market Sentiment, Institutional Investment, Retail Investment, Bitcoin Price, Cryptocurrency Market, Regulatory Clarity, Bitcoin Adoption.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Bitcoin ETF Investments: Over $5 Billion Reflects Growing Market Sentiment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Juego De Voces 2025 Mira El Impactante Dueto De Yahir Y Victor Garcia Cantando Otra Vez

May 20, 2025

Juego De Voces 2025 Mira El Impactante Dueto De Yahir Y Victor Garcia Cantando Otra Vez

May 20, 2025 -

Former Olympic Gold Medalist Speaks Out Against Coachs Harsh Methods

May 20, 2025

Former Olympic Gold Medalist Speaks Out Against Coachs Harsh Methods

May 20, 2025 -

Bbc Faces Backlash Following Potential Lineker Exit

May 20, 2025

Bbc Faces Backlash Following Potential Lineker Exit

May 20, 2025 -

Weight Comments And Brutal Training An Olympic Champions Trauma

May 20, 2025

Weight Comments And Brutal Training An Olympic Champions Trauma

May 20, 2025 -

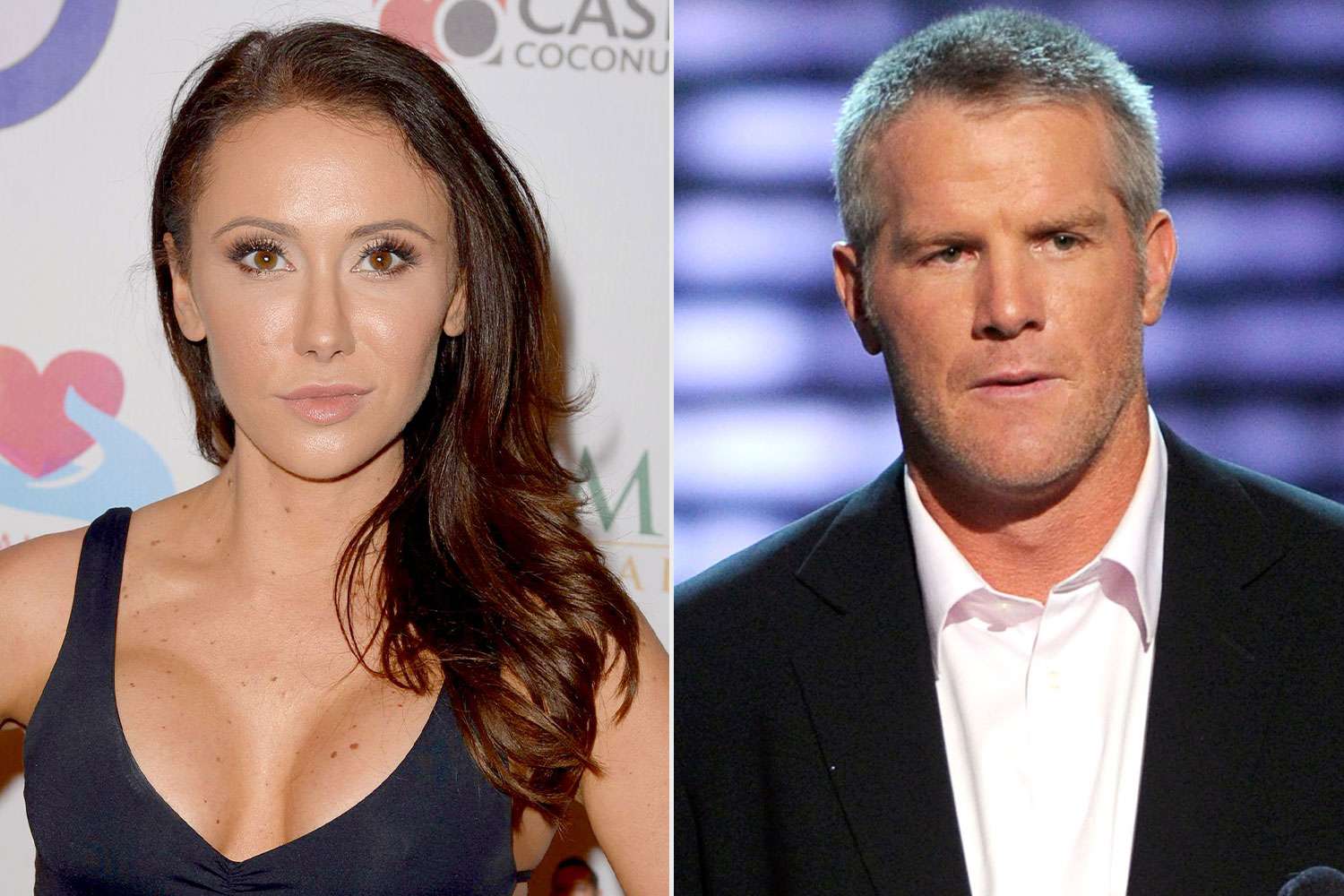

Brett Favres Untold Story A J Perez Recounts Threats And Controversy

May 20, 2025

Brett Favres Untold Story A J Perez Recounts Threats And Controversy

May 20, 2025

Latest Posts

-

Powerful Tornado Strikes St Louis Assessing The Damage And The Path To Recovery

May 20, 2025

Powerful Tornado Strikes St Louis Assessing The Damage And The Path To Recovery

May 20, 2025 -

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Lasting Impact

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Lasting Impact

May 20, 2025 -

Jon Jones And The Ufc A Dispute Over Tom Aspinalls Injury Information

May 20, 2025

Jon Jones And The Ufc A Dispute Over Tom Aspinalls Injury Information

May 20, 2025 -

Curbing Bad Tourist Behavior In Bali New Regulations And Their Impact

May 20, 2025

Curbing Bad Tourist Behavior In Bali New Regulations And Their Impact

May 20, 2025 -

Ufc Accused Of Withholding Information On Aspinall Injury Jon Jones Speaks Out

May 20, 2025

Ufc Accused Of Withholding Information On Aspinall Injury Jon Jones Speaks Out

May 20, 2025