Record Bitcoin ETF Investments: The Implications Of This Massive Capital Influx

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record Bitcoin ETF Investments: The Implications of this Massive Capital Influx

The cryptocurrency market is buzzing with excitement as Bitcoin exchange-traded funds (ETFs) witness record-breaking investment inflows. This surge in capital represents a significant shift in the perception of Bitcoin and its place in the traditional financial landscape. But what are the implications of this massive influx of money into Bitcoin ETFs? Let's delve into the details.

The Numbers Speak Volumes:

Recent reports highlight unprecedented investment in Bitcoin ETFs. While specific figures fluctuate daily, the overall trend is undeniable: billions of dollars are pouring into these funds, pushing the total assets under management (AUM) to record highs. This demonstrates a growing confidence among institutional and retail investors alike in Bitcoin as a viable asset class.

Why the Sudden Surge?

Several factors contribute to this record investment:

- Increased Regulatory Clarity: The approval of Bitcoin ETFs in major markets like the United States has significantly boosted investor confidence. Regulatory approval legitimizes Bitcoin in the eyes of many traditional investors, paving the way for wider adoption.

- Inflation Hedge: With persistent inflation concerns globally, Bitcoin, often seen as a hedge against inflation, is attracting investors seeking to protect their purchasing power. Its decentralized nature and limited supply are key factors driving this narrative.

- Institutional Adoption: Large institutional investors, including pension funds and hedge funds, are increasingly allocating a portion of their portfolios to Bitcoin through ETFs. This signals a maturing market and growing acceptance among sophisticated financial players.

- Ease of Access: Bitcoin ETFs offer a relatively simple and regulated way for investors to gain exposure to Bitcoin without the complexities of directly managing cryptocurrency holdings. This accessibility is a major draw for many newcomers to the crypto space.

Implications of the Capital Influx:

This massive influx of capital has several potential implications:

- Price Volatility: A significant increase in demand can lead to increased Bitcoin price volatility in the short term. While the long-term trend may remain positive, short-term price swings are to be expected.

- Market Maturation: The growing institutional participation and regulatory clarity suggest a path toward greater market maturity and stability. This could attract even more investors in the future.

- Increased Liquidity: Higher trading volumes resulting from ETF investments enhance liquidity in the Bitcoin market, making it easier for investors to buy and sell Bitcoin.

- Wider Adoption: The success of Bitcoin ETFs could encourage further adoption of other cryptocurrencies and blockchain-based technologies.

Potential Risks and Considerations:

While the current trend is positive, investors should be aware of potential risks:

- Regulatory Uncertainty: Despite recent approvals, regulatory landscapes can change quickly. Future regulations could impact the performance of Bitcoin ETFs.

- Market Manipulation: Although less likely with regulated ETFs, the possibility of market manipulation remains a concern in any market.

- Security Risks: While ETFs mitigate some security risks associated with directly holding Bitcoin, investors should still research the fund's security protocols.

Looking Ahead:

The record investment in Bitcoin ETFs represents a pivotal moment for the cryptocurrency market. While uncertainties remain, the overall trend indicates a growing acceptance of Bitcoin within the mainstream financial system. This surge in capital will likely continue to shape the future of Bitcoin and the broader cryptocurrency landscape, driving further innovation and adoption. For investors, understanding these implications and managing risk appropriately is crucial for navigating this evolving market. Stay tuned for further updates on this developing story.

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Cryptocurrency Investment, Bitcoin Price, Institutional Investment, Regulatory Approval, Bitcoin Volatility, Crypto Market, AUM, Assets Under Management, Inflation Hedge, Cryptocurrency ETFs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Bitcoin ETF Investments: The Implications Of This Massive Capital Influx. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stock Market Today S And P 500s Six Day Rally Continues Amidst Moodys Downgrade

May 21, 2025

Stock Market Today S And P 500s Six Day Rally Continues Amidst Moodys Downgrade

May 21, 2025 -

Tim Dillons Cnn Interview A Comedians Perspective On Politics

May 21, 2025

Tim Dillons Cnn Interview A Comedians Perspective On Politics

May 21, 2025 -

Investigation Underway After Train Kills Two Injures Children On Bridge

May 21, 2025

Investigation Underway After Train Kills Two Injures Children On Bridge

May 21, 2025 -

The Trump Putin Call What It Means For The Future Of Ukraine

May 21, 2025

The Trump Putin Call What It Means For The Future Of Ukraine

May 21, 2025 -

Two Dead Children Injured In Train Family Collision On Bridge

May 21, 2025

Two Dead Children Injured In Train Family Collision On Bridge

May 21, 2025

Latest Posts

-

Prime Ministers Home Fire Second Individual Charged

May 21, 2025

Prime Ministers Home Fire Second Individual Charged

May 21, 2025 -

Urgent Update Fourth Escaped New Orleans Inmate Apprehended Heightened Security Measures Implemented

May 21, 2025

Urgent Update Fourth Escaped New Orleans Inmate Apprehended Heightened Security Measures Implemented

May 21, 2025 -

Ny Ag James Trumps Legal Troubles Vs Dojs Real Estate Fraud Investigation

May 21, 2025

Ny Ag James Trumps Legal Troubles Vs Dojs Real Estate Fraud Investigation

May 21, 2025 -

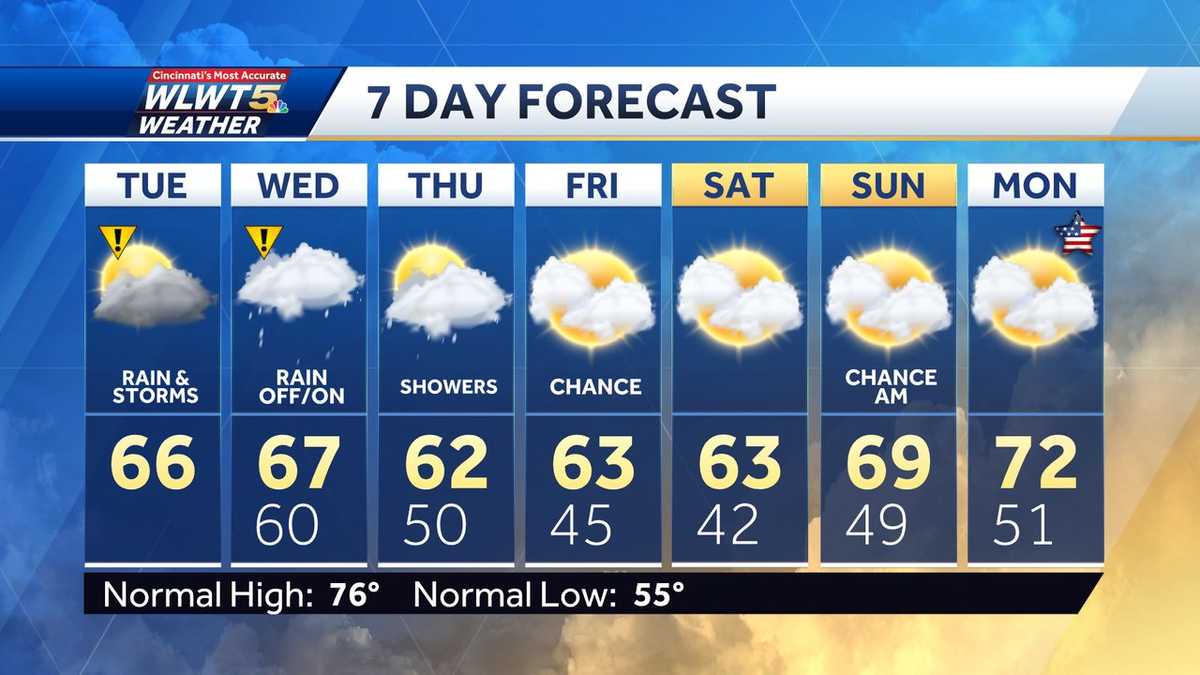

Temperature Drop And Continued Rain Expected This Week

May 21, 2025

Temperature Drop And Continued Rain Expected This Week

May 21, 2025 -

Data Breach Settlement Post Office To Compensate Hundreds Of Victims

May 21, 2025

Data Breach Settlement Post Office To Compensate Hundreds Of Victims

May 21, 2025