Record Low: UK Interest Rates Fall To Lowest Point In Over Two Years

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record Low: UK Interest Rates Plunge to Lowest Point in Over Two Years

The Bank of England (BoE) has sent shockwaves through the UK economy today, announcing a record low interest rate of just 0.25%. This marks the lowest point for interest rates in over two years and signals a significant shift in the central bank's monetary policy. The move comes amid growing concerns about slowing economic growth and the potential for a protracted recession.

This dramatic cut, announced earlier this morning, is intended to stimulate borrowing and investment, injecting much-needed liquidity into the struggling economy. The decision follows a period of intense market volatility and reflects the BoE's determination to avoid a deeper economic downturn.

Why the Record Low? Understanding the BoE's Decision

Several factors contributed to the BoE's unprecedented decision. Firstly, inflation, while still a concern, has shown signs of easing, giving the central bank more room to maneuver. Secondly, the ongoing global economic uncertainty, fueled by factors such as the war in Ukraine and persistent supply chain disruptions, has dampened growth forecasts for the UK. Finally, weakening consumer confidence and a decline in business investment have further fueled the need for stimulative monetary policy.

The BoE's statement accompanying the announcement emphasized the delicate balancing act it faces. While aiming to boost economic activity, the central bank also acknowledged the risks associated with inflation remaining stubbornly high. This highlights the complexities faced by policymakers in navigating the current economic climate.

What Does This Mean for UK Consumers and Businesses?

The immediate impact of this record low interest rate will be felt most keenly by borrowers. Mortgage holders are likely to see a reduction in their monthly payments, potentially freeing up disposable income. Similarly, businesses may find it easier and cheaper to secure loans for investment and expansion. However, savers are likely to experience a further decline in the returns on their savings accounts.

- Positive Impacts:

- Lower mortgage payments for homeowners.

- Cheaper borrowing costs for businesses.

- Potential boost to consumer spending and investment.

- Negative Impacts:

- Reduced returns on savings accounts.

- Potential for increased inflation in the long run (although the BoE is aiming to mitigate this).

Looking Ahead: Uncertainty Remains

While the record low interest rate offers some short-term relief, significant uncertainty remains about the UK's economic outlook. The effectiveness of this monetary policy tool in stimulating growth will depend on several factors, including consumer and business confidence, global economic conditions, and the trajectory of inflation. Economists are closely monitoring the situation and offering varied predictions on the future path of interest rates. Some predict further cuts may be necessary, while others anticipate a gradual increase as inflation concerns resurface.

Related Articles:

Call to Action: Stay informed about the evolving economic landscape by regularly checking our website for the latest updates and analysis. [Link to your website's economics section]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Low: UK Interest Rates Fall To Lowest Point In Over Two Years. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Golfer Tommy Fleetwoods Net Worth And Marital Challenges

Aug 09, 2025

Golfer Tommy Fleetwoods Net Worth And Marital Challenges

Aug 09, 2025 -

Dont Miss Out Buy Tickets For Inter Milans Pre Season Matches

Aug 09, 2025

Dont Miss Out Buy Tickets For Inter Milans Pre Season Matches

Aug 09, 2025 -

Uk Detains First Migrants Under New France Deportation Deal

Aug 09, 2025

Uk Detains First Migrants Under New France Deportation Deal

Aug 09, 2025 -

Monaco Vs Inter Milan The Ultimate Preview And Prediction

Aug 09, 2025

Monaco Vs Inter Milan The Ultimate Preview And Prediction

Aug 09, 2025 -

Fbi Officials Fired A Deep Dive Into The Trump Administration Dispute

Aug 09, 2025

Fbi Officials Fired A Deep Dive Into The Trump Administration Dispute

Aug 09, 2025

Latest Posts

-

Detroit Lions Mailbag Post Rakestraw Injury Who Steps Up In The Secondary

Aug 09, 2025

Detroit Lions Mailbag Post Rakestraw Injury Who Steps Up In The Secondary

Aug 09, 2025 -

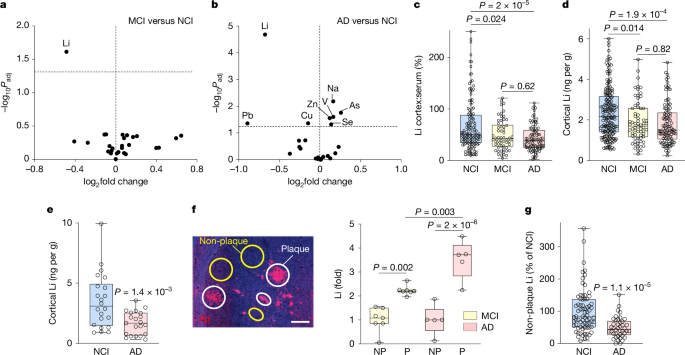

Is Lithium Deficiency Linked To The Development Of Alzheimer S New Research Explores The Connection

Aug 09, 2025

Is Lithium Deficiency Linked To The Development Of Alzheimer S New Research Explores The Connection

Aug 09, 2025 -

Detroit Lions Suffer Setback Ennis Rakestraw Jr To Miss Entire Season

Aug 09, 2025

Detroit Lions Suffer Setback Ennis Rakestraw Jr To Miss Entire Season

Aug 09, 2025 -

David Lammy Hosts Jd Vance At Private Uk Residence For Talks

Aug 09, 2025

David Lammy Hosts Jd Vance At Private Uk Residence For Talks

Aug 09, 2025 -

Ennis Rakestraw Injury How It Impacts The Lions Secondary

Aug 09, 2025

Ennis Rakestraw Injury How It Impacts The Lions Secondary

Aug 09, 2025