Reflecting On A 560% Amazon Return: My Long-Term Investment Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Reflecting on a 560% Amazon Return: My Long-Term Investment Strategy

Introduction: Investing in the stock market can be a rollercoaster, but few rides are as exhilarating as watching a single stock deliver a 560% return. This isn't some get-rich-quick scheme; it's the result of a long-term investment strategy focused on identifying strong, fundamentally sound companies and holding them through market fluctuations. My journey with Amazon exemplifies this approach, offering valuable lessons for both seasoned and novice investors.

The Amazon Investment: A Case Study in Patience

My initial investment in Amazon (AMZN) wasn't based on a hot tip or a fleeting market trend. It stemmed from a deep understanding of the company's disruptive business model and its potential for long-term growth. Back then, Amazon was already a prominent online retailer, but its expansion into cloud computing (AWS), e-books (Kindle), and other innovative sectors was just beginning. This diversification minimized risk and maximized potential for exponential growth.

Key Principles of My Long-Term Investment Strategy:

-

Fundamental Analysis over Hype: I prioritized understanding Amazon's financials, its competitive advantage, and its management team. I didn't get swept up in short-term market noise or speculative trading. This is crucial; focusing on the fundamentals helps you identify undervalued companies with real growth potential. Learn more about fundamental analysis .

-

Long-Term Vision: Patience is paramount. The stock market isn't a get-rich-quick scheme. My Amazon investment spanned years, weathering market corrections and periods of slower growth. Holding onto strong companies during these periods is essential for maximizing long-term returns.

-

Diversification, but with a Focus: While diversification across different asset classes is recommended, I also concentrated a significant portion of my portfolio on companies I believed in deeply – companies like Amazon that possessed significant competitive advantages. This approach, while carrying more risk, allowed for greater potential returns.

-

Regular Review, but Not Over-Trading: I regularly reviewed my investment portfolio, staying updated on Amazon's performance and any significant industry shifts. However, I avoided impulsive trading based on short-term market fluctuations. This disciplined approach prevents emotional decision-making, which often leads to poor investment outcomes.

-

Continuous Learning: The investment landscape is constantly evolving. I consistently invest time in learning about new investment strategies, market trends, and financial analysis techniques. This commitment to ongoing education is essential for adapting to changing market dynamics.

Lessons Learned and Future Outlook:

My Amazon investment underscores the power of a long-term, well-researched investment strategy. While past performance is not indicative of future results, the principles that guided my success remain relevant. The key takeaways are patience, thorough due diligence, and a commitment to continuous learning.

Call to Action: While I can't predict future market movements or guarantee similar returns, I encourage investors to develop their own long-term investment strategies based on thorough research and a deep understanding of the companies they invest in. Remember, investing wisely involves managing risk and having a clear plan for your financial future. Consider consulting with a financial advisor to create a personalized investment strategy.

Keywords: Amazon stock, Amazon investment, long-term investment, investment strategy, stock market, return on investment, financial planning, fundamental analysis, diversification, portfolio management, long-term growth, stock market success, investing for beginners.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Reflecting On A 560% Amazon Return: My Long-Term Investment Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Seaside Heights Violence Fights And Stabbings Plague Jersey Shore Boardwalk

May 28, 2025

Seaside Heights Violence Fights And Stabbings Plague Jersey Shore Boardwalk

May 28, 2025 -

Liverpool Fc Celebratory Parade Investigating The Disturbances

May 28, 2025

Liverpool Fc Celebratory Parade Investigating The Disturbances

May 28, 2025 -

Technology Vs Touch Harvard Commencement Speech Focuses On Patient Care

May 28, 2025

Technology Vs Touch Harvard Commencement Speech Focuses On Patient Care

May 28, 2025 -

Rushdie Attack Court Hands Down Maximum Sentence Author Pleased

May 28, 2025

Rushdie Attack Court Hands Down Maximum Sentence Author Pleased

May 28, 2025 -

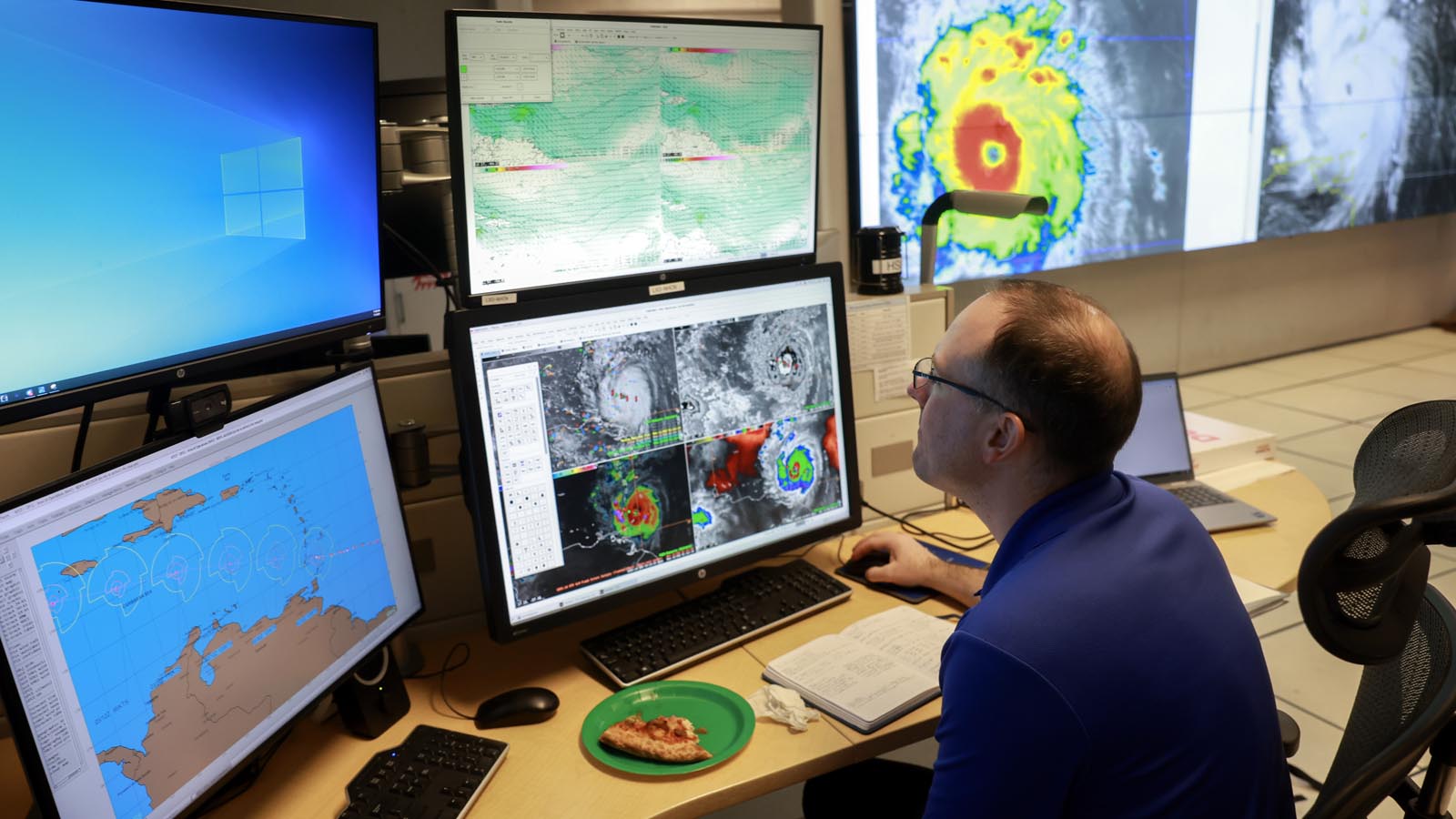

Understanding Hurricane Model Accuracy A 2025 Perspective

May 28, 2025

Understanding Hurricane Model Accuracy A 2025 Perspective

May 28, 2025

Latest Posts

-

Sheinelle Jones And Family Mourn Loss Of Husband Uche Ojeh Today Confirms

May 30, 2025

Sheinelle Jones And Family Mourn Loss Of Husband Uche Ojeh Today Confirms

May 30, 2025 -

Rune Advances To French Open Third Round After Straight Sets Victory

May 30, 2025

Rune Advances To French Open Third Round After Straight Sets Victory

May 30, 2025 -

Transgender Women In Sports Separating Fact From Fiction In The Debate

May 30, 2025

Transgender Women In Sports Separating Fact From Fiction In The Debate

May 30, 2025 -

Us Open Faces Backlash Over Handling Of 2025 Tournament Presale

May 30, 2025

Us Open Faces Backlash Over Handling Of 2025 Tournament Presale

May 30, 2025 -

Home Heat Pump Installation Made Easy The Power Of Planning

May 30, 2025

Home Heat Pump Installation Made Easy The Power Of Planning

May 30, 2025