Retirement Planning With Precious Metals: Self-Directed IRA Options Explored

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Retirement Planning with Precious Metals: Self-Directed IRA Options Explored

Retirement planning is a crucial aspect of securing your financial future. While traditional investments like stocks and bonds offer potential growth, many investors are diversifying their portfolios with precious metals like gold and silver. This strategy, often implemented through a self-directed IRA (SDIRA), offers a unique approach to retirement savings with potential benefits and considerations worth exploring.

What is a Self-Directed IRA (SDIRA)?

A self-directed IRA differs from a traditional IRA in that it provides greater control over your investments. While traditional IRAs typically limit investment options to stocks, bonds, and mutual funds, a SDIRA allows you to invest in a broader range of assets, including alternative investments like precious metals. This flexibility empowers investors to tailor their retirement portfolios to their specific risk tolerance and financial goals. However, it's crucial to understand the regulations and responsibilities associated with managing a SDIRA. You are responsible for making informed investment decisions, understanding the risks involved, and adhering to IRS regulations.

Why Precious Metals for Retirement?

Precious metals, particularly gold and silver, have historically served as a hedge against inflation and economic uncertainty. Unlike paper assets, their value is often seen as more stable during times of economic turmoil. This makes them an attractive diversification strategy for retirement portfolios. Some investors believe that holding precious metals provides a safeguard against potential devaluation of fiat currencies.

Investing in Precious Metals through your SDIRA:

Several options exist for incorporating precious metals into your self-directed IRA:

- Physical Bullion: This involves purchasing physical gold and silver bars or coins, which are then held in an IRS-approved depository. This offers tangible ownership but requires careful selection of a reputable custodian and adherence to strict IRS guidelines regarding storage and handling.

- Precious Metals ETFs and Mutual Funds: These offer a more convenient way to gain exposure to precious metals without the complexities of managing physical bullion. However, it's essential to research the fund's underlying holdings and expense ratios carefully.

- Mining Stocks: Investing in companies that mine precious metals offers another avenue for exposure. This strategy carries higher risk but also potentially higher rewards.

Choosing a Custodian for your Precious Metals IRA:

Selecting the right custodian is paramount. A reputable custodian will ensure that your investments comply with IRS regulations and safeguard your assets. It is crucial to thoroughly research potential custodians, considering factors such as their fees, security measures, and reputation. Not all custodians allow precious metals investments, so careful selection is essential.

Risks and Considerations:

While investing in precious metals through a SDIRA can offer diversification benefits, it's crucial to acknowledge the inherent risks:

- Market Volatility: Precious metal prices can fluctuate significantly, impacting the overall value of your retirement savings.

- Storage and Security: Secure storage of physical bullion is essential, and the costs associated with this can be substantial.

- Liquidity: Selling physical precious metals might take longer compared to liquidating stocks or bonds.

- IRS Regulations: Strict adherence to IRS regulations is critical to avoid penalties.

Conclusion:

Investing in precious metals through a self-directed IRA can be a valuable strategy for diversifying your retirement portfolio and potentially mitigating risks associated with traditional investments. However, careful planning, thorough research, and the selection of a reputable custodian are crucial for success. Consult with a qualified financial advisor to determine if this investment strategy aligns with your individual financial goals and risk tolerance. Remember, this article is for informational purposes only and should not be considered financial advice. Always conduct your own research and seek professional guidance before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Retirement Planning With Precious Metals: Self-Directed IRA Options Explored. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Blake Lively And Justin Baldoni Settle Dispute Details Of Dropped Lawsuit Claims

Jun 05, 2025

Blake Lively And Justin Baldoni Settle Dispute Details Of Dropped Lawsuit Claims

Jun 05, 2025 -

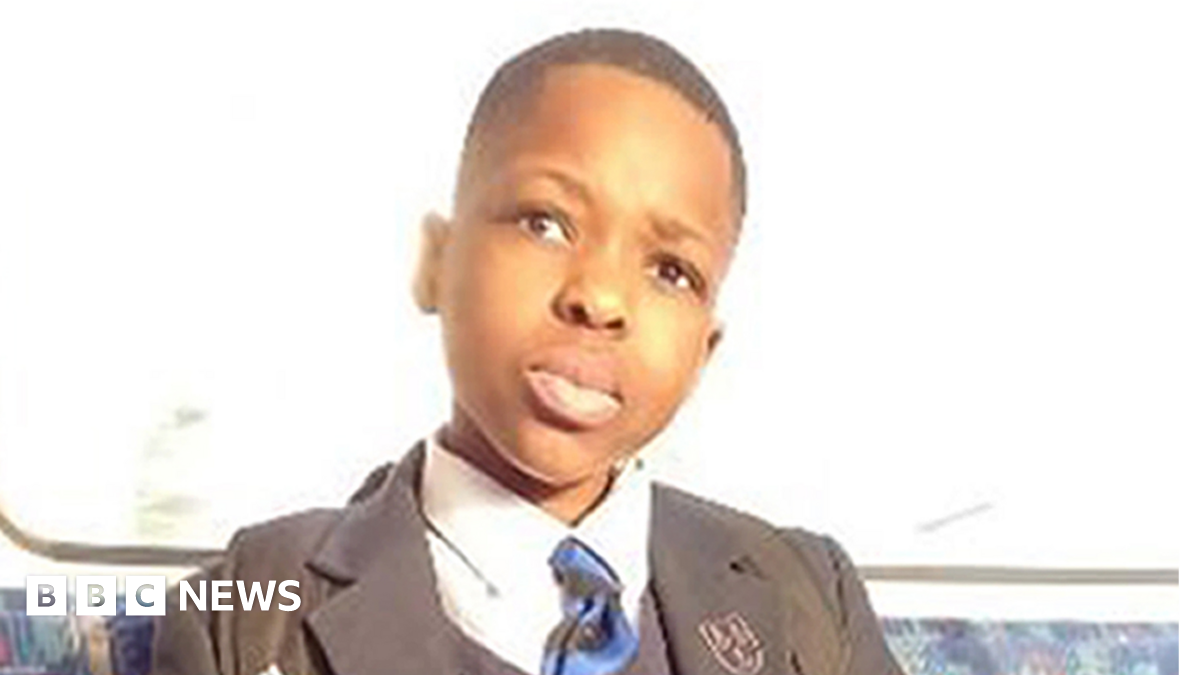

Daniel Anjorin Murder Accused Marcus Monzos Alleged Intent Revealed In Court

Jun 05, 2025

Daniel Anjorin Murder Accused Marcus Monzos Alleged Intent Revealed In Court

Jun 05, 2025 -

Self Directed Precious Metals Iras Key Findings From A New Retirement Report

Jun 05, 2025

Self Directed Precious Metals Iras Key Findings From A New Retirement Report

Jun 05, 2025 -

Thousands Flee As Wwii Bomb Requires Defusal In Cologne

Jun 05, 2025

Thousands Flee As Wwii Bomb Requires Defusal In Cologne

Jun 05, 2025 -

French Open Bubliks Shock Win Djokovic Advances Match Highlights

Jun 05, 2025

French Open Bubliks Shock Win Djokovic Advances Match Highlights

Jun 05, 2025

Latest Posts

-

Travel Smart Understanding Measles Risks And Prevention

Aug 16, 2025

Travel Smart Understanding Measles Risks And Prevention

Aug 16, 2025 -

Court Blocks Trump Administrations Attempt To Limit Dei Initiatives In Higher Education

Aug 16, 2025

Court Blocks Trump Administrations Attempt To Limit Dei Initiatives In Higher Education

Aug 16, 2025 -

Legal Victory For Dei Judge Strikes Down Trump Era Restrictions On Diversity Initiatives

Aug 16, 2025

Legal Victory For Dei Judge Strikes Down Trump Era Restrictions On Diversity Initiatives

Aug 16, 2025 -

Wooler Playgrounds Long Road Back Reopening After Wwii Bomb Discovery

Aug 16, 2025

Wooler Playgrounds Long Road Back Reopening After Wwii Bomb Discovery

Aug 16, 2025 -

Behind The Scenes With Kaitlan Collins National Guard And Trump Putin Summit Coverage

Aug 16, 2025

Behind The Scenes With Kaitlan Collins National Guard And Trump Putin Summit Coverage

Aug 16, 2025