Retirement Planning With Self-Directed Precious Metals IRAs: Key Findings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Retirement Planning with Self-Directed Precious Metals IRAs: Key Findings

Retirement planning is a crucial aspect of financial security, and many individuals are exploring alternative investment strategies to supplement traditional methods. Self-directed precious metals IRAs (Individual Retirement Accounts) have gained popularity as a way to diversify retirement portfolios and potentially protect against inflation. This article explores key findings regarding this increasingly popular retirement planning strategy.

What is a Self-Directed Precious Metals IRA?

A self-directed precious metals IRA allows investors to hold physical precious metals, such as gold, silver, platinum, and palladium, within their retirement accounts. Unlike traditional IRAs that primarily invest in stocks and bonds, this option provides a tangible asset that can offer diversification benefits and potentially hedge against economic uncertainty. The IRS strictly regulates eligible metals and custodians, so careful selection is crucial. You cannot simply store the metals yourself; a reputable custodian must hold the assets on your behalf.

Key Findings: Benefits and Considerations

Several key findings highlight the appeal and potential drawbacks of self-directed precious metals IRAs:

Benefits:

- Inflation Hedge: Precious metals are often viewed as a hedge against inflation. During periods of economic instability, their value tends to rise, potentially preserving the purchasing power of your retirement savings. [Link to an article about inflation hedging]

- Diversification: Adding precious metals to a retirement portfolio diversifies holdings, reducing reliance on fluctuating stock markets and bonds. This reduces overall portfolio risk. [Link to an article about portfolio diversification]

- Tangible Asset: Unlike stocks or bonds, precious metals are tangible assets. This can provide a sense of security and control for some investors.

- Potential for Long-Term Growth: Historically, precious metals have demonstrated long-term growth potential, although past performance is not indicative of future results.

Considerations:

- Liquidity: Selling physical precious metals can take longer than selling stocks or bonds. This should be considered, especially for those anticipating needing access to funds in retirement.

- Storage Costs: Custodian fees and storage charges for your precious metals will add to your overall expenses.

- Market Volatility: While considered a hedge against inflation, precious metals prices can still fluctuate significantly, impacting the value of your IRA.

- IRS Regulations: Strict IRS regulations govern the eligibility of metals and custodians. Non-compliance can result in significant penalties. Consult with a qualified financial advisor and ensure your custodian is reputable and compliant.

Choosing a Custodian: A Critical Step

Selecting a reputable and IRS-approved custodian is paramount. A trustworthy custodian will ensure the safe storage and proper handling of your precious metals. Thoroughly research potential custodians, checking their reputation, fees, and compliance history before making a decision. [Link to a resource for finding reputable custodians]

Conclusion: A Valuable Tool, But Not Without Risk

Self-directed precious metals IRAs can be a valuable addition to a diversified retirement strategy, offering potential benefits like inflation hedging and tangible asset ownership. However, investors must carefully weigh the potential risks, including liquidity constraints and storage costs, and understand the stringent IRS regulations. Thorough research, consultation with a qualified financial advisor, and the selection of a reputable custodian are crucial for success. Before making any investment decisions, it's always best to seek professional financial advice tailored to your individual circumstances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Retirement Planning With Self-Directed Precious Metals IRAs: Key Findings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Skin Tightening Cream Halle Berrys Choice At 58

Jun 05, 2025

Skin Tightening Cream Halle Berrys Choice At 58

Jun 05, 2025 -

Two Us Stocks Dumped By Warren Buffett Implications For Your Portfolio

Jun 05, 2025

Two Us Stocks Dumped By Warren Buffett Implications For Your Portfolio

Jun 05, 2025 -

Paige De Sorbos Summer House Era Ends Official Statement

Jun 05, 2025

Paige De Sorbos Summer House Era Ends Official Statement

Jun 05, 2025 -

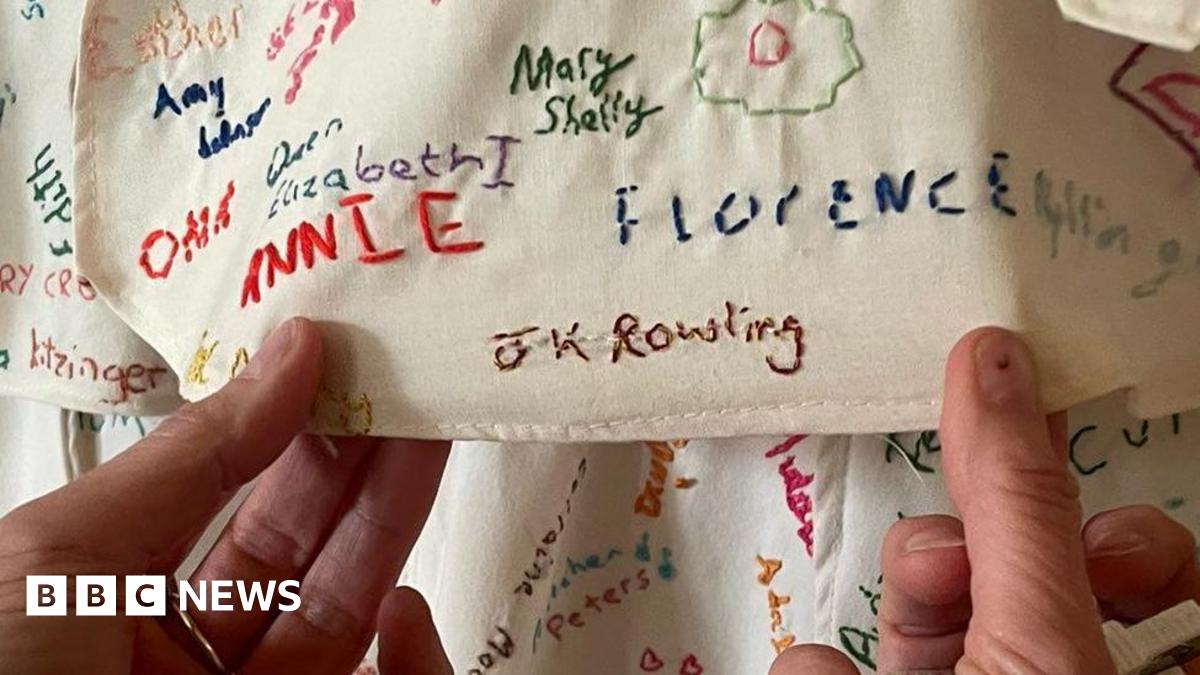

J K Rowling Artwork Vandalized National Trusts Response In Derbyshire

Jun 05, 2025

J K Rowling Artwork Vandalized National Trusts Response In Derbyshire

Jun 05, 2025 -

Unexpected Job Market Growth In April Us Hiring On The Rise

Jun 05, 2025

Unexpected Job Market Growth In April Us Hiring On The Rise

Jun 05, 2025

Latest Posts

-

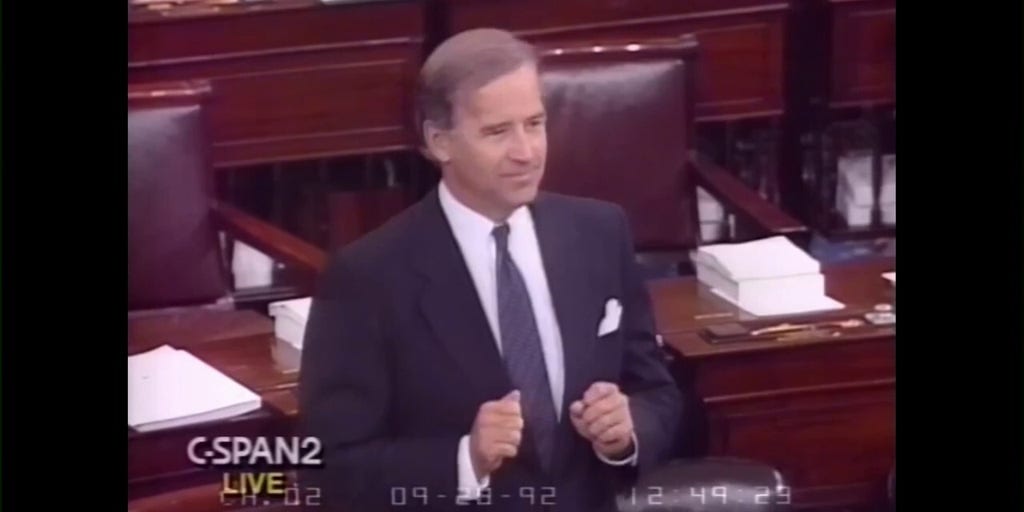

Dont Stop At A Stoplight Bidens 1992 Perspective On Dc Crime

Aug 17, 2025

Dont Stop At A Stoplight Bidens 1992 Perspective On Dc Crime

Aug 17, 2025 -

Uk Trade Envoy Resignation Fallout From Northern Cyprus Trip

Aug 17, 2025

Uk Trade Envoy Resignation Fallout From Northern Cyprus Trip

Aug 17, 2025 -

Denmark Train Accident Tanker Collision Causes Fatality Injuries

Aug 17, 2025

Denmark Train Accident Tanker Collision Causes Fatality Injuries

Aug 17, 2025 -

Air Canada Flight Cancellations Passenger Rights And Recourse

Aug 17, 2025

Air Canada Flight Cancellations Passenger Rights And Recourse

Aug 17, 2025 -

Nakagawas Ninth Home Run Orix Secures Key Victory

Aug 17, 2025

Nakagawas Ninth Home Run Orix Secures Key Victory

Aug 17, 2025