Retirement Reform In Denmark: Reaching New Heights

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Retirement Reform in Denmark: Reaching New Heights

Denmark, a nation renowned for its robust social welfare system, is once again making headlines with its ambitious retirement reform. The changes aim to address the challenges posed by an aging population and ensure the long-term sustainability of the Danish pension system. This reform isn't just tweaking existing policies; it represents a significant overhaul designed to secure a comfortable retirement for future generations.

Addressing the Challenges of an Aging Population

Denmark, like many developed nations, faces a demographic shift. The proportion of retirees is increasing while the working-age population shrinks. This creates significant pressure on the existing pension system, threatening its ability to provide adequate benefits. The current reform directly tackles this issue by implementing several key strategies:

H2: Key Pillars of the Danish Retirement Reform

The reform centers around several crucial pillars:

-

Increasing the Retirement Age: Gradual increases to the official retirement age are a cornerstone of the reform. This acknowledges the increased life expectancy of Danes and aims to distribute the burden of pension payments more equitably across the working population. The exact timeline and specifics of these increases are subject to ongoing parliamentary debate and are regularly reviewed to ensure they remain appropriate in relation to life expectancy and overall health.

-

Strengthening the Mandatory Pension System: Denmark's mandatory pension system, ATP (Arbejdsmarkedets Tillægspension), is being reinforced. This ensures a minimum level of retirement income for all citizens, regardless of their individual savings. The government is exploring options to increase contributions and enhance investment strategies to maximize returns.

-

Incentivizing Longer Working Lives: The reform actively encourages Danes to work longer. This is achieved through a combination of measures, including improved workplace flexibility for older workers, retraining programs to upskill aging workers for modern jobs, and enhanced incentives for delayed retirement. This not only alleviates pressure on the pension system but also taps into the valuable experience and expertise of older workers.

-

Promoting Private Pension Savings: While the mandatory system forms the bedrock of retirement security, the reform also underscores the importance of private pension savings. This encourages individuals to take greater responsibility for their own retirement planning and supplement their state pension. Government initiatives are promoting financial literacy and providing access to independent financial advice to empower citizens to make informed decisions.

H2: The Impact and Future Outlook

The full impact of this comprehensive reform will unfold over time. However, early indications suggest it has the potential to significantly improve the long-term sustainability of the Danish pension system. The government continues to monitor the effectiveness of the changes and adapt its strategies as needed. Regular reviews and public consultations are integral to ensuring the system remains responsive to the evolving needs of the Danish population. This iterative approach to reform highlights Denmark's commitment to adapting its social safety net to the challenges of a rapidly changing world.

H2: Learning from the Danish Model

Denmark's experience with retirement reform offers valuable lessons for other countries grappling with similar demographic challenges. The focus on a multi-pronged approach, incorporating adjustments to the retirement age, strengthening the mandatory system, and promoting private savings, provides a template for sustainable pension reform. By carefully balancing the needs of both current and future generations, Denmark is striving to create a model for a secure and prosperous retirement for all its citizens. Further research into the long-term effects of this reform will undoubtedly provide valuable insights for policymakers worldwide.

Call to Action: Stay informed about future developments in Danish pension reform by following reputable news sources and government publications. Understanding these developments can aid in informed discussions about the future of retirement systems globally.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Retirement Reform In Denmark: Reaching New Heights. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Flood Watch Continues Despite Tornado Threat Expiring Wednesday Evening

May 24, 2025

Flood Watch Continues Despite Tornado Threat Expiring Wednesday Evening

May 24, 2025 -

Retirement Age Increase In Denmark A European High

May 24, 2025

Retirement Age Increase In Denmark A European High

May 24, 2025 -

Western Pennsylvania Flash Flood Warning Issued

May 24, 2025

Western Pennsylvania Flash Flood Warning Issued

May 24, 2025 -

Singer Olly Murs Glasgow Concert Interrupted Stage Walk Off Sparks Speculation

May 24, 2025

Singer Olly Murs Glasgow Concert Interrupted Stage Walk Off Sparks Speculation

May 24, 2025 -

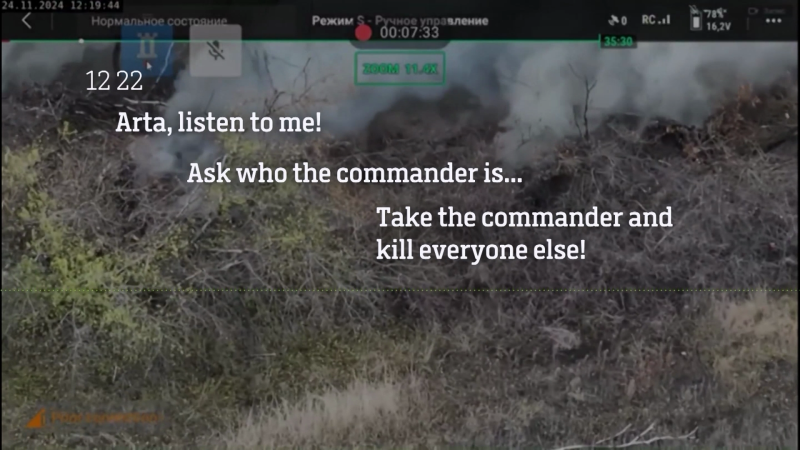

Kill Everyone Else Analysis Of Disturbing Intercepted Russian Military Communication

May 24, 2025

Kill Everyone Else Analysis Of Disturbing Intercepted Russian Military Communication

May 24, 2025

Latest Posts

-

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025 -

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025 -

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025 -

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025