Rising College Costs? Ohio Families Find Clever 529 Solutions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising College Costs? Ohio Families Find Clever 529 Solutions

The soaring cost of higher education is a significant concern for families across the nation, and Ohio is no exception. Tuition fees continue to climb, leaving many parents scrambling to find affordable ways to fund their children's college dreams. However, savvy Ohio families are increasingly turning to 529 plans as a clever and effective solution to navigate these rising costs. This article explores how Ohio's 529 plan, the Ohio 529 Plan, is helping families save for college and the innovative strategies they're employing to maximize their savings.

Understanding the Power of Ohio's 529 Plan

The Ohio 529 Plan offers a tax-advantaged way to save for qualified education expenses, including tuition, fees, room and board, and even certain books and supplies. The biggest advantage? Earnings grow tax-free, and withdrawals are tax-free when used for qualified education expenses. This makes it a powerful tool for long-term college savings.

- Tax Advantages: The tax-free growth and withdrawals significantly boost your savings potential compared to traditional savings accounts.

- Flexibility: Ohio's 529 plan offers various investment options to suit different risk tolerances and time horizons. You can choose from age-based options that automatically adjust the portfolio's risk level as your child gets closer to college, or you can select specific investment funds.

- State Tax Deductions: Ohio residents may also be eligible for state tax deductions on their 529 plan contributions, further enhancing the savings. Check with a tax professional or the Ohio Department of Taxation for the most up-to-date information.

Clever Strategies Ohio Families are Using

While simply contributing regularly is a great start, many Ohio families are employing more strategic approaches to maximize their 529 plan benefits:

- Early Contributions: Starting early is crucial. Even small, consistent contributions made early on can compound significantly over time, making a substantial difference in the overall savings.

- Gifting Strategies: Grandparents and other family members can contribute to the 529 plan, leveraging the gift tax exclusion to maximize contributions without incurring tax penalties.

- Utilizing Employer Matching: Some employers offer matching contributions to 529 plans. Take advantage of this valuable perk to boost your savings even further.

- Exploring Scholarship Opportunities: Supplementing 529 savings with scholarships and grants can significantly reduce the overall college costs. Encourage your child to apply for various scholarships throughout high school. Websites like can help you find relevant opportunities.

- Considering Financial Aid Implications: While 529 assets are considered parental assets when applying for financial aid, their impact is generally less significant than other assets. This makes them a valuable tool even for families seeking financial aid.

Beyond the Basics: Navigating the Ohio 529 Plan

For more detailed information on contribution limits, investment options, and beneficiary changes, visit the official . You can also consult with a qualified financial advisor to create a personalized savings plan tailored to your family's specific needs and circumstances. Understanding the nuances of the plan and utilizing available resources can make all the difference in achieving your college savings goals.

Conclusion: Planning for a Brighter Future

The rising cost of college is a real challenge, but with careful planning and utilization of tools like the Ohio 529 plan, Ohio families can significantly reduce the financial burden. By understanding the advantages of the plan and employing strategic saving techniques, you can pave the way for your child's successful future, one smart contribution at a time. Start planning today and secure your child's educational future!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising College Costs? Ohio Families Find Clever 529 Solutions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Roland Garros 2024 Sinner Addresses His Alcaraz Head To Head Record

Jun 04, 2025

Roland Garros 2024 Sinner Addresses His Alcaraz Head To Head Record

Jun 04, 2025 -

Texas Preemies Successful Fish Skin Treatment For Severe Wound Healing

Jun 04, 2025

Texas Preemies Successful Fish Skin Treatment For Severe Wound Healing

Jun 04, 2025 -

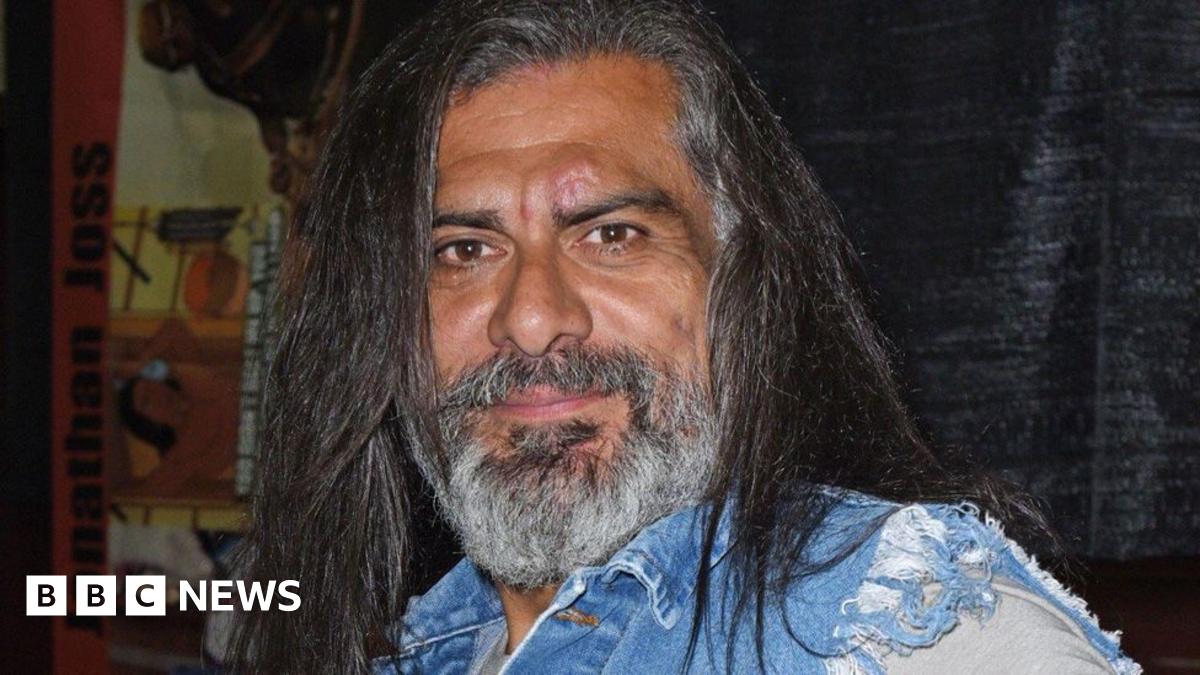

Confirmed Jonathan Joss John Redcorn In King Of The Hill Fatally Shot

Jun 04, 2025

Confirmed Jonathan Joss John Redcorn In King Of The Hill Fatally Shot

Jun 04, 2025 -

Binge Alert Netflixs Compelling New Series Keeps Viewers Hooked

Jun 04, 2025

Binge Alert Netflixs Compelling New Series Keeps Viewers Hooked

Jun 04, 2025 -

After Dominant Minor League Showing Mets Call Up Ronny Mauricio

Jun 04, 2025

After Dominant Minor League Showing Mets Call Up Ronny Mauricio

Jun 04, 2025

Latest Posts

-

New York Man Arrested In Connection With California Clinic Explosion

Jun 05, 2025

New York Man Arrested In Connection With California Clinic Explosion

Jun 05, 2025 -

Pre Earnings Options Strategies For Broadcom A Detailed Analysis

Jun 05, 2025

Pre Earnings Options Strategies For Broadcom A Detailed Analysis

Jun 05, 2025 -

Assessing The Risks And Rewards Of Investing In Robinhood Stock

Jun 05, 2025

Assessing The Risks And Rewards Of Investing In Robinhood Stock

Jun 05, 2025 -

Mike Sullivan Welcomes David Quinn To Penguins Coaching Team

Jun 05, 2025

Mike Sullivan Welcomes David Quinn To Penguins Coaching Team

Jun 05, 2025 -

Villanova University Leaves Caa Football A Comprehensive Overview

Jun 05, 2025

Villanova University Leaves Caa Football A Comprehensive Overview

Jun 05, 2025