Rising College Costs? Ohio Parents Find Success With 529 Plans

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising College Costs? Ohio Parents Find Success with 529 Plans

The soaring cost of higher education is a major concern for families across the nation, and Ohio is no exception. Tuition fees, room and board, and other expenses continue to climb, leaving many parents scrambling to find ways to fund their children's college dreams. But amidst the financial anxieties, a beacon of hope shines brightly: Ohio's 529 college savings plans. More and more Ohio parents are discovering the significant advantages of these tax-advantaged savings vehicles, securing their children's futures and easing the burden of college debt.

Understanding Ohio's 529 Plans: A Powerful Savings Tool

Ohio offers two types of 529 plans: the Ohio Tuition Trust Authority (OTTA) plan and the CollegeAdvantage Direct Plan. Both plans offer significant tax benefits, allowing earnings to grow tax-deferred and withdrawals used for qualified education expenses to be tax-free. This means more money saved for college and less money lost to taxes.

-

Tax Advantages: The biggest draw for Ohio parents is the significant tax advantage. Contributions aren't tax deductible at the federal level, but many states, including Ohio, offer state income tax deductions or credits for contributions made to their 529 plans. This can translate to substantial savings over time. Check with a qualified financial advisor or the Ohio Department of Taxation for the most up-to-date information on state tax benefits.

-

Investment Options: Both plans offer a range of investment options, allowing parents to tailor their investment strategy to their risk tolerance and time horizon. From age-based portfolios designed to become more conservative as college approaches, to more aggressive options for long-term growth, there's an option to suit every family's needs.

-

Flexibility: While primarily designed for college, 529 plan funds can also be used for K-12 tuition expenses (up to $10,000 per year per beneficiary), as well as apprenticeships and other educational expenses. This added flexibility makes 529 plans even more appealing for families with diverse educational goals.

Success Stories from Ohio Families

Many Ohio families are already reaping the rewards of using 529 plans. Sarah Miller, a mother of two from Columbus, shared, "Starting early with a 529 plan was the best financial decision we ever made. The tax benefits alone are incredible, and knowing we're steadily saving for our children's college educations gives us peace of mind."

Another Ohio parent, David Jones from Cincinnati, added, "We initially underestimated the cost of college. Thankfully, our 529 plan helped significantly reduce the financial burden. It allowed us to focus on supporting our daughter academically, rather than constantly worrying about tuition bills."

Getting Started with a 529 Plan: A Simple Process

Opening a 529 plan is surprisingly straightforward. You can open an account online through the CollegeAdvantage website or through a financial advisor. Even small, regular contributions can make a significant difference over time, thanks to the power of compounding interest. Don't underestimate the potential of starting early; even small monthly contributions can accumulate substantially over many years.

Beyond the Numbers: Securing Your Child's Future

While the financial benefits of 529 plans are undeniable, the true value lies in the peace of mind they provide. Knowing that you're proactively saving for your child's education allows you to focus on supporting their academic journey, rather than being overwhelmed by the daunting cost of college. It's an investment not just in their education, but in their future.

Call to Action: Visit the CollegeAdvantage website today to learn more about Ohio's 529 plans and start securing your child's future. Don't let rising college costs derail your dreams. Take control of your family's financial future and start planning today! [Link to CollegeAdvantage website]

Related Keywords: Ohio 529 plan, College savings plan, Ohio college savings, 529 plan benefits, College tuition cost, Saving for college, College planning, Tax-advantaged savings, Financial planning for college, Ohio education savings plan.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising College Costs? Ohio Parents Find Success With 529 Plans. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Aaron Taylor Johnson And Jodie Comer A Steamy On Set Photo

Jun 03, 2025

Aaron Taylor Johnson And Jodie Comer A Steamy On Set Photo

Jun 03, 2025 -

Boeing Stock Soars Bank Of America Cites Trumps Trade Deals As Key Driver

Jun 03, 2025

Boeing Stock Soars Bank Of America Cites Trumps Trade Deals As Key Driver

Jun 03, 2025 -

Live England Vs West Indies Odi Hit By Traffic Delays Latest Updates

Jun 03, 2025

Live England Vs West Indies Odi Hit By Traffic Delays Latest Updates

Jun 03, 2025 -

Tackling Tuition Creative Ohio 529 Plan Uses For College Savings

Jun 03, 2025

Tackling Tuition Creative Ohio 529 Plan Uses For College Savings

Jun 03, 2025 -

Tennis News Musetti Upsets Rune Tiafoe Continues Us Open Dominance

Jun 03, 2025

Tennis News Musetti Upsets Rune Tiafoe Continues Us Open Dominance

Jun 03, 2025

Latest Posts

-

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025 -

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025 -

2028 Election Looms Pentagon Schedules Crucial Golden Dome Missile Defense Test

Aug 02, 2025

2028 Election Looms Pentagon Schedules Crucial Golden Dome Missile Defense Test

Aug 02, 2025 -

Zelenskys Law Reversal A Victory For Young Ukrainians

Aug 02, 2025

Zelenskys Law Reversal A Victory For Young Ukrainians

Aug 02, 2025 -

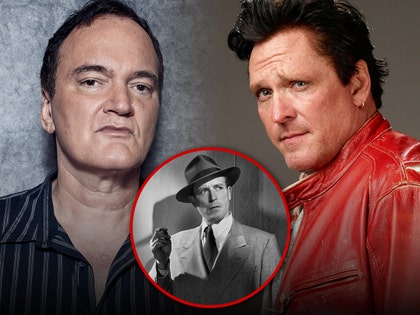

Michael Madsen Defends Tarantinos Firing Of Lawrence Tierney

Aug 02, 2025

Michael Madsen Defends Tarantinos Firing Of Lawrence Tierney

Aug 02, 2025