Rising College Costs? Ohio Parents Share Clever 529 Plan Hacks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising College Costs? Ohio Parents Share Clever 529 Plan Hacks

The soaring cost of higher education is a major concern for families across the nation, and Ohio is no exception. Tuition fees, room and board, and other expenses continue to climb, leaving many parents scrambling to find ways to afford college for their children. But there's hope! Savvy Ohio parents are leveraging the power of 529 plans with some clever strategies to help them save for their children's future. We've gathered some of their best hacks to help you navigate the complexities of college savings and achieve your financial goals.

Understanding Ohio's 529 Plan Advantage:

Ohio's 529 Plan, officially known as the Ohio Tuition Trust Authority (OTTA) 529 Plan, offers several benefits. It's a tax-advantaged savings plan designed specifically to help families save for qualified education expenses. This includes tuition, fees, room and board, and even some books and supplies. But simply opening an account isn't enough. Maximizing your savings requires strategic planning and utilizing these smart hacks:

Hacks from Ohio Parents:

-

Maximize State Tax Deductions: Ohio offers state tax deductions on contributions made to its 529 plan. This is a significant advantage that can significantly boost your savings over time. Be sure to understand the current deduction limits and contribute accordingly. [Link to Ohio's 529 Plan website for tax deduction information]

-

Start Early and Stay Consistent: The earlier you start saving, the more time your money has to grow. Even small, consistent contributions can make a big difference thanks to the power of compounding interest. Consider setting up automatic monthly contributions to ensure you stay on track.

-

Utilize Employer Matching Programs: Some employers offer matching contributions to 529 plans. This is essentially free money, so be sure to take advantage of it if your employer offers such a program.

-

Consider "Gifting" Strategies: Grandparents or other family members can contribute to your child's 529 plan, potentially maximizing contribution limits and leveraging their own tax advantages. Consult a financial advisor to understand the gifting tax implications.

-

Diversify Your Investments: 529 plans offer various investment options, from conservative to more aggressive. Choose a mix that aligns with your risk tolerance and time horizon. Remember, the longer until college, the more you can afford to invest aggressively.

-

Track Your Progress Regularly: Regularly review your 529 plan's performance and adjust your investment strategy as needed. This ensures you're on track to meet your college savings goals. Many online platforms provide easy-to-use tracking tools.

-

Explore Scholarship Opportunities: Don't rely solely on your 529 plan. Actively research and apply for scholarships and grants. These can significantly reduce your overall college costs. [Link to a reputable scholarship search website]

Beyond the 529:

While a 529 plan is a crucial tool, it's not the only way to save for college. Consider exploring other options like:

- High-yield savings accounts: These offer a safe place to park money you may need in the near term.

- Custodial accounts (UTMA/UGMA): These accounts allow you to invest for your child but provide access to the funds before they turn 18 (with limitations).

Seek Professional Advice:

Remember, every family's financial situation is unique. It's always wise to consult with a qualified financial advisor to create a personalized college savings plan that best meets your needs and goals. They can help you navigate the complexities of 529 plans and other savings vehicles.

Call to Action: Are you ready to start maximizing your Ohio 529 plan? Visit the Ohio Tuition Trust Authority website today and learn more! [Link to Ohio's 529 Plan website]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising College Costs? Ohio Parents Share Clever 529 Plan Hacks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

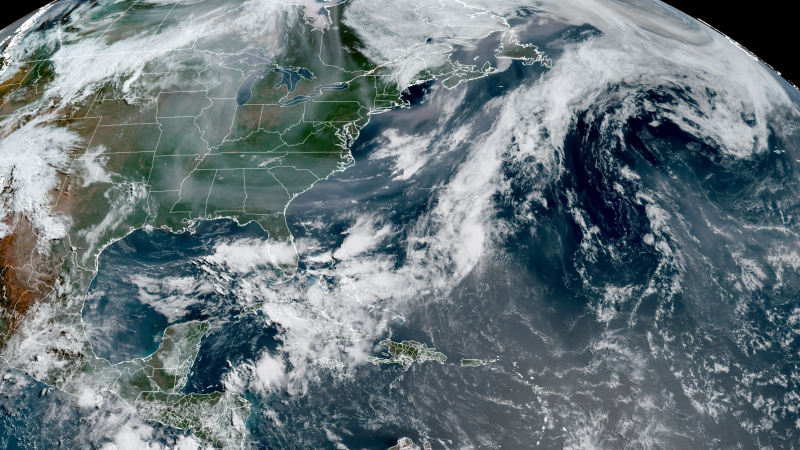

Air Quality Alert Canadian Smoke And African Dust To Mix Over Southern Us

Jun 04, 2025

Air Quality Alert Canadian Smoke And African Dust To Mix Over Southern Us

Jun 04, 2025 -

Swinging Betrayal And Belief Uncovering The Complex Lives Of Mormon Wives

Jun 04, 2025

Swinging Betrayal And Belief Uncovering The Complex Lives Of Mormon Wives

Jun 04, 2025 -

Glastonbury Festival 2025 Complete Stage Times And Lineup Revealed

Jun 04, 2025

Glastonbury Festival 2025 Complete Stage Times And Lineup Revealed

Jun 04, 2025 -

Mets Call Up Ronny Mauricio Is This His Time To Shine

Jun 04, 2025

Mets Call Up Ronny Mauricio Is This His Time To Shine

Jun 04, 2025 -

Hailee Steinfelds Marriage To Josh Allen Fact Or Fiction

Jun 04, 2025

Hailee Steinfelds Marriage To Josh Allen Fact Or Fiction

Jun 04, 2025

Latest Posts

-

Will Karen Read Testify Defense Filing Suggests Otherwise In Retrial

Jun 06, 2025

Will Karen Read Testify Defense Filing Suggests Otherwise In Retrial

Jun 06, 2025 -

Villanova Leaves Caa Football Official Statement And Impact

Jun 06, 2025

Villanova Leaves Caa Football Official Statement And Impact

Jun 06, 2025 -

Reverse Discrimination Lawsuit Changes After Supreme Court Ruling

Jun 06, 2025

Reverse Discrimination Lawsuit Changes After Supreme Court Ruling

Jun 06, 2025 -

Pathogen Smuggling Investigation University Of Michigan And Two Chinese Researchers

Jun 06, 2025

Pathogen Smuggling Investigation University Of Michigan And Two Chinese Researchers

Jun 06, 2025 -

Us Supreme Court Heterosexual Woman Loses Reverse Discrimination Case

Jun 06, 2025

Us Supreme Court Heterosexual Woman Loses Reverse Discrimination Case

Jun 06, 2025