Rising College Costs? Ohio Parents Share Their 529 Plan Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising College Costs? Ohio Parents Share Their 529 Plan Strategies

The soaring cost of higher education is a major concern for parents across the nation, and Ohio is no exception. With tuition fees increasing year after year, families are scrambling to find ways to afford college for their children. One popular tool many Ohio parents utilize is the 529 Plan, a tax-advantaged savings plan designed specifically for education expenses. But navigating the complexities of 529 plans can be daunting. This article delves into the strategies Ohio parents are employing to maximize their 529 plan contributions and prepare for the rising cost of college.

Understanding Ohio's 529 Plan: A Crucial First Step

Ohio offers its residents the Ohio 529 Plan, managed by the Ohio Tuition Trust Authority. This plan provides several investment options, allowing parents to tailor their savings strategy to their risk tolerance and timeline. Understanding the different investment options, from age-based portfolios to more aggressive growth options, is crucial for effective planning. [Link to Ohio 529 Plan website].

Key Features of the Ohio 529 Plan:

- Tax Advantages: Earnings grow tax-deferred, and withdrawals used for qualified education expenses are tax-free at the federal level. Ohio also offers state tax deductions or credits for contributions, making it even more attractive. [Link to article explaining Ohio's state tax benefits for 529 plans].

- Flexibility: The Ohio 529 Plan can be used for a wide range of qualified education expenses, including tuition, fees, room and board, and even some K-12 expenses.

- Beneficiary Changes: The beneficiary of the plan can be changed, offering flexibility should your child's plans change or if you have other family members who may benefit.

Ohio Parents' Top 529 Plan Strategies: Lessons Learned

We spoke to several Ohio parents to uncover their successful 529 plan strategies:

1. Start Early and Contribute Regularly: The power of compounding is undeniable. Parents who started saving early, even with small contributions, saw significantly larger balances by college time. "We started contributing as soon as our daughter was born," says Sarah Miller, a parent from Columbus. "Even small monthly amounts add up over time."

2. Utilize Auto-Debit: Setting up automatic monthly contributions takes the guesswork out of saving. This ensures consistent contributions, regardless of busy schedules or fluctuating income.

3. Diversify Investments: Don't put all your eggs in one basket. Consider diversifying your investments within the 529 plan to mitigate risk and potentially maximize returns. Consult with a financial advisor to determine the best allocation strategy based on your risk tolerance and time horizon.

4. Take Advantage of Employer Matching: Some employers offer matching contributions to 529 plans. Don't miss out on free money! Check with your HR department to see if this benefit is available to you.

5. Explore State Tax Benefits: Ohio offers specific tax advantages for contributing to the 529 plan. Make sure you understand these benefits and maximize your deductions or credits. [Link to Ohio Department of Taxation website regarding 529 plan tax benefits].

Beyond the 529 Plan: Complementary Strategies

While the 529 plan is a cornerstone of college savings, it's not the only tool in your arsenal. Consider these complementary strategies:

- Scholarships and Grants: Actively pursue scholarships and grants to reduce the overall cost of college.

- Federal Student Loans: Understand the various types of federal student loans and their implications.

- Part-Time Jobs: Encourage your child to work part-time to contribute to their college expenses.

Conclusion: Planning for College Success in Ohio

Planning for college is a marathon, not a sprint. By understanding the benefits of Ohio's 529 plan and employing smart strategies, Ohio parents can significantly reduce the financial burden of higher education. Start early, contribute consistently, and diversify your investments – your child's future will thank you for it. Remember to consult with a financial advisor to create a personalized college savings plan that meets your unique needs and circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising College Costs? Ohio Parents Share Their 529 Plan Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

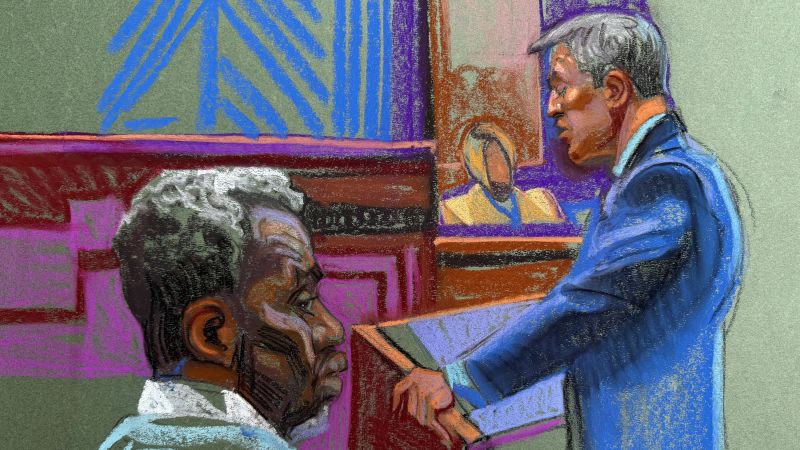

Sean Diddy Combs Trial Recent News And Potential Outcomes

Jun 03, 2025

Sean Diddy Combs Trial Recent News And Potential Outcomes

Jun 03, 2025 -

Maximize Your Childs Future The Power Of 529 College Savings Plans

Jun 03, 2025

Maximize Your Childs Future The Power Of 529 College Savings Plans

Jun 03, 2025 -

Psg Victory Celebrations Marred By Tragedy Two Fatalities Mass Arrests In France

Jun 03, 2025

Psg Victory Celebrations Marred By Tragedy Two Fatalities Mass Arrests In France

Jun 03, 2025 -

Us Open Musettis Landmark Victory And Tiafoes Historic Feat

Jun 03, 2025

Us Open Musettis Landmark Victory And Tiafoes Historic Feat

Jun 03, 2025 -

Report Actress Hailee Steinfeld Buffalo Bills Josh Allen Exchange Vows

Jun 03, 2025

Report Actress Hailee Steinfeld Buffalo Bills Josh Allen Exchange Vows

Jun 03, 2025

Latest Posts

-

Analysis Mc Larens Strong Practice Performance At The Hungaroring

Aug 02, 2025

Analysis Mc Larens Strong Practice Performance At The Hungaroring

Aug 02, 2025 -

Mc Laren Dominates Hungarian Gp Practice Unstoppable At The Hungaroring

Aug 02, 2025

Mc Laren Dominates Hungarian Gp Practice Unstoppable At The Hungaroring

Aug 02, 2025 -

Could Robert Pattinson And David Corenswets Heroes Unite In A Dc Sequel

Aug 02, 2025

Could Robert Pattinson And David Corenswets Heroes Unite In A Dc Sequel

Aug 02, 2025 -

New Rules Civil Service Internships Reserved For Working Class Applicants

Aug 02, 2025

New Rules Civil Service Internships Reserved For Working Class Applicants

Aug 02, 2025 -

Kai Cenat Vs X Qc A Net Worth Showdown

Aug 02, 2025

Kai Cenat Vs X Qc A Net Worth Showdown

Aug 02, 2025