Rising Mortgage Lengths: First-Timers Facing 31-Year Loans

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising Mortgage Lengths: First-Timers Facing 31-Year Loans

Record-high interest rates are forcing first-time homebuyers into longer mortgage terms, impacting their financial futures.

The dream of homeownership is becoming increasingly distant for many, thanks to a perfect storm of rising interest rates and persistently high house prices. A recent surge in mortgage lengths, with first-time buyers now commonly facing 31-year loans, highlights a worrying trend impacting financial stability for a generation. This isn't just about longer repayment periods; it's about significantly increased overall interest payments and a potentially slower path to building wealth.

The Impact of Extended Mortgage Terms:

The shift towards longer mortgage terms is a direct consequence of the current economic climate. With interest rates at levels not seen in years, prospective homeowners are finding themselves priced out of shorter-term loans. A 31-year mortgage, compared to a more traditional 25-year term, means:

- Significantly higher total interest paid: Over the life of the loan, the extra six years will result in tens of thousands of dollars more in interest payments, significantly impacting long-term financial planning.

- Slower equity building: While you're paying down the principal, a larger portion of your monthly payments goes towards interest in the early years of a longer-term loan. This slows down the rate at which you build equity in your home.

- Increased financial vulnerability: A longer mortgage term increases your exposure to economic fluctuations. Unexpected job loss or a market downturn could become more problematic with a longer repayment period.

Why are mortgages getting longer?

The primary driver is the current high-interest rate environment. To make monthly payments more affordable, lenders and borrowers are opting for longer loan terms. This strategy, while seemingly helpful in the short term, can have profound long-term consequences. The Federal Reserve's recent interest rate hikes, aimed at combating inflation, have directly contributed to this situation. [Link to relevant Federal Reserve data].

Strategies for First-Time Homebuyers:

Facing this challenging market, first-time homebuyers need to be proactive and strategic:

- Improve credit score: A higher credit score can unlock better interest rates and potentially shorter loan terms. [Link to resource on improving credit scores]

- Save a larger down payment: A substantial down payment can reduce the loan amount needed, resulting in lower monthly payments and potentially a shorter loan term.

- Explore different mortgage options: Shop around and compare rates from various lenders to find the most suitable mortgage product. Consider government-backed loans like FHA loans which often have lower down payment requirements.

- Consider location: Exploring areas with slightly lower housing prices can make a significant difference in affordability.

Looking Ahead:

The rising trend of longer mortgage lengths represents a significant challenge for first-time homebuyers. Understanding the implications of extended repayment periods is crucial for making informed financial decisions. While owning a home remains a significant milestone, navigating the current market requires careful planning, financial literacy, and a realistic assessment of long-term financial implications. The situation calls for increased financial education and support for those entering the housing market.

Call to Action: Are you a first-time homebuyer facing similar challenges? Share your experiences and advice in the comments below. Let's support each other in navigating this complex landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising Mortgage Lengths: First-Timers Facing 31-Year Loans. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Raw Footage Of Ross Monaghan Shooting Appears On Spanish Network

Jun 03, 2025

Raw Footage Of Ross Monaghan Shooting Appears On Spanish Network

Jun 03, 2025 -

Day 24 Of Karen Read Trial Defenses First Witness Testifies

Jun 03, 2025

Day 24 Of Karen Read Trial Defenses First Witness Testifies

Jun 03, 2025 -

Absentee Ballot Lawsuit Supreme Court Takes Up Illinois Congressmans Appeal

Jun 03, 2025

Absentee Ballot Lawsuit Supreme Court Takes Up Illinois Congressmans Appeal

Jun 03, 2025 -

England West Indies Cricket Match Postponed Due To Traffic

Jun 03, 2025

England West Indies Cricket Match Postponed Due To Traffic

Jun 03, 2025 -

Tom Daleys Powerful Message The Importance Of Parental Support And Self Love

Jun 03, 2025

Tom Daleys Powerful Message The Importance Of Parental Support And Self Love

Jun 03, 2025

Latest Posts

-

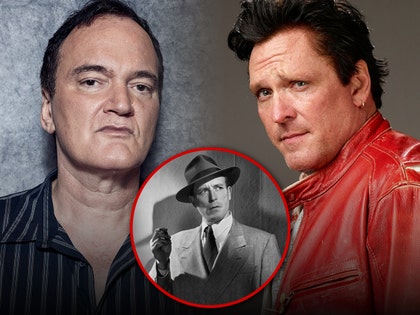

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025 -

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025 -

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025 -

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025 -

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025