Rising Mortgage Terms: Why First-Timers Borrow For 31 Years

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising Mortgage Terms: Why First-Time Homebuyers Are Opting for 31-Year Loans

The dream of homeownership is becoming increasingly elusive for many, particularly first-time buyers. Soaring interest rates have significantly impacted affordability, pushing many to consider longer mortgage terms – often stretching to a remarkable 31 years – to make their monthly payments manageable. But why this dramatic shift, and what are the implications?

This article delves into the rising trend of longer mortgage terms, exploring the reasons behind the shift and the potential consequences for borrowers. We'll examine the impact of rising interest rates, the evolving housing market, and the financial strategies first-time homebuyers are employing to navigate this challenging landscape.

The Impact of Rising Interest Rates:

The most significant factor driving the increase in longer mortgage terms is the undeniable rise in interest rates. Over the past year, we've seen a substantial increase, making monthly payments on a 15- or even a 30-year mortgage significantly higher than just a few years ago. This has forced many potential homeowners to re-evaluate their affordability and consider longer loan terms to lower their monthly outlays. A 31-year mortgage, while seemingly a small increase over the standard 30-year term, can result in a noticeable decrease in monthly payments, making homeownership a more attainable goal for some.

The Shrinking Pool of Affordable Homes:

Coupled with rising interest rates, the ongoing housing shortage contributes to the problem. The limited supply of homes, particularly in desirable locations, drives up prices, further stretching the budgets of first-time homebuyers. Opting for a longer loan term becomes a strategic maneuver to afford a home in a competitive market, even if it means paying more in interest over the life of the loan.

Navigating the Financial Landscape:

First-time homebuyers are employing various strategies to secure financing in this challenging market. These strategies include:

- Saving Aggressively: Many are prioritizing saving a larger down payment to reduce the loan amount and, consequently, the monthly payment.

- Exploring Longer Loan Terms: As discussed, extending the loan term is a common tactic to lower monthly payments.

- Seeking Government Assistance Programs: Programs like FHA loans and VA loans offer more accessible financing options for first-time buyers. [Link to relevant government website]

- Improving Credit Scores: A strong credit score is crucial for securing favorable interest rates and loan terms. [Link to a resource about improving credit scores]

The Pros and Cons of 31-Year Mortgages:

While a lower monthly payment is appealing, it's crucial to weigh the pros and cons of a 31-year mortgage:

Pros:

- Lower Monthly Payments: This makes homeownership more accessible.

- Greater Affordability: Allows buyers to purchase in more competitive markets.

Cons:

- Higher Total Interest Paid: Extending the loan term significantly increases the total interest paid over the life of the loan.

- Longer Commitment: Borrowers are tied to their mortgage for a longer period.

Looking Ahead:

The trend of longer mortgage terms is likely to persist as long as interest rates remain elevated and the housing market remains tight. First-time homebuyers should carefully weigh their options, consulting with financial advisors and mortgage lenders to determine the most suitable loan term based on their individual financial circumstances and long-term goals. Understanding the implications of a 31-year mortgage is crucial before making such a significant financial commitment.

Call to Action: Are you a first-time homebuyer facing challenges in today's market? Share your experiences and questions in the comments below! We're here to help you navigate the complexities of homeownership.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising Mortgage Terms: Why First-Timers Borrow For 31 Years. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Blake Lively Drops Lawsuit Claims Against Justin Baldoni

Jun 04, 2025

Blake Lively Drops Lawsuit Claims Against Justin Baldoni

Jun 04, 2025 -

Dramatic Video Tourists Run As Mount Etna Erupts

Jun 04, 2025

Dramatic Video Tourists Run As Mount Etna Erupts

Jun 04, 2025 -

John Brenkus Sports Science Founder Passes Away At 54

Jun 04, 2025

John Brenkus Sports Science Founder Passes Away At 54

Jun 04, 2025 -

John Brenkus Sports Science Host Passes Away At 54 Following Depression Struggle

Jun 04, 2025

John Brenkus Sports Science Host Passes Away At 54 Following Depression Struggle

Jun 04, 2025 -

Thames Water Faces Major Blow Preferred Bidders Withdrawal Creates Crisis

Jun 04, 2025

Thames Water Faces Major Blow Preferred Bidders Withdrawal Creates Crisis

Jun 04, 2025

Latest Posts

-

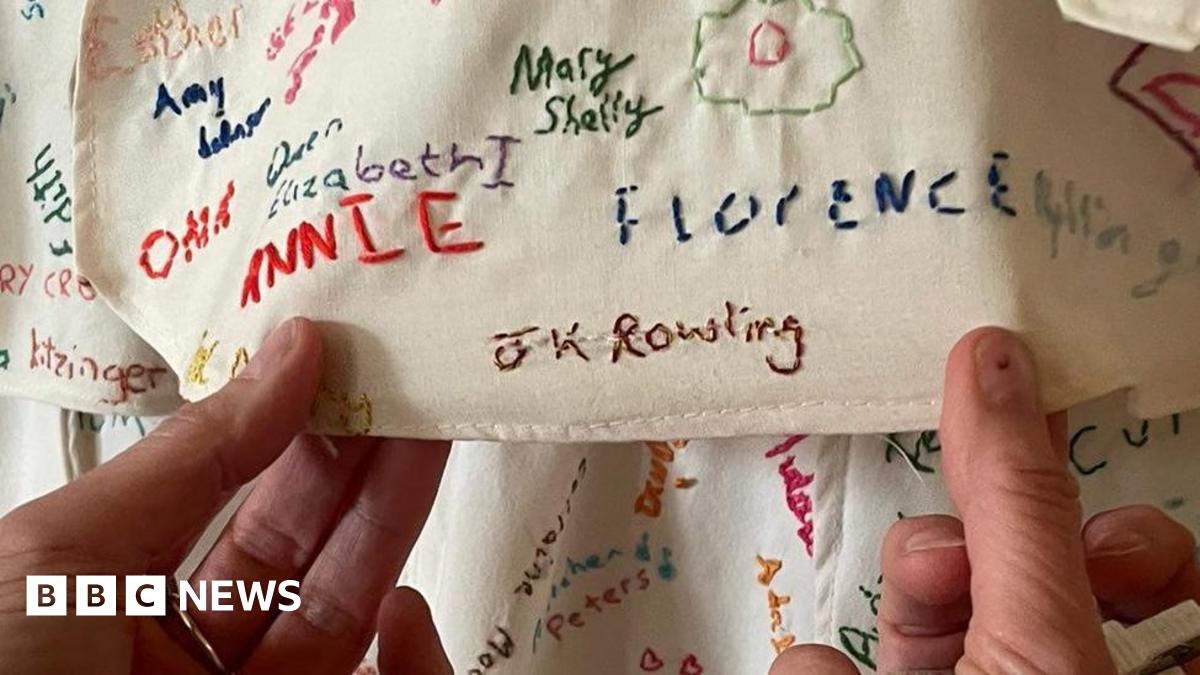

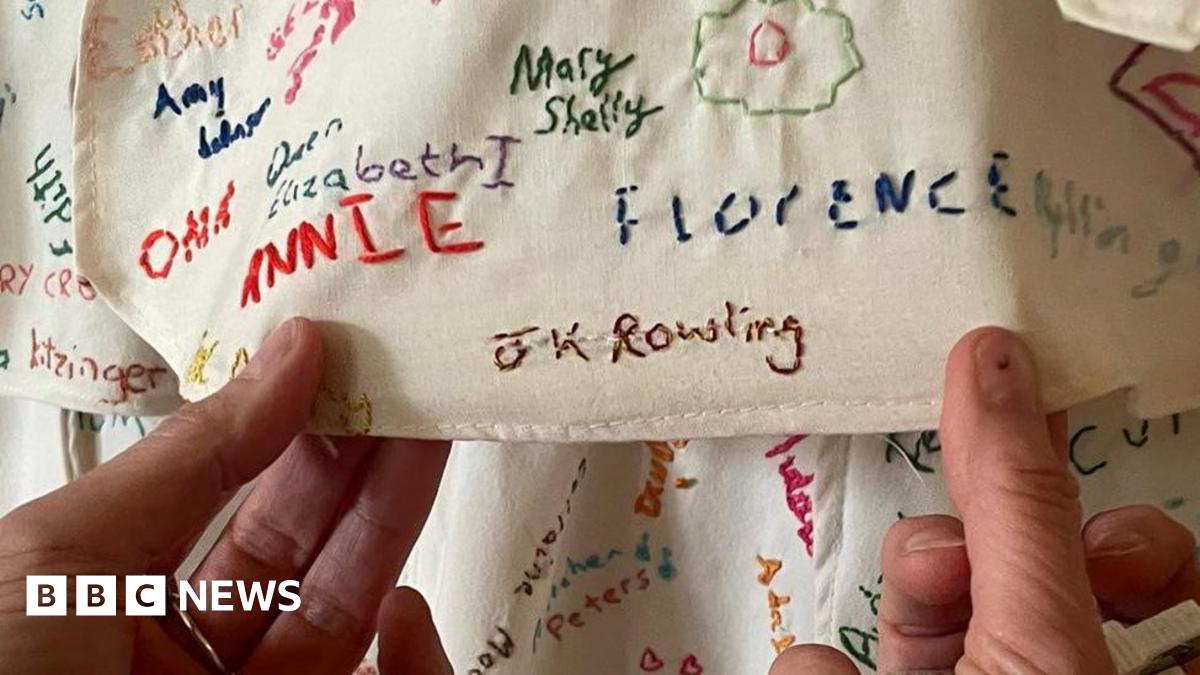

Derbyshire National Trust Site Covers Up Tampered Artwork J K Rowling Depicted

Jun 06, 2025

Derbyshire National Trust Site Covers Up Tampered Artwork J K Rowling Depicted

Jun 06, 2025 -

The Enduring Search For Madeleine Mc Cann Hope Remains After 18 Years

Jun 06, 2025

The Enduring Search For Madeleine Mc Cann Hope Remains After 18 Years

Jun 06, 2025 -

Rangers Coaching Staff Expands Quinn And Sacco On Board

Jun 06, 2025

Rangers Coaching Staff Expands Quinn And Sacco On Board

Jun 06, 2025 -

National Trust Investigation Damaged Artwork Featuring J K Rowling In Derbyshire

Jun 06, 2025

National Trust Investigation Damaged Artwork Featuring J K Rowling In Derbyshire

Jun 06, 2025 -

Impact Of Supreme Court Decision On Reverse Discrimination Claims In Employment

Jun 06, 2025

Impact Of Supreme Court Decision On Reverse Discrimination Claims In Employment

Jun 06, 2025