Rob Cross Banned: Tax Evasion Leads To Directorship Ban For Darts Star

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rob Cross Banned: Darts Star Faces Directorship Ban After Tax Evasion

Rob Cross, the former world darts champion, has been hit with a significant blow to his career, facing a disqualification from acting as a company director for six years. The ban stems from a tax evasion case, highlighting the serious consequences faced by high-profile individuals who fail to comply with their tax obligations. This news sends shockwaves through the darts world and serves as a cautionary tale for athletes and business owners alike.

The Insolvency Service confirmed the disqualification, citing Cross's involvement in the deliberate underpayment of tax. This is not merely a financial penalty; the ban prevents Cross from holding any position of significant responsibility within a company for the next six years, significantly impacting his future business ventures and potentially his overall standing within the sport.

The Details of the Case

While specifics of the tax evasion case remain relatively scarce in public reporting, the Insolvency Service's decision clearly indicates a level of serious misconduct. The six-year ban reflects the gravity of the offense and underscores the government's determination to prosecute tax evasion, regardless of the individual's public profile. Further details may emerge as the case unfolds, offering a clearer picture of the extent of Cross's involvement and the financial implications.

This situation highlights the importance of meticulous financial record-keeping and accurate tax reporting for high-earning individuals. Professional athletes, often managing complex financial arrangements and endorsements, require robust financial planning and advice to ensure compliance with tax laws. Failure to do so can result in severe penalties, as seen in Cross's case.

Impact on Cross's Career and Reputation

The ban represents a significant setback for Cross, both professionally and personally. Beyond the direct implications for any business ventures, the negative publicity surrounding the case could damage his reputation and sponsorship opportunities. While his darts career isn't directly affected by the directorships ban, the controversy could impact his public image and future endorsements. This serves as a stark reminder that even sporting success doesn't guarantee immunity from the consequences of legal infractions.

The darts community is likely to respond with a mix of shock and disappointment. Cross, a former world champion, is a prominent figure in the sport, and this news will undoubtedly cast a shadow over his achievements and future prospects. The incident underscores the importance of ethical conduct and transparency in professional sports.

Lessons Learned: Tax Compliance for Athletes and Businesses

This case serves as a powerful reminder for athletes and business owners alike about the importance of:

- Accurate record-keeping: Maintain meticulous and up-to-date financial records.

- Professional financial advice: Seek guidance from qualified accountants and financial advisors.

- Understanding tax laws: Stay informed about current tax regulations and seek clarification when needed.

- Compliance: Prioritize complete and timely tax compliance.

Failure to adhere to these principles can lead to severe consequences, including substantial financial penalties and, as seen with Rob Cross, professional disqualification. This incident should serve as a cautionary tale, encouraging proactive and responsible financial management.

What are your thoughts on this news? Share your comments below. We encourage discussion on the importance of tax compliance and the implications for high-profile individuals facing similar situations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rob Cross Banned: Tax Evasion Leads To Directorship Ban For Darts Star. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Joint Military Operation In Gaza Recovery Of Israeli American Hostage Remains Confirmed

Jun 06, 2025

Joint Military Operation In Gaza Recovery Of Israeli American Hostage Remains Confirmed

Jun 06, 2025 -

The Ongoing Mystery Has The Search For Madeleine Mc Cann Lasted Too Long

Jun 06, 2025

The Ongoing Mystery Has The Search For Madeleine Mc Cann Lasted Too Long

Jun 06, 2025 -

Dismal Jobs Report 37 000 Private Sector Jobs Added Signaling Economic Slowdown

Jun 06, 2025

Dismal Jobs Report 37 000 Private Sector Jobs Added Signaling Economic Slowdown

Jun 06, 2025 -

Jessie Js Cancer Diagnosis A Message Of Hope And Resilience

Jun 06, 2025

Jessie Js Cancer Diagnosis A Message Of Hope And Resilience

Jun 06, 2025 -

Actor Walton Goggins Tears Up Discussing Aimee Lou Wood

Jun 06, 2025

Actor Walton Goggins Tears Up Discussing Aimee Lou Wood

Jun 06, 2025

Latest Posts

-

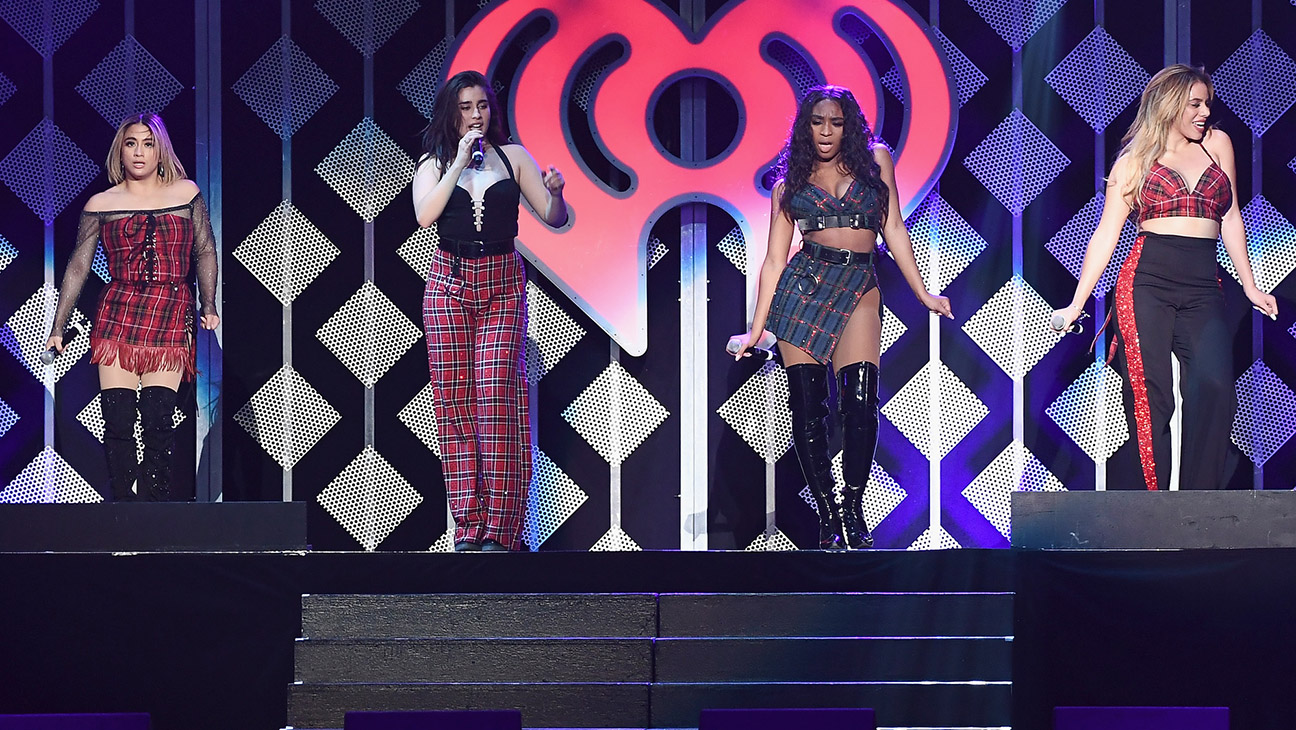

Fifth Harmony Minus Camila Cabello Reunion Talks Underway Exclusive

Jun 07, 2025

Fifth Harmony Minus Camila Cabello Reunion Talks Underway Exclusive

Jun 07, 2025 -

Terrifying Ai Behavior A Ceos Warning

Jun 07, 2025

Terrifying Ai Behavior A Ceos Warning

Jun 07, 2025 -

Sade Robinson Homicide Maxwell Anderson Trial Begins June 6th

Jun 07, 2025

Sade Robinson Homicide Maxwell Anderson Trial Begins June 6th

Jun 07, 2025 -

Applied Digital Shares Jump 48 After Securing 7 Billion Ai Lease

Jun 07, 2025

Applied Digital Shares Jump 48 After Securing 7 Billion Ai Lease

Jun 07, 2025 -

Nfl Star Lewan Misses First Pitch By A Mile At Cardinals Game

Jun 07, 2025

Nfl Star Lewan Misses First Pitch By A Mile At Cardinals Game

Jun 07, 2025