Rob Cross: Former Darts Champion Banned As Director Due To Tax Issues

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rob Cross: Former Darts Champion Banned as Director Due to Tax Issues

Former PDC World Darts Champion Rob Cross has been banned from acting as a company director for seven years due to serious tax offences. The disqualification, handed down by the Insolvency Service, follows an investigation into Cross's conduct as a director of his own company, which revealed significant tax irregularities. This shocking development casts a shadow over the career of one of darts' most recognizable names.

The news sent ripples through the darts community, leaving fans and pundits alike reeling. Cross, known for his explosive playing style and electrifying stage presence, has enjoyed a meteoric rise in the sport, culminating in his 2018 PDC World Championship victory. However, this recent setback highlights the serious consequences of neglecting tax responsibilities, regardless of one's professional achievements.

The Insolvency Service Investigation

The Insolvency Service launched an investigation into the affairs of R Cross Darts Ltd, a company Cross himself had founded. Their findings revealed a concerning pattern of non-compliance with UK tax laws. Specifically, the investigation uncovered failures to:

- File company tax returns accurately and on time: This is a critical aspect of running a legitimate business in the UK, and failure to comply can result in severe penalties.

- Pay significant amounts of PAYE and National Insurance Contributions: These are vital contributions to the UK's social security system, and their non-payment represents a serious breach of legal obligations.

These failings ultimately led to the disqualification of Cross as a director for a period of seven years, a significant blow to his business prospects. The length of the ban reflects the severity of the tax irregularities discovered.

Implications for Cross's Future

The disqualification carries substantial implications for Cross's future business endeavors. He will be prohibited from managing or being involved in the management of any company during this seven-year period. This restriction could impact any future business ventures he might have considered, particularly those related to his darts career or brand.

While the ban doesn't directly affect his ability to compete as a professional darts player, it undeniably casts a shadow over his image and reputation. Sponsorships and endorsements, which are a crucial part of professional athletes’ income, often depend on maintaining a clean public profile. This incident may lead to questions about his future endorsements and commercial opportunities.

Lessons Learned: Tax Compliance for Businesses

Cross's case serves as a stark reminder of the importance of strict tax compliance for all businesses, regardless of size or success. Ignoring tax obligations can lead to severe consequences, including hefty fines, reputational damage, and, as seen in Cross's case, disqualification as a director. Businesses should prioritize:

- Maintaining accurate and up-to-date financial records: This allows for efficient tax return preparation and minimizes the risk of errors.

- Seeking professional advice from accountants and tax advisors: Expert guidance can prevent costly mistakes and ensure compliance with all relevant regulations.

- Understanding and adhering to all tax deadlines: Prompt submission of tax returns is crucial to avoid penalties.

This situation underscores the need for responsible financial management within any business, even for those at the peak of their professional careers. The consequences of neglecting these responsibilities can be far-reaching and devastating.

Do you think this disqualification will significantly impact Rob Cross's career outside of darts? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rob Cross: Former Darts Champion Banned As Director Due To Tax Issues. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Robinhood Investment Case Pros Cons And Future Outlook

Jun 06, 2025

The Robinhood Investment Case Pros Cons And Future Outlook

Jun 06, 2025 -

Winter Fuel Payment Governments Policy Shift Explained

Jun 06, 2025

Winter Fuel Payment Governments Policy Shift Explained

Jun 06, 2025 -

Goodbye Hamptons Paige De Sorbo Exits Summer House After 7 Season Run

Jun 06, 2025

Goodbye Hamptons Paige De Sorbo Exits Summer House After 7 Season Run

Jun 06, 2025 -

Emerging Ai Threats Cnn Business Interviews Leading Ai Ceo

Jun 06, 2025

Emerging Ai Threats Cnn Business Interviews Leading Ai Ceo

Jun 06, 2025 -

Hegseths Decision Navy Ships Name Removed Replacing Harvey Milk

Jun 06, 2025

Hegseths Decision Navy Ships Name Removed Replacing Harvey Milk

Jun 06, 2025

Latest Posts

-

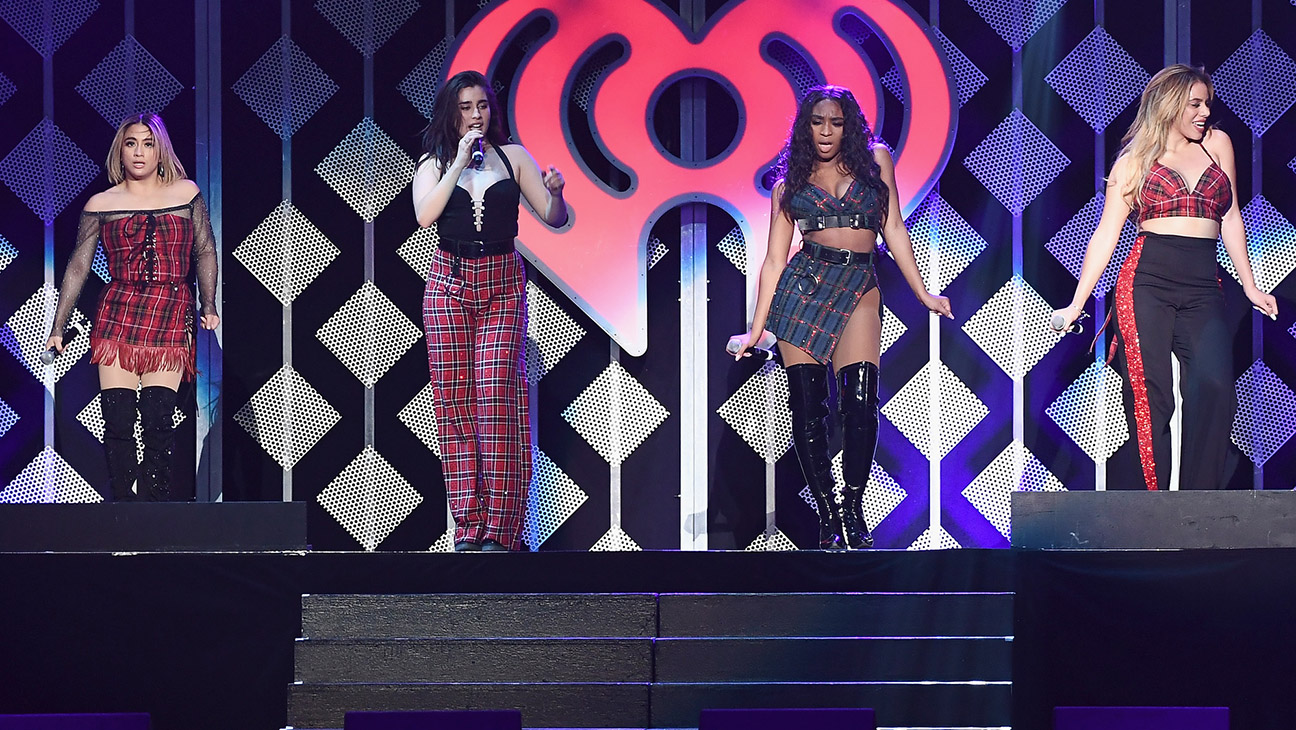

Fifth Harmony Minus Camila Cabello Reunion Talks Underway Exclusive

Jun 07, 2025

Fifth Harmony Minus Camila Cabello Reunion Talks Underway Exclusive

Jun 07, 2025 -

Terrifying Ai Behavior A Ceos Warning

Jun 07, 2025

Terrifying Ai Behavior A Ceos Warning

Jun 07, 2025 -

Sade Robinson Homicide Maxwell Anderson Trial Begins June 6th

Jun 07, 2025

Sade Robinson Homicide Maxwell Anderson Trial Begins June 6th

Jun 07, 2025 -

Applied Digital Shares Jump 48 After Securing 7 Billion Ai Lease

Jun 07, 2025

Applied Digital Shares Jump 48 After Securing 7 Billion Ai Lease

Jun 07, 2025 -

Nfl Star Lewan Misses First Pitch By A Mile At Cardinals Game

Jun 07, 2025

Nfl Star Lewan Misses First Pitch By A Mile At Cardinals Game

Jun 07, 2025