Robinhood (HOOD) Stock Market Performance: 6.46% Increase June 3rd

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Stock Soars: 6.46% Jump on June 3rd – What's Driving the Surge?

Robinhood Markets, Inc. (HOOD) experienced a significant boost on June 3rd, with its stock price surging by 6.46%. This unexpected jump has left investors and analysts scrambling to understand the underlying factors driving this positive market performance. While the broader market also saw gains that day, Robinhood's performance significantly outpaced the overall market movement, sparking considerable interest. Let's delve into the potential reasons behind this impressive surge.

What Fueled Robinhood's Impressive 6.46% Gain?

Several contributing factors could explain Robinhood's substantial stock price increase on June 3rd. While pinpointing the exact cause is difficult, a confluence of events likely played a crucial role:

-

Improved Investor Sentiment: Recent financial reports, although not always overwhelmingly positive, may have hinted at stabilizing or improving performance. This could have led to a renewed sense of optimism among investors, triggering a buy-in wave. This shift in sentiment often precedes significant stock price changes.

-

Positive Market Trends: The overall positive movement in the broader stock market undoubtedly contributed to Robinhood's gains. A rising tide lifts all boats, and a generally bullish market environment can boost even struggling stocks like HOOD. Understanding the broader market context is essential when analyzing individual stock performance.

-

Speculation and Short Covering: It's plausible that a degree of short covering contributed to the rise. Short sellers who bet against Robinhood might have covered their positions to avoid potential losses, further pushing the price upward. This is a common phenomenon in volatile stocks.

-

Strategic Initiatives: While not publicly announced on June 3rd, any unanticipated positive news regarding Robinhood's strategic initiatives, new partnerships, or product developments could have fueled the increase. Investors are always looking for signals of future growth and profitability.

Analyzing Robinhood's Long-Term Prospects

While the 6.46% jump is encouraging, it's crucial to analyze Robinhood's long-term prospects with a balanced perspective. The company continues to navigate a challenging market landscape, facing competition from established players and regulatory scrutiny. Long-term success will depend on several factors, including:

-

User Growth and Retention: Attracting and retaining users remains paramount. Robinhood needs to offer competitive features and a user-friendly experience to maintain its market share.

-

Revenue Diversification: Reducing reliance on trading revenue is key. Expanding into new financial services and broadening revenue streams will be vital for sustained growth.

-

Regulatory Compliance: Navigating the ever-evolving regulatory environment is critical. Maintaining compliance and avoiding costly penalties will be essential for long-term stability.

Looking Ahead: What to Expect from HOOD

The June 3rd surge provides a temporary glimpse of potential upside, but investors should approach HOOD with caution and conduct thorough due diligence before making any investment decisions. The stock's volatility underscores the inherent risks associated with investing in this sector. Keeping a close eye on future financial reports, news announcements, and market trends will be essential for gauging Robinhood's continued performance. Consider consulting with a financial advisor before making any investment decisions related to HOOD or any other stock.

Keywords: Robinhood, HOOD, stock market, stock price, 6.46%, June 3rd, investor sentiment, market trends, short covering, stock performance, financial reports, revenue diversification, regulatory compliance, investment, trading, volatility

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood (HOOD) Stock Market Performance: 6.46% Increase June 3rd. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Maxwell Anderson Found Guilty Milwaukee Jury Reaches Verdict

Jun 06, 2025

Maxwell Anderson Found Guilty Milwaukee Jury Reaches Verdict

Jun 06, 2025 -

Confirmed Winter Fuel Payment U Turn After Chancellors Announcement

Jun 06, 2025

Confirmed Winter Fuel Payment U Turn After Chancellors Announcement

Jun 06, 2025 -

Assessing The Significance Have Recent Ukrainian Airfield Attacks Changed The Conflict

Jun 06, 2025

Assessing The Significance Have Recent Ukrainian Airfield Attacks Changed The Conflict

Jun 06, 2025 -

The Ongoing Mystery Has The Search For Madeleine Mc Cann Gone On Too Long

Jun 06, 2025

The Ongoing Mystery Has The Search For Madeleine Mc Cann Gone On Too Long

Jun 06, 2025 -

Steve Guttenberg On His New Lifetime Movie Kidnapped By A Killer

Jun 06, 2025

Steve Guttenberg On His New Lifetime Movie Kidnapped By A Killer

Jun 06, 2025

Latest Posts

-

2 000 Gallon Diesel Spill Assessing The Damage To Baltimores Inner Harbor

Jun 06, 2025

2 000 Gallon Diesel Spill Assessing The Damage To Baltimores Inner Harbor

Jun 06, 2025 -

Lewans Errant Throw A Hilarious First Pitch Fail At Busch Stadium

Jun 06, 2025

Lewans Errant Throw A Hilarious First Pitch Fail At Busch Stadium

Jun 06, 2025 -

Steve Guttenberg Takes On Dark Role In Upcoming Lifetime Movie

Jun 06, 2025

Steve Guttenberg Takes On Dark Role In Upcoming Lifetime Movie

Jun 06, 2025 -

Outrageous 6m Nhs Scotland Contract Fraud Results In Jail Time

Jun 06, 2025

Outrageous 6m Nhs Scotland Contract Fraud Results In Jail Time

Jun 06, 2025 -

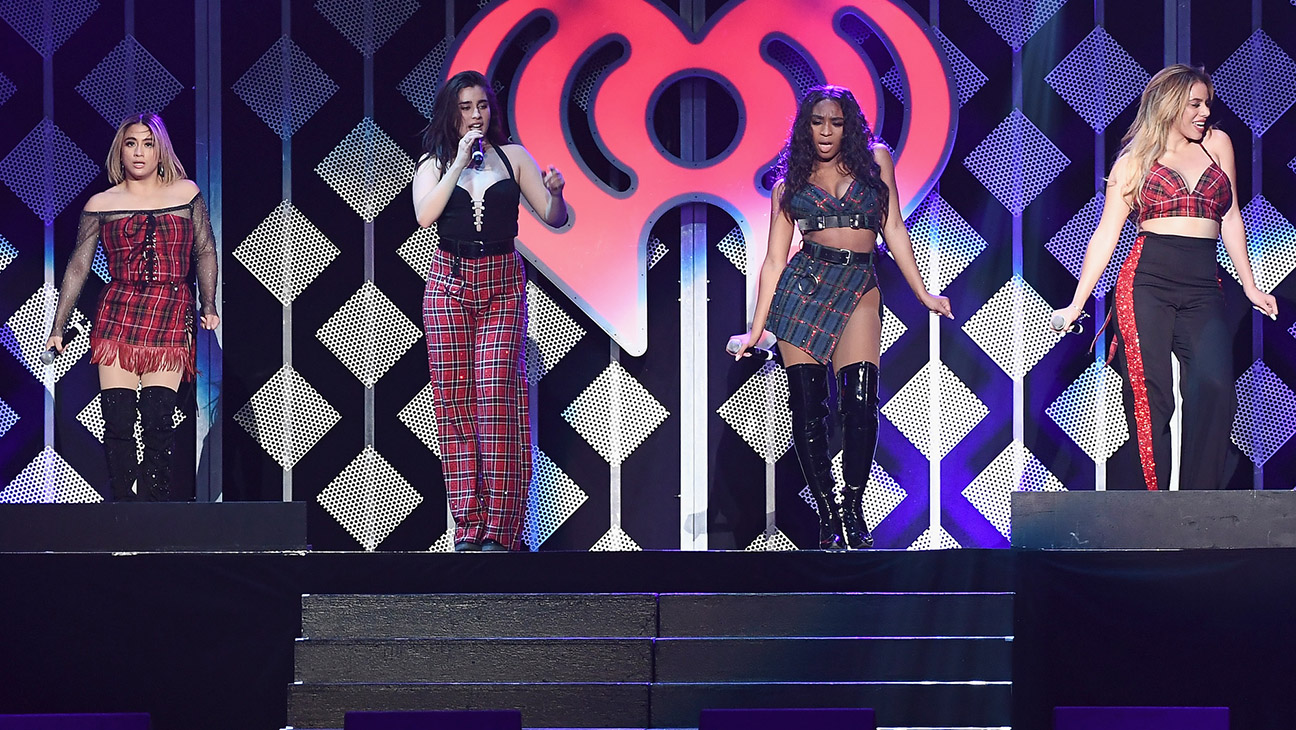

Exclusive Fifth Harmony Minus Camila Considers A Comeback

Jun 06, 2025

Exclusive Fifth Harmony Minus Camila Considers A Comeback

Jun 06, 2025