Robinhood (HOOD) Stock Market Performance: 6.46% Rise On June 3rd And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Stock Soars 6.46% on June 3rd: A Glimpse into the Future?

Robinhood Markets, Inc. (HOOD) experienced a significant surge on June 3rd, closing the day with a remarkable 6.46% increase. This unexpected jump has ignited considerable speculation about the future trajectory of the popular trading app's stock. While one day doesn't define a trend, the move offers a compelling opportunity to analyze the underlying factors and consider the potential implications for investors. What fueled this sudden rise, and what does it mean for the long-term outlook of HOOD stock? Let's delve into the details.

The Catalyst Behind the June 3rd Rally:

Pinpointing the precise cause of the 6.46% increase requires a multifaceted approach. Several contributing factors likely played a role:

- Positive Market Sentiment: The broader market experienced a positive day on June 3rd, contributing to a general uplift in investor confidence. This overall positive sentiment often boosts even struggling stocks, including HOOD.

- Speculative Trading Activity: Robinhood itself remains a somewhat volatile stock, susceptible to significant swings based on speculative trading activity. Short squeezes or a sudden influx of bullish sentiment can easily trigger price jumps like the one seen on June 3rd.

- Potential for Future Growth: While Robinhood's recent performance has been mixed, the company continues to invest in new features and services aimed at attracting and retaining users. Any positive news related to user growth or new product launches could impact the stock price.

- Lack of Significant Negative News: The absence of major negative news or regulatory announcements can also contribute to a positive market reaction. In the volatile world of finance, the lack of bad news can be just as impactful as positive news.

Analyzing Robinhood's Current Financial Situation:

It's crucial to remember that a single day's performance doesn't fully represent the health of a company. Robinhood's recent financial reports reveal a mixed bag. While user growth has shown some improvement, the company is still grappling with challenges such as increased competition and fluctuating revenue streams. Analyzing their quarterly earnings reports and SEC filings is essential for any investor considering a position in HOOD. [Link to Robinhood Investor Relations Page]

Future Outlook: Challenges and Opportunities for HOOD:

The future of HOOD stock remains uncertain. While the June 3rd jump is encouraging, investors should approach it with caution. The company faces several headwinds:

- Intense Competition: The online brokerage industry is fiercely competitive, with established players and new entrants vying for market share.

- Regulatory Scrutiny: The financial technology sector faces ongoing regulatory scrutiny, which could impact Robinhood's operations and profitability.

- Market Volatility: The overall market's volatility continues to be a major factor impacting the performance of growth stocks like HOOD.

However, Robinhood also possesses several potential strengths:

- Strong Brand Recognition: Robinhood benefits from strong brand recognition and a large user base.

- Innovation Potential: The company's continued investment in new features and services could drive future growth.

- Expanding Product Offerings: Diversification into new financial products and services could help mitigate risk and increase revenue streams.

Conclusion:

The 6.46% rise in HOOD stock on June 3rd is a notable event, but it should be interpreted within the context of the broader market conditions and Robinhood's ongoing challenges and opportunities. Investors should conduct thorough due diligence, analyzing financial statements, understanding the competitive landscape, and considering their own risk tolerance before making any investment decisions. The future of HOOD remains a complex equation with variables that are difficult to predict with certainty. Stay informed and invest wisely.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood (HOOD) Stock Market Performance: 6.46% Rise On June 3rd And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Unexpected Reality Maintaining Two Separate Homes

Jun 06, 2025

The Unexpected Reality Maintaining Two Separate Homes

Jun 06, 2025 -

Dispute Erupts White House And Bbc Clash Over Gaza News Coverage

Jun 06, 2025

Dispute Erupts White House And Bbc Clash Over Gaza News Coverage

Jun 06, 2025 -

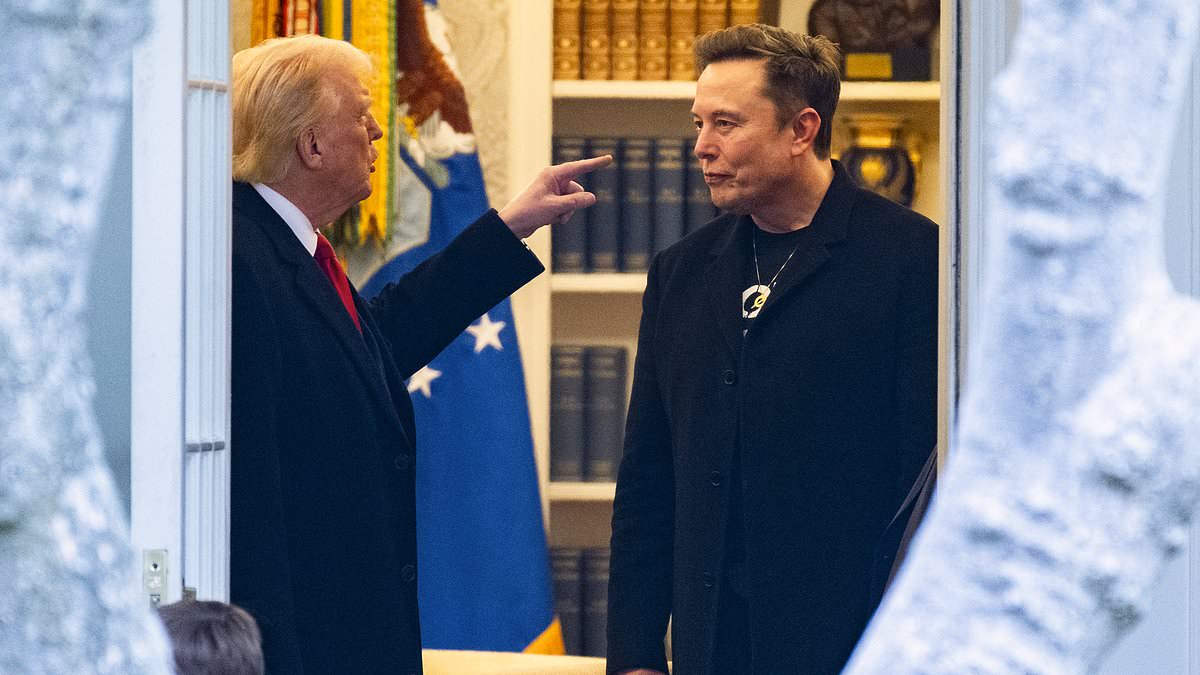

Key Trump Advisor Behind Musk Trump Rift Revealed

Jun 06, 2025

Key Trump Advisor Behind Musk Trump Rift Revealed

Jun 06, 2025 -

Madeleine Mc Cann Disappearance Is It Too Late For Answers

Jun 06, 2025

Madeleine Mc Cann Disappearance Is It Too Late For Answers

Jun 06, 2025 -

Analyzing The Impact Were Ukraines Airfield Strikes A Turning Point

Jun 06, 2025

Analyzing The Impact Were Ukraines Airfield Strikes A Turning Point

Jun 06, 2025

Latest Posts

-

Applied Digital Stock Jumps 48 On Record Breaking Core Weave Agreement

Jun 07, 2025

Applied Digital Stock Jumps 48 On Record Breaking Core Weave Agreement

Jun 07, 2025 -

Ibms Stock Market Struggle Challenges And Potential Recovery

Jun 07, 2025

Ibms Stock Market Struggle Challenges And Potential Recovery

Jun 07, 2025 -

Steve Guttenbergs Kidnapped By A Killer A Lifetime Movie Interview

Jun 07, 2025

Steve Guttenbergs Kidnapped By A Killer A Lifetime Movie Interview

Jun 07, 2025 -

White Lotus Goggins And Wood On Their On Screen Chemistry And Off Screen Interactions

Jun 07, 2025

White Lotus Goggins And Wood On Their On Screen Chemistry And Off Screen Interactions

Jun 07, 2025 -

Tax Trouble Rob Cross Ex Darts World Champion Banned From Acting As Director

Jun 07, 2025

Tax Trouble Rob Cross Ex Darts World Champion Banned From Acting As Director

Jun 07, 2025