Robinhood (HOOD) Stock Market Update: 6.46% Gain On June 3

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Stock Soars: 6.46% Jump on June 3rd – What's Driving the Rally?

Robinhood Markets, Inc. (HOOD) experienced a significant surge on June 3rd, closing with a remarkable 6.46% gain. This unexpected jump has sparked considerable interest among investors, prompting questions about the underlying factors contributing to this positive momentum. Was it a short squeeze? A positive earnings preview? Or something else entirely? Let's delve into the potential reasons behind this noteworthy market movement.

Understanding the June 3rd Rally:

The 6.46% increase wasn't an isolated event. While the exact causes are multifaceted and subject to ongoing market analysis, several contributing factors likely played a role:

-

Positive Market Sentiment: The broader market experienced a relatively positive day on June 3rd, with several tech stocks showing gains. This general upward trend undoubtedly contributed to HOOD's impressive performance. Positive economic indicators or easing concerns about inflation could have fueled this broader market optimism.

-

Increased Trading Volume: A significant increase in trading volume often accompanies substantial price movements. Analyzing the trading volume on June 3rd for HOOD can provide further insight into the intensity of buying pressure. High volume suggests strong conviction behind the price increase, making it less likely to be a fleeting, temporary bump.

-

Speculation and Short Covering: While not confirmed, speculation surrounding Robinhood and potential short squeezes could have influenced the price increase. If a significant portion of HOOD stock was shorted, a sudden influx of buying could trigger a short squeeze, forcing short sellers to buy back shares to limit their losses, further driving up the price.

-

Upcoming Earnings Report: Investors are always keenly anticipating upcoming earnings reports. Any positive whispers or leaked information about Robinhood's upcoming financial performance could have fueled anticipatory buying, pushing the stock price higher in advance. Analyzing pre-earnings trading patterns for HOOD can provide clues about investor sentiment.

Analyzing the Long-Term Outlook for HOOD:

While the 6.46% gain is undeniably positive news for HOOD shareholders, it's crucial to avoid making hasty conclusions based on a single day's performance. The long-term outlook for Robinhood remains complex and depends on several factors:

-

Regulatory Landscape: The regulatory environment for online brokerage firms continues to evolve, and changes in regulations could significantly impact Robinhood's operations and profitability.

-

Competition: Robinhood operates in a highly competitive market with established players and emerging fintech companies. Maintaining its market share and attracting new users will be crucial for its future success.

-

Financial Performance: Ultimately, HOOD's long-term success hinges on its ability to consistently deliver strong financial results, demonstrating sustainable growth and profitability.

Conclusion:

The 6.46% gain in HOOD stock on June 3rd is a notable event, but investors should approach it cautiously. While several factors likely contributed to this positive movement, it's vital to conduct thorough research and consider the broader market context before making any investment decisions. Staying informed about Robinhood's financial performance, upcoming announcements, and the overall market sentiment is critical for making informed investment choices. Remember to consult with a financial advisor before making any significant investment decisions.

Keywords: Robinhood, HOOD, stock market, stock price, 6.46% gain, June 3, stock update, market analysis, trading volume, short squeeze, earnings report, investment, financial news, fintech, online brokerage

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood (HOOD) Stock Market Update: 6.46% Gain On June 3. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Search Ends Body Discovered In Portugal Confirming Missing Scots Fate

Jun 06, 2025

Search Ends Body Discovered In Portugal Confirming Missing Scots Fate

Jun 06, 2025 -

Uk Winter Fuel Payment Chancellors U Turn Brings Relief To Millions

Jun 06, 2025

Uk Winter Fuel Payment Chancellors U Turn Brings Relief To Millions

Jun 06, 2025 -

Stars Post Season Disappointment Leads To De Boers Dismissal

Jun 06, 2025

Stars Post Season Disappointment Leads To De Boers Dismissal

Jun 06, 2025 -

Matthew Hussey And Wife Expecting A New Chapter After Camila Cabello Relationship

Jun 06, 2025

Matthew Hussey And Wife Expecting A New Chapter After Camila Cabello Relationship

Jun 06, 2025 -

Actor Steve Guttenbergs Killer Role In Lifetimes New Thriller

Jun 06, 2025

Actor Steve Guttenbergs Killer Role In Lifetimes New Thriller

Jun 06, 2025

Latest Posts

-

Dallas Stars Coaching Search Concludes Meet The New Head Coach

Jun 06, 2025

Dallas Stars Coaching Search Concludes Meet The New Head Coach

Jun 06, 2025 -

Maxwell Anderson Faces Trial For The Murder Of Sade Robinson

Jun 06, 2025

Maxwell Anderson Faces Trial For The Murder Of Sade Robinson

Jun 06, 2025 -

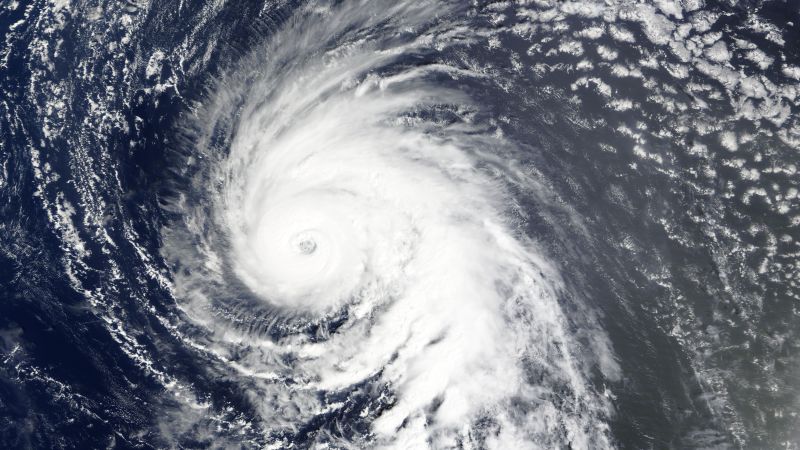

Understanding Ghost Hurricanes Implications For Hurricane Prediction Models

Jun 06, 2025

Understanding Ghost Hurricanes Implications For Hurricane Prediction Models

Jun 06, 2025 -

Dallas Stars Post Season Disappointment Leads To De Boers Dismissal

Jun 06, 2025

Dallas Stars Post Season Disappointment Leads To De Boers Dismissal

Jun 06, 2025 -

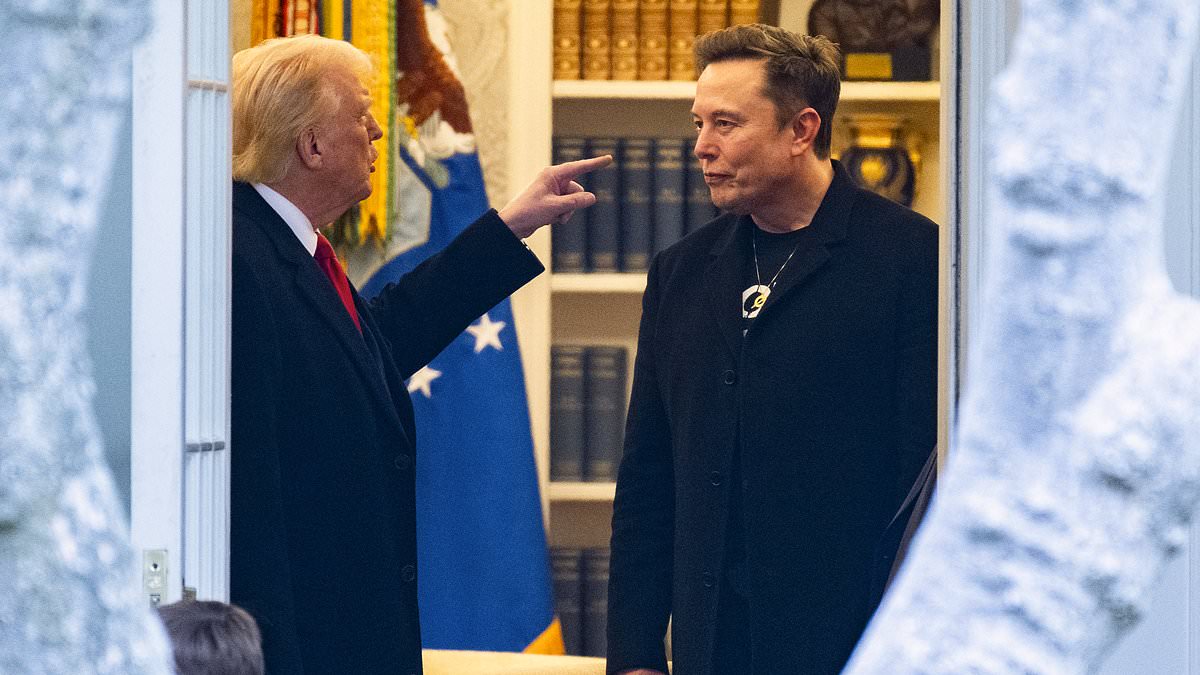

Trump Musk Fallout Uncovering The Advisors Pivotal Role

Jun 06, 2025

Trump Musk Fallout Uncovering The Advisors Pivotal Role

Jun 06, 2025