Robinhood (HOOD) Stock Performance: A 6.46% Rise On June 3 And What It Means

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Stock Performance: A 6.46% Rise on June 3rd and What it Means

Robinhood Markets, Inc. (HOOD) experienced a significant surge on June 3rd, 2024, with its stock price climbing 6.46%. This unexpected jump has sparked considerable interest amongst investors, prompting questions about the underlying reasons and the potential implications for the future. This article delves into the details of this noteworthy event and explores potential factors contributing to the rise.

A Closer Look at the June 3rd Surge:

The 6.46% increase wasn't an isolated incident; it followed a period of fluctuating performance for HOOD. While the exact trigger for this specific jump remains somewhat elusive, several contributing factors likely played a crucial role. Analyzing the market conditions surrounding this event is key to understanding the implications.

Potential Factors Behind the Rise:

-

Improved Market Sentiment: The broader market experienced a positive shift on June 3rd, with several tech stocks showing gains. This general improvement in investor confidence could have contributed to the increase in HOOD's stock price. Positive economic indicators or shifts in regulatory environments can significantly influence overall market sentiment.

-

Increased Trading Volume: A noticeable increase in trading volume often accompanies significant price movements. While specific data on HOOD's trading volume on June 3rd would need further investigation, a higher volume could indicate increased investor interest and activity. This surge could stem from positive news, speculation, or a combination of factors.

-

Speculation and Analyst Predictions: Market analysts' predictions and reports can influence investor behavior. Positive analyst ratings or upgrades could have contributed to the increase in buying pressure, driving the stock price upwards. It's crucial to consider that these predictions are not guarantees of future performance.

-

New Product Launches or Developments: Although not confirmed in this instance, the introduction of new features, partnerships, or regulatory approvals could have generated positive sentiment and influenced investor decisions. Keeping up-to-date on Robinhood's announcements and developments is vital for investors.

What Does This Mean for Investors?

A single day's stock performance doesn't necessarily predict long-term trends. While the 6.46% increase is encouraging, investors should avoid making hasty decisions based solely on short-term fluctuations. A comprehensive analysis of the company's financial health, future prospects, and broader market conditions is crucial before making any investment choices.

Long-Term Outlook for HOOD:

Robinhood's future performance hinges on several factors, including:

-

Competitive Landscape: The brokerage industry is fiercely competitive. Robinhood's ability to differentiate itself and attract and retain customers will significantly influence its long-term success.

-

Regulatory Environment: Changes in regulations can significantly impact the brokerage industry. Staying informed about regulatory developments is critical for understanding the potential risks and opportunities for HOOD.

-

Technological Innovation: Continuous innovation and adaptation are vital for remaining competitive. Robinhood's ability to leverage technology to enhance its services and attract new users will be crucial for future growth.

Conclusion:

The 6.46% rise in Robinhood's stock price on June 3rd, 2024, provides a snapshot of the dynamic nature of the stock market. While the reasons behind this specific jump are multi-faceted, understanding the potential contributing factors and the broader market context is crucial for investors. It is important to remember that past performance is not indicative of future results. Conduct thorough research and consult with a financial advisor before making any investment decisions regarding HOOD or any other stock.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood (HOOD) Stock Performance: A 6.46% Rise On June 3 And What It Means. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Joe Sacco Departs Bruins New Nhl Coaching Staff Role Confirmed

Jun 06, 2025

Joe Sacco Departs Bruins New Nhl Coaching Staff Role Confirmed

Jun 06, 2025 -

Aplds Hyperscale Data Center Expansion A 5 Billion Commitment

Jun 06, 2025

Aplds Hyperscale Data Center Expansion A 5 Billion Commitment

Jun 06, 2025 -

Peter De Boer Out Dallas Stars Clean House After Disappointing Playoffs

Jun 06, 2025

Peter De Boer Out Dallas Stars Clean House After Disappointing Playoffs

Jun 06, 2025 -

Hood Stock Surges Robinhood Shares Up 6 46 June 3rd Whats Behind The Rise

Jun 06, 2025

Hood Stock Surges Robinhood Shares Up 6 46 June 3rd Whats Behind The Rise

Jun 06, 2025 -

High Court Backs Plaintiff In Reverse Discrimination Case Setting New Precedent

Jun 06, 2025

High Court Backs Plaintiff In Reverse Discrimination Case Setting New Precedent

Jun 06, 2025

Latest Posts

-

Ni Product Launch Teens Brave Rain And Long Queues

Jun 07, 2025

Ni Product Launch Teens Brave Rain And Long Queues

Jun 07, 2025 -

Dallas Stars Coaching Change Impact On The Upcoming Season

Jun 07, 2025

Dallas Stars Coaching Change Impact On The Upcoming Season

Jun 07, 2025 -

June 6th Trial Maxwell Anderson Accused In Sade Robinsons Death

Jun 07, 2025

June 6th Trial Maxwell Anderson Accused In Sade Robinsons Death

Jun 07, 2025 -

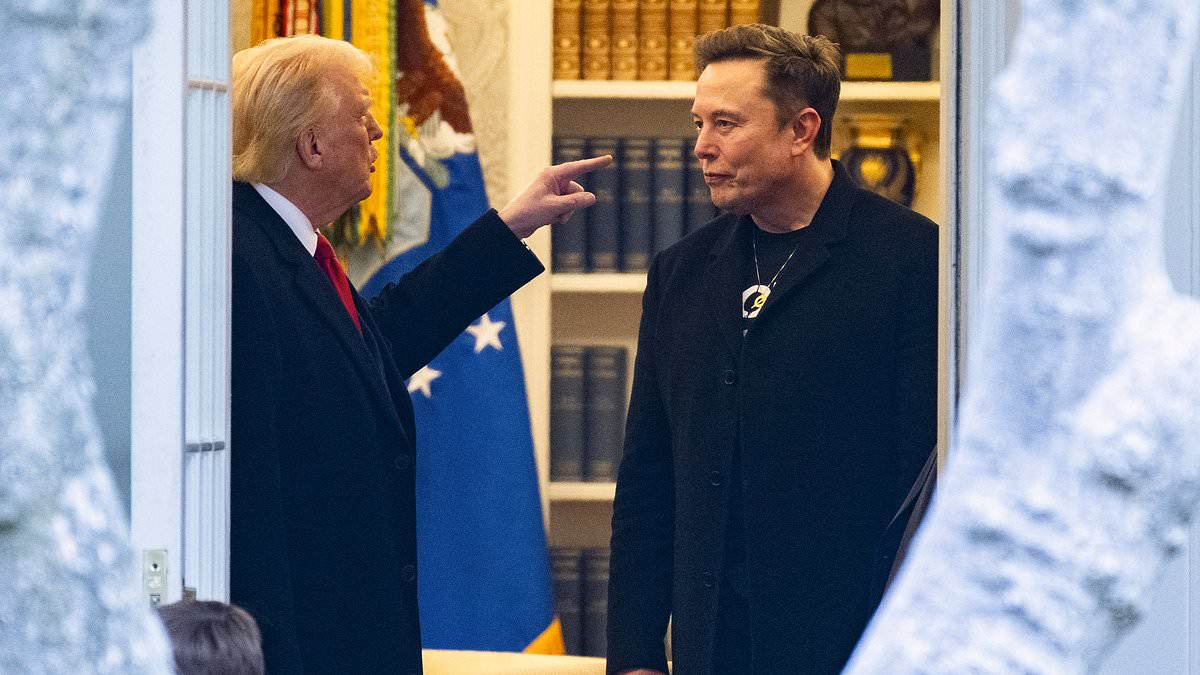

Unraveling The Trump Musk Rift An Influential Advisors Impact

Jun 07, 2025

Unraveling The Trump Musk Rift An Influential Advisors Impact

Jun 07, 2025 -

Camila Cabellos Ex Matthew Hussey To Welcome First Child With Spouse

Jun 07, 2025

Camila Cabellos Ex Matthew Hussey To Welcome First Child With Spouse

Jun 07, 2025