Robinhood Markets Inc (HOOD): 6.46% Share Price Rise On June 3rd

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Soars: Stock Price Jumps 6.46% on June 3rd – What Fueled the Rally?

Robinhood Markets Inc. (HOOD) experienced a significant surge on June 3rd, with its share price jumping 6.46%. This unexpected rally has sent ripples through the financial markets, leaving many investors wondering about the underlying causes. While pinpointing a single catalyst is difficult, several factors likely contributed to this impressive gain. This article delves into the potential reasons behind this dramatic increase and explores what it might mean for the future of the popular trading platform.

Understanding the June 3rd Surge:

The 6.46% jump wasn't an isolated event; HOOD stock has shown signs of volatility recently. While the exact reasons behind this specific day's surge remain multifaceted, several key factors likely played a significant role:

-

Positive Market Sentiment: The broader market experienced a period of relative optimism on June 3rd. A positive overall market trend often lifts even struggling stocks, providing a tailwind for companies like Robinhood. This broader positive sentiment could have encouraged investors to revisit previously underperforming stocks.

-

Increased Trading Volume: A noticeable increase in trading volume often accompanies significant price movements. Higher volume suggests increased investor interest and engagement, which can drive price increases. Analyzing the trading volume on June 3rd is crucial to understanding the scale of the buying pressure.

-

Speculation and Short Covering: Robinhood has been a target for short-sellers in the past. If a significant portion of these short-sellers decided to cover their positions (buying shares to close their short positions), this would artificially inflate the price, contributing to the rapid increase. This is a common phenomenon in volatile stocks.

-

Potential for Future Growth: Investors might be anticipating future growth from Robinhood. While the company has faced challenges, ongoing developments in its platform, expansion into new markets, or strategic partnerships could fuel investor confidence and drive up the share price. Any positive news or announcements surrounding these aspects could have significantly influenced the stock's performance.

-

Lack of Specific News: It's important to note that, in some cases, significant price swings occur without readily identifiable news. Market forces, algorithm-driven trading, and overall investor sentiment can create volatility even without specific company-related announcements.

What Does This Mean for Robinhood Investors?

The 6.46% jump is certainly positive news for Robinhood investors, but it's crucial to avoid reading too much into a single day's performance. Stock prices fluctuate, and this rally doesn't necessarily signal a long-term upward trend. Investors should carefully consider the company's overall financial health, its long-term growth prospects, and their own risk tolerance before making any investment decisions.

Looking Ahead:

Robinhood’s future success hinges on several factors, including:

- Maintaining user engagement and growth.

- Successful expansion into new financial products and services.

- Effective management of regulatory hurdles.

- Continued innovation to stay competitive in the rapidly evolving fintech landscape.

While the June 3rd surge offers a glimmer of hope, it’s vital for investors to maintain a long-term perspective and thoroughly research the company before committing capital. Consult with a financial advisor for personalized guidance tailored to your investment goals and risk tolerance. Remember, past performance is not indicative of future results.

Keywords: Robinhood, HOOD, stock price, share price, June 3rd, stock market, trading platform, investment, fintech, volatility, market sentiment, short covering, trading volume, stock analysis, financial news.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Markets Inc (HOOD): 6.46% Share Price Rise On June 3rd. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

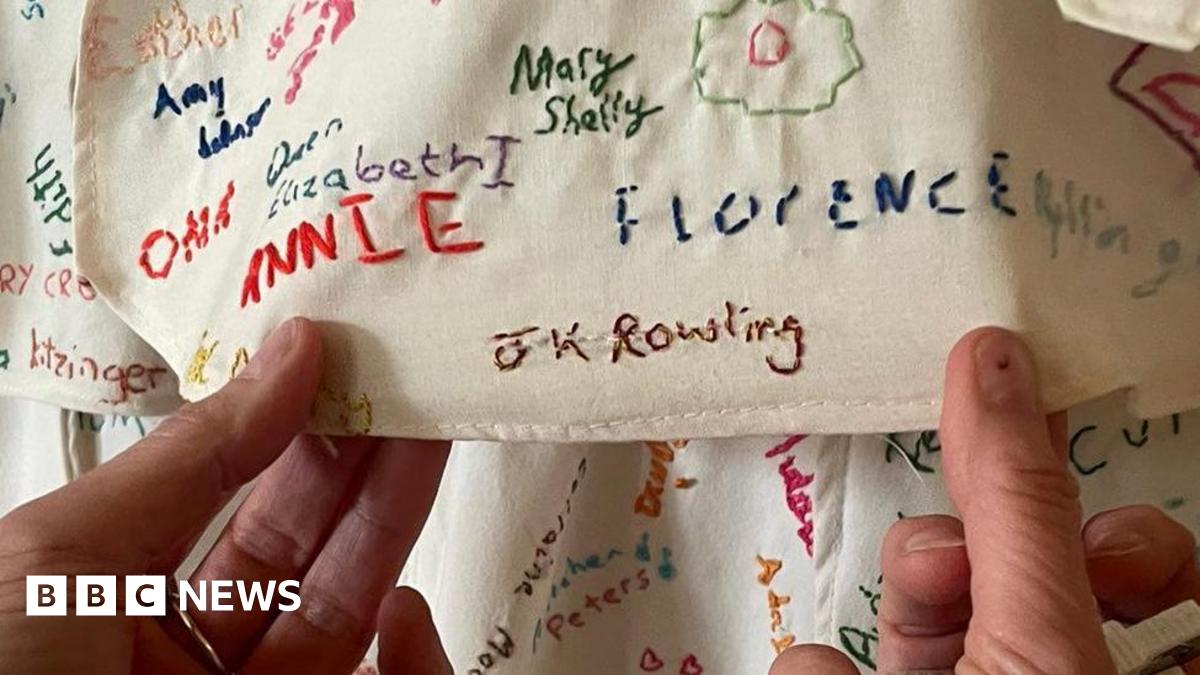

National Trust Investigation Damaged J K Rowling Artwork In Derbyshire

Jun 05, 2025

National Trust Investigation Damaged J K Rowling Artwork In Derbyshire

Jun 05, 2025 -

Uncovering Grace Potters Forgotten Music A Soundbites Interview

Jun 05, 2025

Uncovering Grace Potters Forgotten Music A Soundbites Interview

Jun 05, 2025 -

Buffetts Recent Sell Off A Closer Look At His Two Us Investment Decisions

Jun 05, 2025

Buffetts Recent Sell Off A Closer Look At His Two Us Investment Decisions

Jun 05, 2025 -

Thames Waters Plans In Jeopardy After Bidder Withdrawal

Jun 05, 2025

Thames Waters Plans In Jeopardy After Bidder Withdrawal

Jun 05, 2025 -

Police Raid All American Rejects Backyard Concert In College Town Cancelled

Jun 05, 2025

Police Raid All American Rejects Backyard Concert In College Town Cancelled

Jun 05, 2025

Latest Posts

-

Indian Clinical Trials Examining The Impact Of Mangoes On Blood Sugar Levels

Aug 17, 2025

Indian Clinical Trials Examining The Impact Of Mangoes On Blood Sugar Levels

Aug 17, 2025 -

Hong Kong Media And The Intensifying Us China Power Struggle

Aug 17, 2025

Hong Kong Media And The Intensifying Us China Power Struggle

Aug 17, 2025 -

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025 -

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025 -

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025