Robinhood Markets Inc. (HOOD): 6.46% Share Price Surge Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Markets Inc. (HOOD): 6.46% Share Price Surge Explained

Robinhood Markets, Inc. (HOOD) experienced a significant 6.46% surge in its share price on [Date of Surge], leaving many investors wondering about the driving forces behind this unexpected jump. While pinpointing a single cause is difficult, several factors likely contributed to this positive market movement for the popular trading app. This article delves into the potential reasons behind HOOD's impressive gains, examining both internal company developments and broader market trends.

Understanding the Surge: A Multi-Faceted Analysis

The recent surge in Robinhood's stock price isn't solely attributable to one event. Instead, it's likely a confluence of factors, including:

1. Positive Earnings Reports and Revenue Growth: While specifics need to be referenced from the official report, positive earnings reports often directly influence a company's stock price. Strong revenue growth, particularly exceeding analyst expectations, can signal a healthy financial outlook and attract investor confidence. To fully understand the impact, reviewing the complete financial statements released by Robinhood is crucial. [Link to Robinhood Investor Relations page]

2. Increased User Engagement and Trading Activity: Robinhood's success hinges on its user base and their trading activity. An increase in daily active users or a rise in trading volume could indicate growing popularity and renewed confidence in the platform. This increased engagement translates directly into higher revenue potential, making it an attractive proposition for investors.

3. Strategic Initiatives and Technological Advancements: Robinhood's strategic decisions and investment in new technologies could be contributing factors. Any announcements regarding new features, improved trading tools, or expansion into new markets can significantly impact investor sentiment. For instance, enhancements to their crypto trading platform or the introduction of new investment options could stimulate user engagement and, consequently, the stock price.

4. Broader Market Trends and Sentiment: The overall market sentiment plays a crucial role. A positive market trend, fueled by economic indicators or investor optimism, can lift even individual stocks, including those in the financial technology sector. Conversely, a negative market trend can have the opposite effect. Therefore, understanding the broader economic context is vital to fully comprehending HOOD's price movement.

5. Short Squeeze Potential: While not confirmed, the possibility of a short squeeze can't be entirely ruled out. A short squeeze happens when a large number of investors who bet against the stock (short sellers) are forced to buy shares to cover their positions, driving the price up rapidly. This often occurs when positive news unexpectedly emerges, leading to a rapid shift in market sentiment.

Analyzing the Future of HOOD:

While the recent 6.46% surge is encouraging, it's crucial to maintain a balanced perspective. Long-term investors should consider the company's overall financial health, strategic direction, and competitive landscape before making any investment decisions. Factors like regulatory changes and competition from established players in the brokerage industry continue to pose challenges.

Conclusion:

The 6.46% surge in Robinhood's share price is likely a result of a combination of factors. Analyzing the company's financial performance, user engagement, strategic initiatives, and the broader market context provides a more complete understanding of this significant price movement. However, investors are advised to conduct thorough due diligence before making any investment decisions based solely on short-term price fluctuations. Remember to consult with a financial advisor before making any investment choices.

Keywords: Robinhood, HOOD, Stock Price, Share Price Surge, Stock Market, Trading App, Financial Technology, Fintech, Investment, Earnings Report, Revenue Growth, User Engagement, Short Squeeze, Market Trends, Investor Sentiment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Markets Inc. (HOOD): 6.46% Share Price Surge Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Teenagers Camp Out For New Ni Release 15 Hour Rain Wait

Jun 06, 2025

Teenagers Camp Out For New Ni Release 15 Hour Rain Wait

Jun 06, 2025 -

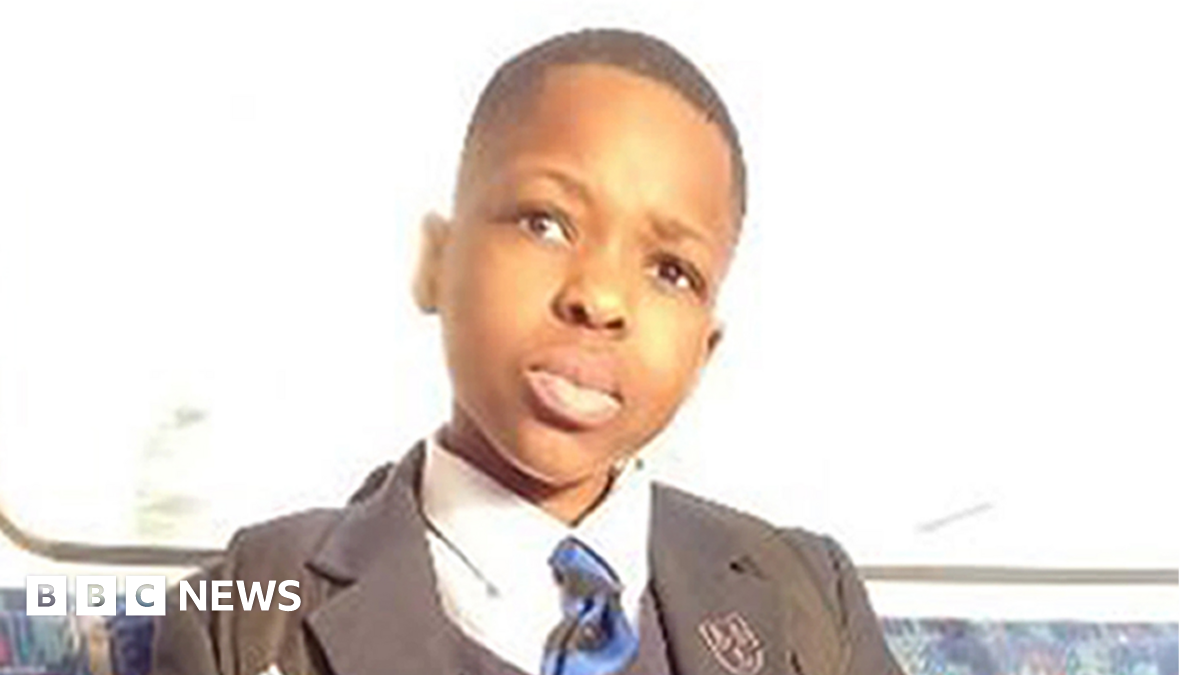

Marcus Monzos Alleged Plan To Kill Daniel Anjorin Key Testimony In Murder Case

Jun 06, 2025

Marcus Monzos Alleged Plan To Kill Daniel Anjorin Key Testimony In Murder Case

Jun 06, 2025 -

Missing Scot Found Dead Portugal Stag Party Tragedy

Jun 06, 2025

Missing Scot Found Dead Portugal Stag Party Tragedy

Jun 06, 2025 -

Dispute Erupts White House Challenges Bbcs Gaza News Coverage

Jun 06, 2025

Dispute Erupts White House Challenges Bbcs Gaza News Coverage

Jun 06, 2025 -

Confirmed Winter Fuel Payment Changes For 2024

Jun 06, 2025

Confirmed Winter Fuel Payment Changes For 2024

Jun 06, 2025

Latest Posts

-

Cassie Ventura Friend To Testify Again In Combs Trial Today

Jun 06, 2025

Cassie Ventura Friend To Testify Again In Combs Trial Today

Jun 06, 2025 -

Four Convicted In Outrageous 6m Nhs Scotland Contract Fraud

Jun 06, 2025

Four Convicted In Outrageous 6m Nhs Scotland Contract Fraud

Jun 06, 2025 -

Combs Trial Update Renewed Testimony Expected From Venturas Friend

Jun 06, 2025

Combs Trial Update Renewed Testimony Expected From Venturas Friend

Jun 06, 2025 -

Season Over Coach Out Dallas Stars Part Ways With Peter De Boer

Jun 06, 2025

Season Over Coach Out Dallas Stars Part Ways With Peter De Boer

Jun 06, 2025 -

The 12 Countries Subject To Trumps Travel Ban Reasons And Implications

Jun 06, 2025

The 12 Countries Subject To Trumps Travel Ban Reasons And Implications

Jun 06, 2025