Robinhood Stock Investment: Weighing The Pros And Cons For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock Investment: Weighing the Pros and Cons for Investors

Robinhood, the commission-free trading app that revolutionized investing for millennials, has become a household name. But is investing in Robinhood stock itself a smart move? This article delves into the pros and cons, helping you decide if RH stock aligns with your investment strategy.

The Allure of Robinhood: A Commission-Free Revolution

Robinhood's initial success stemmed from its disruptive commission-free trading model. This accessibility attracted a surge of new investors, particularly younger demographics previously excluded by traditional brokerage fees. This democratization of investing fueled significant growth, making Robinhood a compelling investment opportunity for some.

Pros of Investing in Robinhood Stock:

- Brand Recognition and Market Share: Robinhood boasts impressive brand recognition and a significant market share, especially among younger investors. This strong brand presence translates to potential for future growth and market dominance.

- Technological Innovation: The company continues to innovate, introducing new features and services to enhance the user experience. Further technological advancements could attract more users and boost revenue.

- Growth Potential in Emerging Markets: Robinhood's expansion into new markets and product offerings presents significant growth opportunities. This diversification mitigates risk and opens doors to untapped revenue streams.

- Potential for Increased Revenue Streams: Beyond brokerage services, Robinhood is exploring avenues like premium subscriptions and financial planning tools, diversifying its revenue streams and bolstering its financial stability.

Cons of Investing in Robinhood Stock:

- Regulatory Scrutiny and Legal Challenges: Robinhood has faced considerable regulatory scrutiny and legal challenges, impacting its reputation and potentially affecting future profitability. Staying informed about these ongoing issues is crucial.

- Competition in a Crowded Market: The online brokerage industry is intensely competitive. Established players and emerging fintech companies pose a significant threat to Robinhood's market share.

- Dependence on Trading Volume: Robinhood's revenue is significantly tied to trading volume. Fluctuations in market activity can directly impact its profitability. A decline in trading activity could negatively affect the stock price.

- User Acquisition Costs: Attracting new users remains a substantial expense for Robinhood. Balancing user acquisition costs with profitability is a key challenge for the company.

Analyzing the Financial Performance:

Before investing in any stock, it's crucial to carefully analyze its financial performance. Review Robinhood's financial statements, including revenue growth, profitability, and debt levels. Consider consulting with a qualified financial advisor to assess the risks and potential returns. Understanding key financial metrics like the price-to-earnings ratio (P/E ratio) and revenue growth rate can provide valuable insights. You can find this information on reputable financial websites like and .

Should You Invest in Robinhood Stock?

Investing in Robinhood stock, like any investment, carries inherent risks. The decision to invest should align with your individual risk tolerance, investment goals, and a thorough understanding of the company's financial health and market position. The information presented here is for educational purposes only and should not be considered financial advice. Always conduct your own research and consult with a financial professional before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock Investment: Weighing The Pros And Cons For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Supreme Court Ruling Easier Reverse Discrimination Suits For Straight Women

Jun 06, 2025

Supreme Court Ruling Easier Reverse Discrimination Suits For Straight Women

Jun 06, 2025 -

Ryan Goslings Potential As White Black Panther Analyzing The Ketema Reveals Implications For The Mcu

Jun 06, 2025

Ryan Goslings Potential As White Black Panther Analyzing The Ketema Reveals Implications For The Mcu

Jun 06, 2025 -

Heart Operation Deaths Spark Police Inquiry At Major Nhs Hospital

Jun 06, 2025

Heart Operation Deaths Spark Police Inquiry At Major Nhs Hospital

Jun 06, 2025 -

Wisconsin Man Convicted In Gruesome Murder Of 19 Year Old After First Date

Jun 06, 2025

Wisconsin Man Convicted In Gruesome Murder Of 19 Year Old After First Date

Jun 06, 2025 -

Controversy Erupts Marvel Introduces A New Black Panther Character

Jun 06, 2025

Controversy Erupts Marvel Introduces A New Black Panther Character

Jun 06, 2025

Latest Posts

-

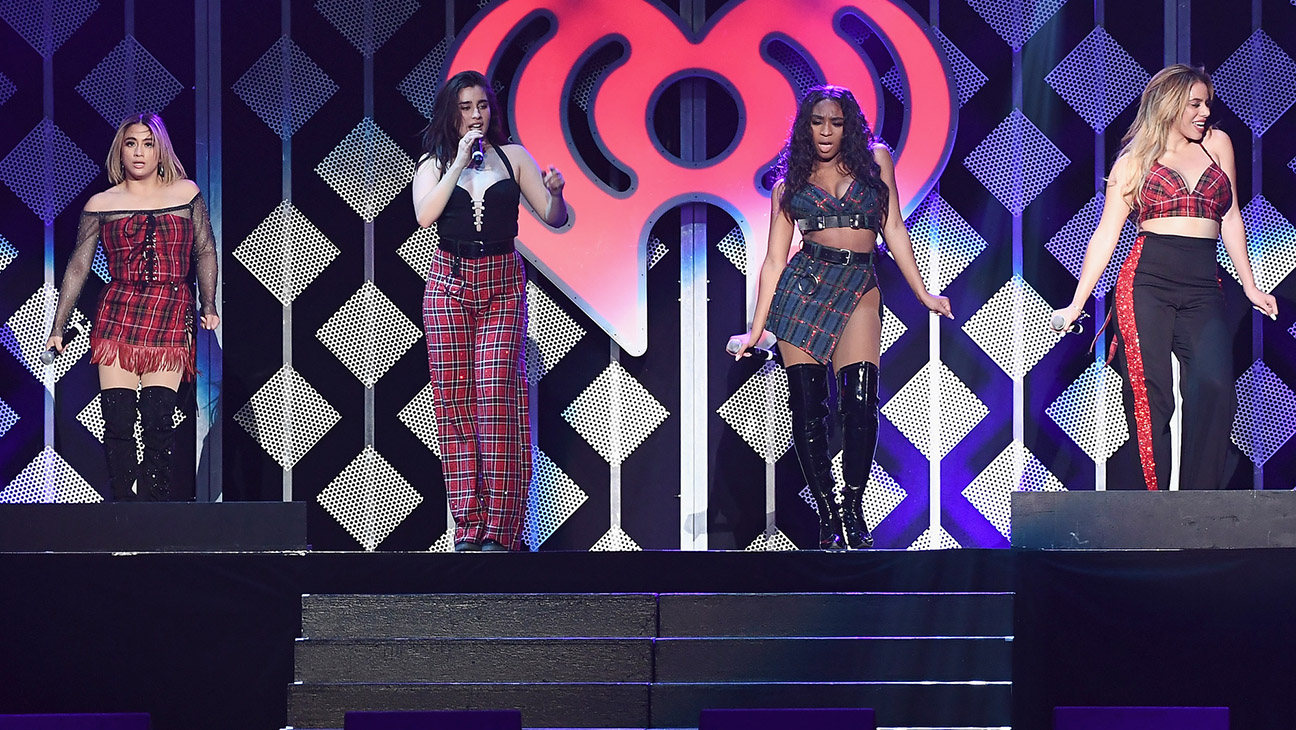

Exclusive Update Fifth Harmony Considering Reunion Without Cabello

Jun 06, 2025

Exclusive Update Fifth Harmony Considering Reunion Without Cabello

Jun 06, 2025 -

Applied Digitals Stock Soars 48 On Massive Ai Lease

Jun 06, 2025

Applied Digitals Stock Soars 48 On Massive Ai Lease

Jun 06, 2025 -

Sade Robinson Killing The Maxwell Anderson Trial And Its Implications

Jun 06, 2025

Sade Robinson Killing The Maxwell Anderson Trial And Its Implications

Jun 06, 2025 -

June 6th Maxwell Anderson Faces Charges In Sade Robinson Death

Jun 06, 2025

June 6th Maxwell Anderson Faces Charges In Sade Robinson Death

Jun 06, 2025 -

Investigation Launched Into 2 000 Gallon Diesel Spill In Baltimore Harbor

Jun 06, 2025

Investigation Launched Into 2 000 Gallon Diesel Spill In Baltimore Harbor

Jun 06, 2025