Robinhood Stock Investment: Weighing The Risks And Rewards

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock Investment: Weighing the Risks and Rewards

The meteoric rise of Robinhood, the commission-free trading app, has captivated millions, making investing accessible to a new generation. But with its user-friendly interface and gamified approach, comes a crucial question: is investing in Robinhood stock itself a smart move? This article delves into the potential risks and rewards, helping you make an informed decision.

The Allure of Robinhood: A Millennial Magnet

Robinhood's success story is undeniable. Its disruptive business model, offering commission-free trading and fractional shares, democratized investing and attracted a massive user base, particularly among millennials and Gen Z. This explosive growth initially translated into a soaring stock price. However, the initial public offering (IPO) and subsequent market performance tell a more nuanced story. The company's innovative approach to trading attracted significant attention and investment, initially boosting its stock value. However, the subsequent decline highlights the importance of understanding the inherent risks.

Understanding the Risks:

Several factors contribute to the inherent risks associated with investing in Robinhood:

- Market Volatility: Like any stock, Robinhood's price is subject to market fluctuations. External factors, such as economic downturns or changes in regulatory landscapes, can significantly impact its performance. [Link to article about market volatility]

- Competition: The brokerage industry is highly competitive. Established players and new entrants constantly challenge Robinhood's market share, impacting its growth potential and profitability.

- Regulatory Scrutiny: Robinhood has faced regulatory scrutiny regarding its practices, including allegations of misleading customers and insufficient risk management. These regulatory hurdles can impact the company's financial stability and future growth.

- Dependence on Trading Volume: Robinhood's revenue model heavily relies on trading volume. A decline in trading activity could directly affect its profitability.

- Gamification Concerns: While its gamified approach attracted new investors, it also raised concerns about impulsive trading and increased risk-taking behavior among less experienced investors.

Potential Rewards:

Despite the risks, investing in Robinhood could offer certain rewards:

- Growth Potential: Robinhood continues to innovate and expand its services, potentially unlocking future growth opportunities. The company's expansion into crypto trading and other financial products demonstrates its ambition for continued growth.

- First-Mover Advantage: As a pioneer in commission-free trading, Robinhood holds a significant first-mover advantage in the market. This established brand recognition could provide a competitive edge.

- Technological Innovation: Robinhood's technology and user experience continue to be refined. Further advancements in its platform could attract more users and enhance its profitability.

Making an Informed Decision:

Before investing in Robinhood stock, it's crucial to:

- Conduct Thorough Research: Understand the company's financial performance, business model, and competitive landscape. Analyze financial statements, news articles, and analyst reports.

- Assess Your Risk Tolerance: Investing in Robinhood involves significant risk. Only invest an amount you're comfortable potentially losing.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversifying your investments across different asset classes can help mitigate risk.

- Seek Professional Advice: Consult a financial advisor for personalized guidance based on your financial goals and risk tolerance.

Conclusion:

Investing in Robinhood stock presents a compelling yet risky opportunity. The potential for significant rewards exists, but careful consideration of the inherent risks is paramount. Thorough research, a realistic assessment of your risk tolerance, and diversification are essential steps in making an informed investment decision. Remember, investing always carries risk, and past performance is not indicative of future results.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock Investment: Weighing The Risks And Rewards. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Police Investigation Three Young Girls Found Dead Father A Person Of Interest

Jun 06, 2025

Police Investigation Three Young Girls Found Dead Father A Person Of Interest

Jun 06, 2025 -

Supreme Court Rules Unanimously For Ohio Woman In Discrimination Case

Jun 06, 2025

Supreme Court Rules Unanimously For Ohio Woman In Discrimination Case

Jun 06, 2025 -

Investigation Underway Police Examine Fatal Heart Surgeries At Nhs Trust

Jun 06, 2025

Investigation Underway Police Examine Fatal Heart Surgeries At Nhs Trust

Jun 06, 2025 -

Massive Ai Lease Agreement Fuels 48 Rise In Applied Digital Shares

Jun 06, 2025

Massive Ai Lease Agreement Fuels 48 Rise In Applied Digital Shares

Jun 06, 2025 -

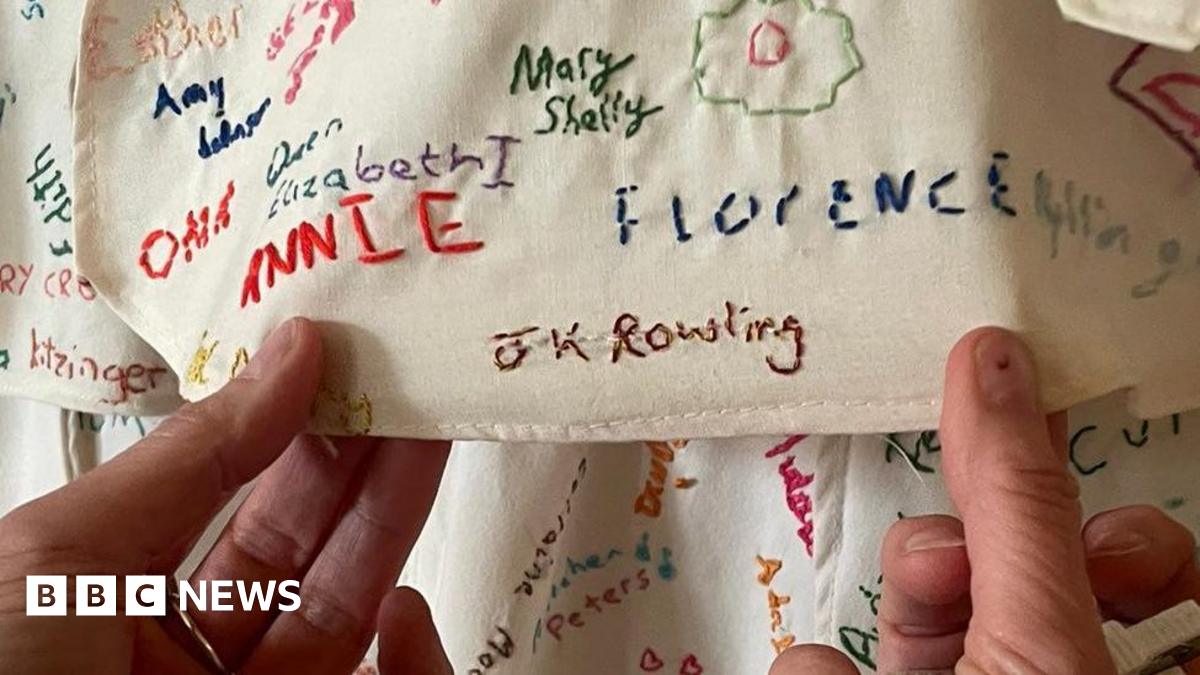

National Trust Addresses Damage To J K Rowling Related Artwork In Derbyshire

Jun 06, 2025

National Trust Addresses Damage To J K Rowling Related Artwork In Derbyshire

Jun 06, 2025

Latest Posts

-

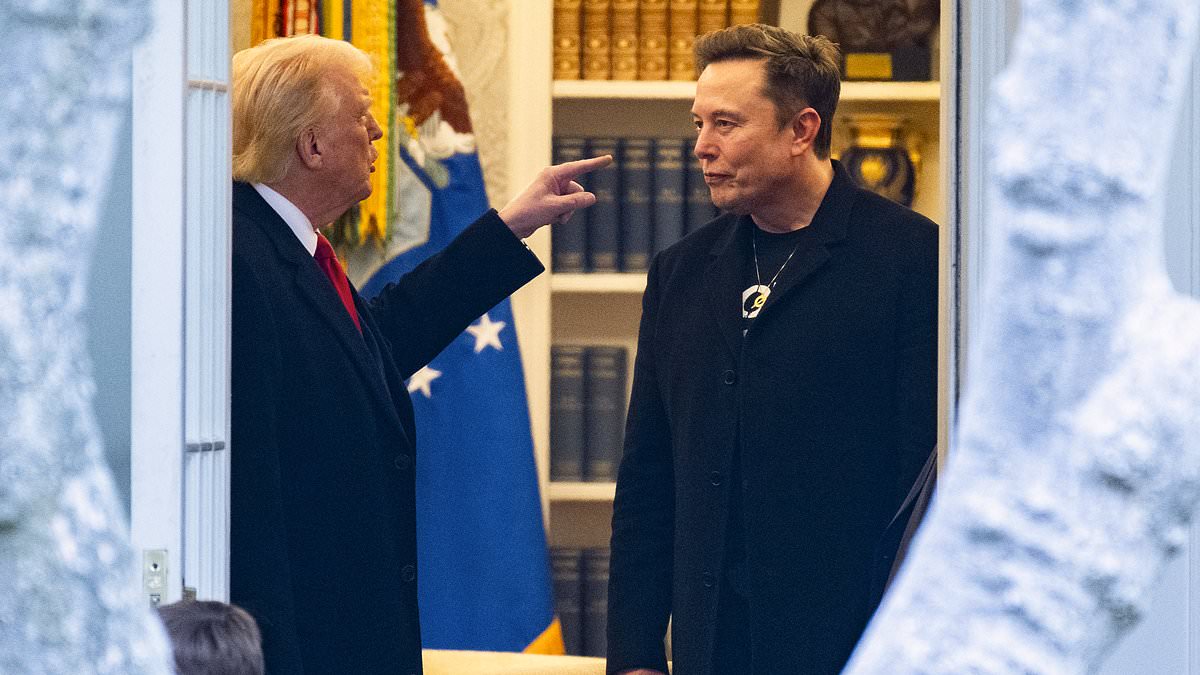

The Trump Musk Rift Uncovering The Influence Of A Powerful Advisor

Jun 06, 2025

The Trump Musk Rift Uncovering The Influence Of A Powerful Advisor

Jun 06, 2025 -

The Truth Behind The Rumors Walton Goggins And Aimee Lou Wood On Their White Lotus Experience

Jun 06, 2025

The Truth Behind The Rumors Walton Goggins And Aimee Lou Wood On Their White Lotus Experience

Jun 06, 2025 -

Significant Diesel Spill Impacts Baltimore Harbor 2 000 Gallons And Rising Concerns

Jun 06, 2025

Significant Diesel Spill Impacts Baltimore Harbor 2 000 Gallons And Rising Concerns

Jun 06, 2025 -

Nhl Playoffs Peter De Boer Out As Dallas Stars Head Coach

Jun 06, 2025

Nhl Playoffs Peter De Boer Out As Dallas Stars Head Coach

Jun 06, 2025 -

Core Weaves 7 Billion Lease Propels Applied Digital Stock 48 Higher

Jun 06, 2025

Core Weaves 7 Billion Lease Propels Applied Digital Stock 48 Higher

Jun 06, 2025