Robinhood Stock: Is It Still A Buy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock: Is it Still a Buy in 2024? Navigating the Volatility

Robinhood's meteoric rise and subsequent fall have captivated investors. Once a darling of the meme stock era, the commission-free trading platform now faces a more challenging landscape. So, is Robinhood stock still a buy? The answer, as with most investments, is complex and depends on your individual risk tolerance and investment strategy. This article delves into the current state of Robinhood, analyzing its strengths, weaknesses, and future prospects to help you make an informed decision.

Robinhood's Rise and Fall from Grace:

Robinhood's initial success was built on its disruptive, commission-free trading model, attracting millions of millennial and Gen Z investors. The pandemic fueled its growth further, with unprecedented levels of retail trading activity. However, the subsequent market downturn, increased regulatory scrutiny, and heightened competition have significantly impacted the company's performance. The dramatic price swings in its own stock have also contributed to investor uncertainty.

Analyzing the Current Landscape:

Several key factors need to be considered when evaluating Robinhood's investment potential:

- Increased Competition: The brokerage industry is fiercely competitive, with established players and new entrants vying for market share. Robinhood needs to differentiate itself beyond its commission-free model to maintain its user base and attract new customers.

- Regulatory Scrutiny: The company has faced several regulatory investigations and fines, impacting its reputation and financial stability. Navigating the complex regulatory environment will be crucial for its long-term success.

- Financial Performance: Robinhood's financial performance has been volatile, with fluctuating revenues and profitability. Investors need to closely monitor its financial reports and assess its ability to achieve sustainable growth.

- Expansion into New Areas: Robinhood is diversifying its offerings beyond stock trading, exploring areas like cryptocurrencies and wealth management. The success of these expansion efforts will be crucial for future growth.

- Subscription Model Success: Robinhood's transition to a subscription-based model for premium features is key to its long-term profitability. The success of this strategy will be a major factor in its future valuation.

Strengths of Robinhood:

- Large User Base: Robinhood boasts a substantial and engaged user base, providing a strong foundation for future growth.

- Brand Recognition: The company enjoys significant brand recognition, particularly among younger investors.

- Technological Innovation: Robinhood continues to invest in technological improvements, enhancing its trading platform and user experience.

Weaknesses of Robinhood:

- Dependence on Trading Volume: Robinhood's revenue is heavily dependent on trading volume, making it vulnerable to market fluctuations.

- Customer Acquisition Costs: Attracting and retaining customers can be expensive, impacting profitability.

- Security Concerns: Past security breaches have raised concerns about the platform's security measures.

Is it a Buy? A Cautious Approach:

The question of whether Robinhood stock is a buy remains a complex one. While the company possesses certain strengths and is attempting to adapt to the changing market, its vulnerabilities remain significant. Investors should proceed with caution, carefully considering their risk tolerance and conducting thorough due diligence before investing. It is crucial to remember that past performance is not indicative of future results.

Further Research:

Before making any investment decisions, it is highly recommended to consult with a qualified financial advisor and conduct your own thorough research. Consider examining Robinhood's latest financial reports, analyzing industry trends, and assessing the overall market conditions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you could lose money. Always conduct your own research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock: Is It Still A Buy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

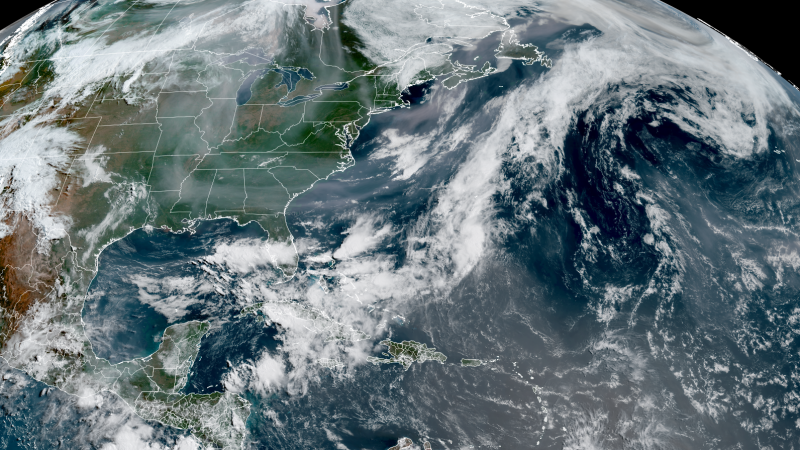

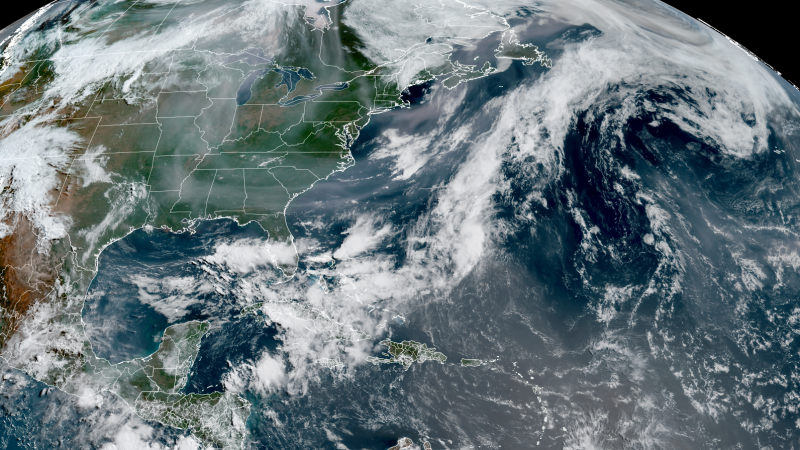

Weather Forecast Imminent Collision Of Wildfire Smoke And African Dust In Southern Regions

Jun 05, 2025

Weather Forecast Imminent Collision Of Wildfire Smoke And African Dust In Southern Regions

Jun 05, 2025 -

Forecast Collision Of Canadian Wildfire Smoke And African Dust Plume Expected In Southern Regions

Jun 05, 2025

Forecast Collision Of Canadian Wildfire Smoke And African Dust Plume Expected In Southern Regions

Jun 05, 2025 -

Tennis Star Alexander Bublik On The Robot Mentality Of Professional Sport

Jun 05, 2025

Tennis Star Alexander Bublik On The Robot Mentality Of Professional Sport

Jun 05, 2025 -

All American Rejects Unpermitted Gig College Town Police Intervention

Jun 05, 2025

All American Rejects Unpermitted Gig College Town Police Intervention

Jun 05, 2025 -

Katherine Hill Pontardawe Mum Faces 50 000 Repayment Order For Theft

Jun 05, 2025

Katherine Hill Pontardawe Mum Faces 50 000 Repayment Order For Theft

Jun 05, 2025

Latest Posts

-

Que Hacen Los Papas De Aldo De Nigris Descubriendo Sus Historias La Casa De Los Famosos

Aug 17, 2025

Que Hacen Los Papas De Aldo De Nigris Descubriendo Sus Historias La Casa De Los Famosos

Aug 17, 2025 -

Nba Prop Bet Limits Players Union Backs Increased Oversight

Aug 17, 2025

Nba Prop Bet Limits Players Union Backs Increased Oversight

Aug 17, 2025 -

The Hidden Talent Exploring The Musical Journey Of Mike Vennart

Aug 17, 2025

The Hidden Talent Exploring The Musical Journey Of Mike Vennart

Aug 17, 2025 -

Sleep Tokens Praise Unveiling Mike Vennarts Underrated Guitar Prowess

Aug 17, 2025

Sleep Tokens Praise Unveiling Mike Vennarts Underrated Guitar Prowess

Aug 17, 2025 -

Hollywood Star Power Austin Butler Works Behind The Austin Bar

Aug 17, 2025

Hollywood Star Power Austin Butler Works Behind The Austin Bar

Aug 17, 2025