Robinhood Stock Performance: A Bull Case For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock Performance: A Bull Case for Investors

Robinhood, the once-darling of commission-free trading, has experienced a rollercoaster ride since its IPO. While its stock price has seen significant volatility, a compelling bull case is emerging for long-term investors willing to navigate the short-term turbulence. This article delves into the factors suggesting a potential resurgence for the controversial brokerage giant.

H2: Beyond the Hype: Understanding Robinhood's Potential

Robinhood's initial public offering (IPO) in 2021 was met with immense hype, fueled by its disruptive commission-free trading model and a massive user base attracted by its user-friendly interface. However, the subsequent stock price decline was partly attributed to regulatory scrutiny, increased competition, and a post-pandemic market correction that impacted growth stocks disproportionately. Yet, beneath the surface, several positive trends are developing.

H2: Key Factors Supporting a Bullish Outlook

Several factors contribute to a positive outlook for Robinhood's stock performance:

-

Expanding Revenue Streams: Robinhood is diversifying beyond its initial commission-free trading model. The introduction of new products and services, including options trading, crypto trading, and a debit card with cash-back rewards, are broadening revenue streams and reducing reliance on transaction fees alone. This diversification is crucial for long-term sustainability and profitability.

-

Growing User Base and Engagement: Despite the market downturn, Robinhood continues to attract new users. While user growth may have slowed compared to its peak, the platform's large and active user base provides a solid foundation for future growth. Increased user engagement, measured by active traders and trading volume, is also a positive indicator.

-

Technological Innovation: Robinhood is investing heavily in technology to enhance its platform and offer a superior user experience. Improvements in trading tools, investment research, and educational resources can attract and retain users. This focus on technology reflects a commitment to innovation and staying ahead of the competition in a rapidly evolving market.

-

Regulatory Adaptations: While regulatory scrutiny remains a challenge, Robinhood is actively adapting to the changing regulatory landscape. Addressing concerns raised by regulators and demonstrating compliance can improve investor confidence and unlock further growth potential.

H3: Addressing the Bear Case:

It's crucial to acknowledge the counterarguments. Concerns about increased competition from established players and new entrants, as well as potential regulatory fines, remain valid. However, the steps Robinhood is taking to diversify its revenue streams and improve its compliance demonstrate a proactive approach to addressing these concerns.

H2: Investing in Robinhood: A Long-Term Perspective

Investing in Robinhood requires a long-term perspective. While short-term volatility is expected, the company's strategic initiatives and potential for future growth suggest a positive outlook for patient investors. The key lies in assessing whether Robinhood's efforts to diversify revenue streams, enhance user engagement, and navigate regulatory hurdles will translate into sustained profitability and market share growth.

H2: Disclaimer and Further Research:

This article offers a bullish perspective on Robinhood's stock performance but is not financial advice. Investors should conduct thorough due diligence and consider their individual risk tolerance before making any investment decisions. Consult with a qualified financial advisor for personalized guidance. For further research, you can explore resources such as the company's investor relations website and reputable financial news sources.

Call to Action (Subtle): Stay informed on Robinhood's progress by following reputable financial news outlets and analyzing their quarterly earnings reports.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock Performance: A Bull Case For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Duchess Meghan Shares Adorable Pregnancy Dance Video

Jun 06, 2025

Duchess Meghan Shares Adorable Pregnancy Dance Video

Jun 06, 2025 -

Impact Of Supreme Court Decision New Path For Reverse Discrimination Claims

Jun 06, 2025

Impact Of Supreme Court Decision New Path For Reverse Discrimination Claims

Jun 06, 2025 -

Madeleine Mc Cann Case Hope Remains After 18 Years Of Searching

Jun 06, 2025

Madeleine Mc Cann Case Hope Remains After 18 Years Of Searching

Jun 06, 2025 -

Ghost Hurricanes A New Tool For More Accurate Hurricane Forecasts

Jun 06, 2025

Ghost Hurricanes A New Tool For More Accurate Hurricane Forecasts

Jun 06, 2025 -

The Impact Of First Bacteria On Future Health A Microbiome Perspective

Jun 06, 2025

The Impact Of First Bacteria On Future Health A Microbiome Perspective

Jun 06, 2025

Latest Posts

-

Matthew Hussey Expecting First Child With Spouse

Jun 06, 2025

Matthew Hussey Expecting First Child With Spouse

Jun 06, 2025 -

Hype Builds Crowds Gather Outside Jd Sports For The New Air Jordan 110 Drop

Jun 06, 2025

Hype Builds Crowds Gather Outside Jd Sports For The New Air Jordan 110 Drop

Jun 06, 2025 -

Jd Sports 110 Release People Camp Out For Highly Anticipated Sneakers

Jun 06, 2025

Jd Sports 110 Release People Camp Out For Highly Anticipated Sneakers

Jun 06, 2025 -

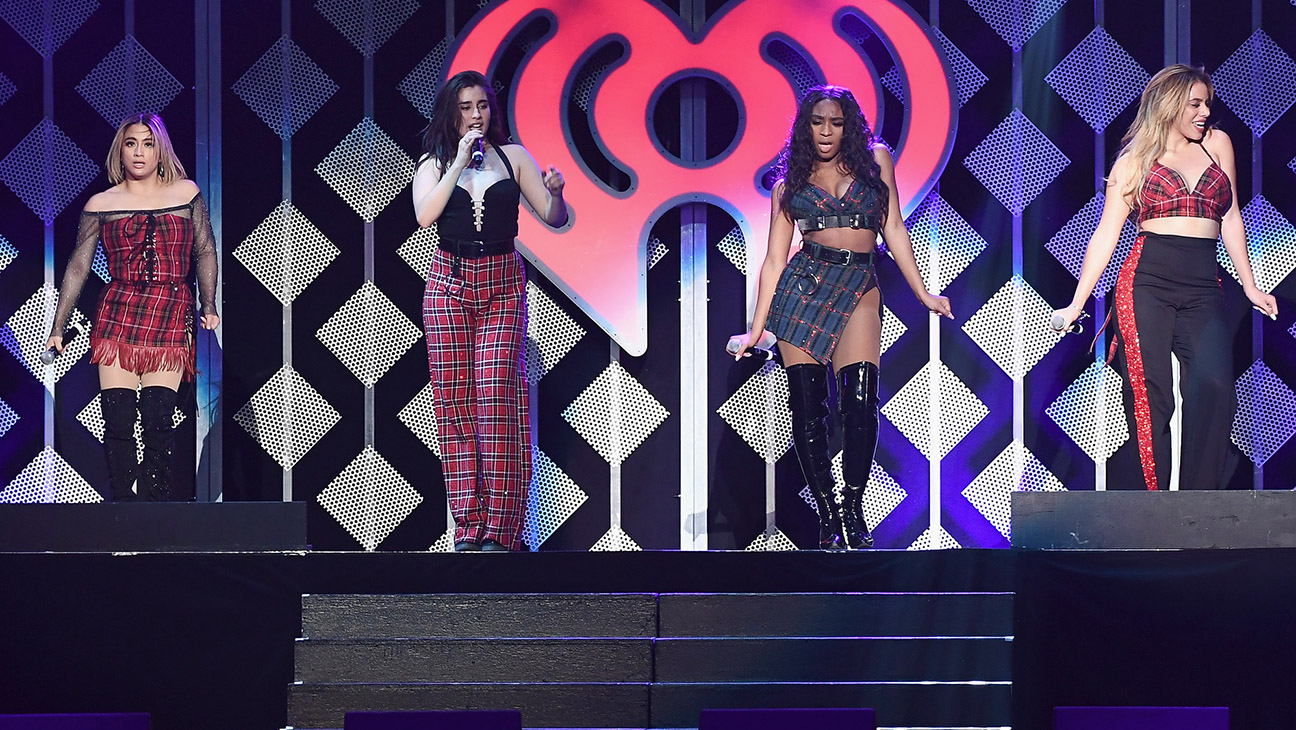

Exclusive Fifth Harmony Minus Camila Discuss Potential Reunion

Jun 06, 2025

Exclusive Fifth Harmony Minus Camila Discuss Potential Reunion

Jun 06, 2025 -

The Reason Behind Walton Goggins Tearful Instagram Unfollow Of Aimee Lou Wood

Jun 06, 2025

The Reason Behind Walton Goggins Tearful Instagram Unfollow Of Aimee Lou Wood

Jun 06, 2025