Robinhood Stock Performance: A Strong Case For Continued Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock Performance: A Strong Case for Continued Investment?

Robinhood, the disruptive brokerage app that stormed onto the financial scene, has had a rollercoaster ride since its IPO. While its initial public offering (IPO) didn't exactly soar, recent performance has sparked renewed interest and a debate: is now the time to invest in Robinhood, or should investors remain cautious? This article delves into Robinhood's stock performance, examining the factors contributing to its fluctuations and exploring the potential for future growth.

Understanding Robinhood's Recent Performance:

Robinhood's stock price (HOOD) has experienced significant volatility. After a disappointing IPO, the stock faced challenges related to regulatory scrutiny, increased competition, and a post-pandemic slowdown in retail trading activity. However, recent quarters have shown signs of improvement. The company has reported positive earnings surprises, demonstrating progress in diversifying its revenue streams beyond trading commissions. This diversification, a key factor in investor confidence, includes a growing subscription revenue model and expansion into new financial products.

Key Factors Driving Potential Growth:

Several factors contribute to a bullish outlook for Robinhood's future:

-

Expanding Product Offerings: Robinhood is moving beyond its core brokerage services, introducing crypto trading, options trading, and wealth management tools. This diversification reduces reliance on trading volume and creates multiple revenue streams. This strategic move towards a more comprehensive financial platform is crucial for long-term sustainability.

-

Focus on Customer Acquisition and Retention: While attracting new users is essential, retaining existing customers and increasing their engagement is equally important. Robinhood’s efforts to improve its user experience and offer more sophisticated investment tools aim to boost customer loyalty and average revenue per user (ARPU).

-

Technological Innovation: Robinhood's technological prowess remains a significant advantage. Its user-friendly interface and innovative features continue to attract a younger demographic of investors, a crucial target market for future growth. Continued investment in technology will likely be pivotal to maintaining this competitive edge.

-

Regulatory Landscape: While regulatory scrutiny remains a potential headwind, the company is actively navigating these challenges. Adapting to evolving regulations and demonstrating compliance will be crucial for long-term stability.

Challenges and Risks Remain:

Despite the positive trends, it's essential to acknowledge the challenges:

-

Intense Competition: The brokerage industry is fiercely competitive, with established players and new entrants vying for market share. Maintaining its competitive advantage requires continuous innovation and adaptation.

-

Market Volatility: The overall stock market’s performance significantly impacts Robinhood's stock price, as investor sentiment influences trading activity.

-

Regulatory Uncertainty: Changes in financial regulations could affect Robinhood’s business model and profitability.

Is Robinhood a Good Investment?

The question of whether Robinhood is a "good" investment depends on individual risk tolerance and investment goals. The stock carries inherent risk, given its volatility and the challenges outlined above. However, the company's efforts to diversify revenue streams, improve user experience, and expand its product offerings suggest a potential for future growth.

Before investing in Robinhood or any stock, conducting thorough due diligence and seeking professional financial advice is crucial. This article does not constitute financial advice.

Learn More:

For further information on Robinhood and its financial performance, you can visit the company's investor relations website [link to Robinhood investor relations]. You can also consult reputable financial news sources for up-to-date analysis.

Disclaimer: This article provides general information and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock Performance: A Strong Case For Continued Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dramatic Rescue 22 Crew Members Saved After North Pacific Ship Fire

Jun 06, 2025

Dramatic Rescue 22 Crew Members Saved After North Pacific Ship Fire

Jun 06, 2025 -

Ryan Goslings Mcu Future Analyzing The White Black Panther Possibility Following Ketema

Jun 06, 2025

Ryan Goslings Mcu Future Analyzing The White Black Panther Possibility Following Ketema

Jun 06, 2025 -

Supreme Court Eases Burden Of Proof In Reverse Discrimination Cases

Jun 06, 2025

Supreme Court Eases Burden Of Proof In Reverse Discrimination Cases

Jun 06, 2025 -

End Of An Era Stars Dismiss Coach Peter De Boer Following Playoff Exit

Jun 06, 2025

End Of An Era Stars Dismiss Coach Peter De Boer Following Playoff Exit

Jun 06, 2025 -

Rangers Coaching Staff Expansion Quinn And Sacco Hired

Jun 06, 2025

Rangers Coaching Staff Expansion Quinn And Sacco Hired

Jun 06, 2025

Latest Posts

-

Is Ibm Relevant In 2024 A Critical Analysis Of Its Comeback

Jun 06, 2025

Is Ibm Relevant In 2024 A Critical Analysis Of Its Comeback

Jun 06, 2025 -

Sade Robinson Death Updates On The Maxwell Anderson Trial Proceedings

Jun 06, 2025

Sade Robinson Death Updates On The Maxwell Anderson Trial Proceedings

Jun 06, 2025 -

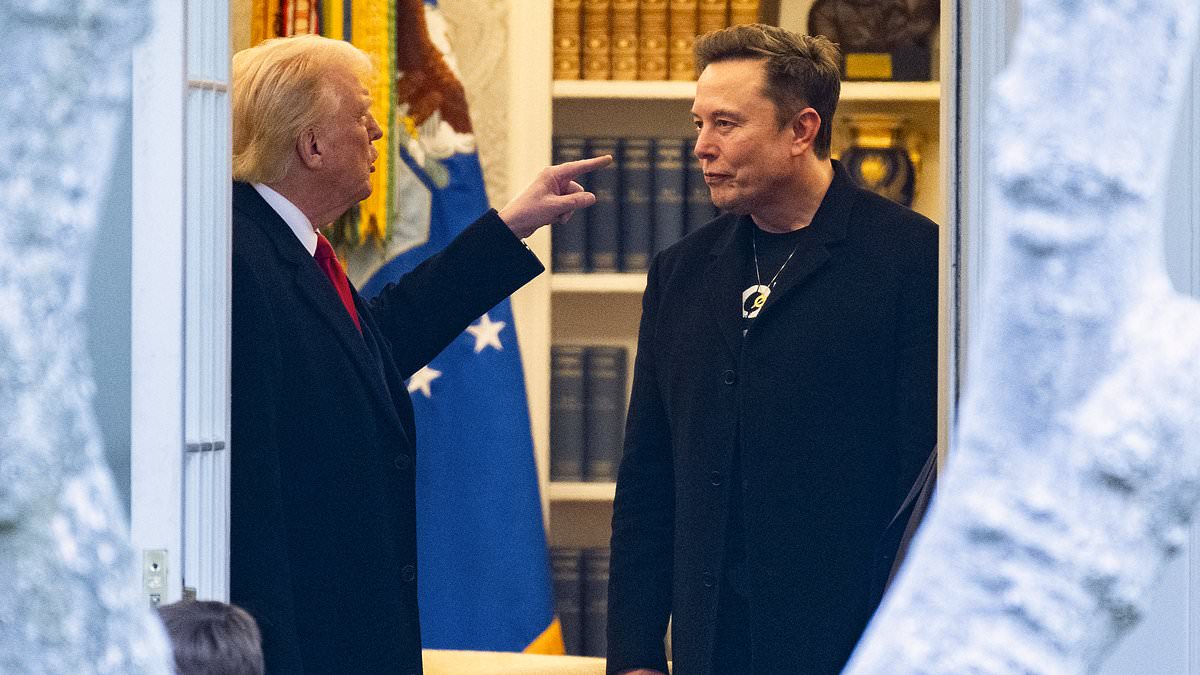

Key Trump Advisor At Center Of Musk Trump Feud

Jun 06, 2025

Key Trump Advisor At Center Of Musk Trump Feud

Jun 06, 2025 -

Gaza Hostage Crisis Israeli Military Confirms Recovery Of Two Bodies

Jun 06, 2025

Gaza Hostage Crisis Israeli Military Confirms Recovery Of Two Bodies

Jun 06, 2025 -

Nhl Playoffs Dallas Stars Fire Coach Pete De Boer After Conference Finals Defeat

Jun 06, 2025

Nhl Playoffs Dallas Stars Fire Coach Pete De Boer After Conference Finals Defeat

Jun 06, 2025