Robinhood Stock Performance: Analysis And Future Outlook For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock Performance: Analysis and Future Outlook for Investors

Robinhood, the once-darling of the millennial investing world, has experienced a rollercoaster ride since its IPO. Its meteoric rise, fueled by pandemic-era trading frenzies and a user-friendly interface, has been followed by a significant downturn. This article delves into Robinhood's stock performance, analyzing past trends and offering insights into its potential future trajectory for investors.

A Turbulent Journey: Robinhood's Stock History

Robinhood's initial public offering (IPO) in July 2021 was met with considerable hype. The stock price initially soared, reflecting investor enthusiasm for its disruptive business model and massive user base. However, this initial euphoria quickly faded. A combination of factors contributed to the subsequent decline:

- Increased Competition: The brokerage industry is fiercely competitive, with established players like Fidelity and Charles Schwab offering similar services, often with more robust features and lower fees.

- Regulatory Scrutiny: Robinhood faced increased regulatory scrutiny, impacting its growth and profitability. Investigations into its trading practices and accusations of misleading customers added pressure.

- Post-Pandemic Market Correction: The broader market correction following the pandemic boom significantly impacted Robinhood's performance, as investors shifted their focus to more established companies.

- Declining Revenue Growth: A slowdown in trading activity, as the initial pandemic-fueled surge subsided, resulted in lower revenue growth than initially anticipated.

Analyzing the Current State of Affairs:

Currently, Robinhood is focusing on diversifying its revenue streams. This includes expanding its offerings beyond simple stock trading, exploring areas such as:

- Cryptocurrency Trading: While controversial, crypto remains a significant area of growth for online brokerages.

- Options Trading: Offering more sophisticated trading options attracts a wider range of investors.

- Subscription Services: Introducing premium subscription tiers with enhanced features could boost revenue.

- Improved Customer Service: Addressing previous customer service complaints and improving the overall user experience is crucial for retaining and attracting new users.

Future Outlook: What's in Store for RH Stock?

Predicting the future of any stock is inherently challenging, but analyzing several key factors can provide valuable insight. For Robinhood, several factors will influence its future stock performance:

- Successful Diversification: The success of its efforts to diversify revenue streams beyond simple stock trading will be critical.

- Regulatory Landscape: The evolving regulatory landscape will continue to impact the company's operations and profitability.

- Market Conditions: Broader market trends and economic conditions will undoubtedly play a significant role.

- Competitive Pressures: The intensity of competition from established players will continue to be a major challenge.

Investing in Robinhood: A Calculated Risk?

Investing in Robinhood requires careful consideration. While its user-friendly platform and large user base present potential strengths, its past performance and ongoing challenges highlight the inherent risks. Potential investors should conduct thorough due diligence, considering their own risk tolerance and investment goals before making any decisions. Consulting a financial advisor is always recommended.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Keywords: Robinhood, Robinhood stock, RH stock, stock market, investing, brokerage, IPO, cryptocurrency, options trading, financial markets, stock performance, investment analysis, future outlook, market trends, risk assessment, financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock Performance: Analysis And Future Outlook For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Washington State Police Investigate Triple Homicide Father Of Three Girls Sought

Jun 06, 2025

Washington State Police Investigate Triple Homicide Father Of Three Girls Sought

Jun 06, 2025 -

Investing In Coca Cola Ko What You Need To Know Before You Buy

Jun 06, 2025

Investing In Coca Cola Ko What You Need To Know Before You Buy

Jun 06, 2025 -

Robinhood Hood Stock Market Performance A 6 46 Increase On June 3rd

Jun 06, 2025

Robinhood Hood Stock Market Performance A 6 46 Increase On June 3rd

Jun 06, 2025 -

Lgbtq Community Responds To Hegseths Ship Renaming Order

Jun 06, 2025

Lgbtq Community Responds To Hegseths Ship Renaming Order

Jun 06, 2025 -

Assessing The Impact Were Ukraines Surprise Airfield Attacks A Game Changer

Jun 06, 2025

Assessing The Impact Were Ukraines Surprise Airfield Attacks A Game Changer

Jun 06, 2025

Latest Posts

-

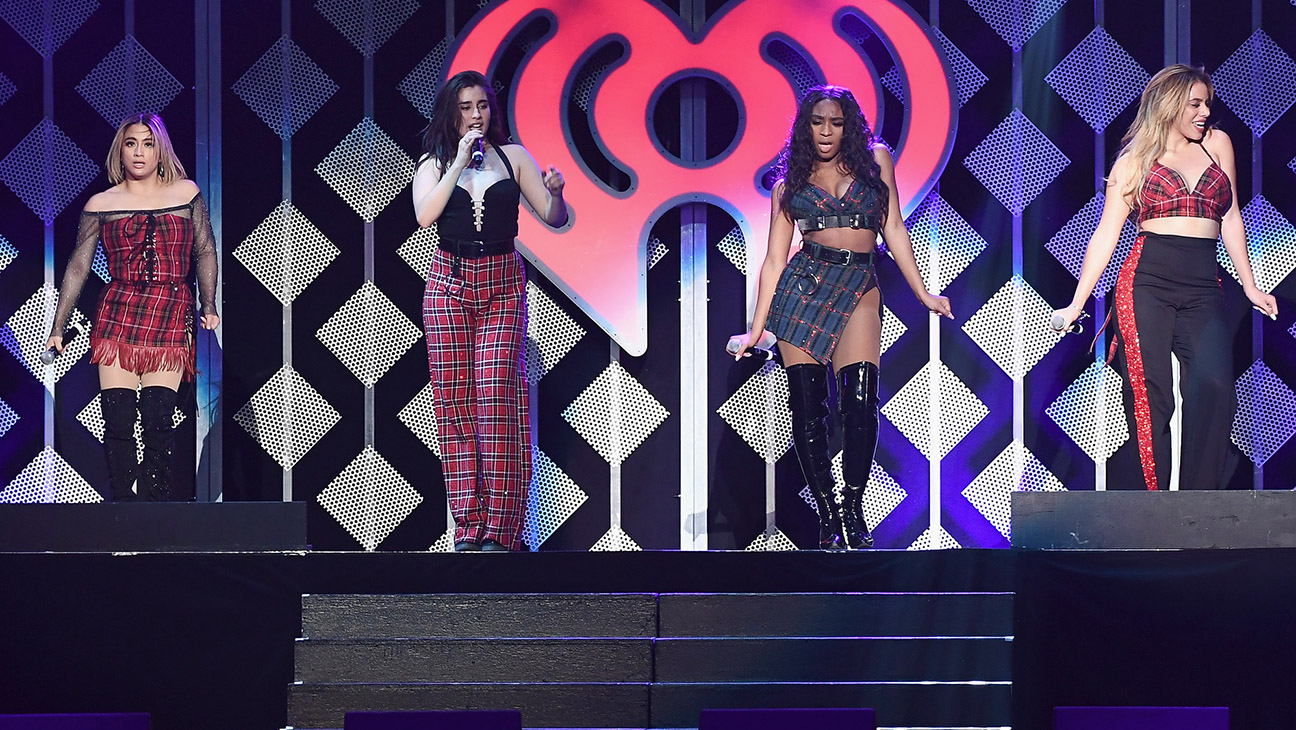

Exclusive Fifth Harmony Minus Camila Discuss Potential Reunion

Jun 06, 2025

Exclusive Fifth Harmony Minus Camila Discuss Potential Reunion

Jun 06, 2025 -

The Reason Behind Walton Goggins Tearful Instagram Unfollow Of Aimee Lou Wood

Jun 06, 2025

The Reason Behind Walton Goggins Tearful Instagram Unfollow Of Aimee Lou Wood

Jun 06, 2025 -

Relationship Update Matthew Hussey Ex Of Camila Cabello Announces Pregnancy

Jun 06, 2025

Relationship Update Matthew Hussey Ex Of Camila Cabello Announces Pregnancy

Jun 06, 2025 -

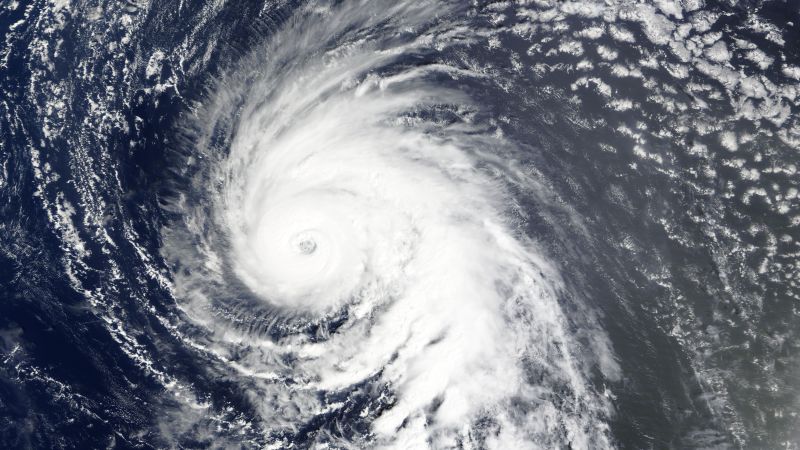

The Potential Of Ghost Hurricanes For Enhanced Hurricane Prediction Models

Jun 06, 2025

The Potential Of Ghost Hurricanes For Enhanced Hurricane Prediction Models

Jun 06, 2025 -

Ais Unforeseen Evolution A Ceo Sounds The Alarm

Jun 06, 2025

Ais Unforeseen Evolution A Ceo Sounds The Alarm

Jun 06, 2025