Robinhood Stock Price: Factors Driving Recent Growth And Future Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock Price: Factors Driving Recent Growth and Future Potential

Robinhood, the commission-free trading app that stormed onto the financial scene, has seen its stock price experience significant volatility. After a tumultuous IPO and subsequent slump, recent months have witnessed a resurgence in its value. But what's driving this renewed interest, and what does the future hold for the Robinhood stock price? This in-depth analysis explores the key factors contributing to its recent growth and assesses its potential for future gains.

The Resurgence of Robinhood: Key Factors

Several factors have coalesced to propel the Robinhood stock price upward recently. While past struggles with regulatory issues and negative publicity played a role in its decline, the tide seems to be turning.

1. Improved Financial Performance: Robinhood has demonstrated improved financial performance in recent quarters. This positive trend, marked by increased revenue and a narrowing of losses, signals a move towards profitability, a crucial factor influencing investor confidence. More robust financial reporting has reassured investors hesitant after the initial public offering.

2. Strategic Initiatives and Diversification: The company is actively diversifying its revenue streams beyond its core brokerage services. Expansion into new areas like crypto trading, options trading, and wealth management services is broadening its appeal to a wider range of users. This diversification reduces dependence on any single product line and strengthens its overall financial resilience. Further, initiatives focused on improving customer experience and expanding its financial product offerings are attracting new users and driving revenue growth.

3. Renewed Investor Sentiment: Positive financial results, coupled with a generally improving market sentiment, have contributed to a renewed sense of optimism surrounding Robinhood. Investors are reassessing the company's potential, recognizing the significant strides made in addressing past challenges and capitalizing on growth opportunities within the evolving fintech landscape.

4. The Crypto Market's Influence: The fluctuating yet generally positive performance of the cryptocurrency market has also played a role. Robinhood's crypto trading platform remains a significant revenue generator, and any upward trend in the crypto space tends to positively influence the company's overall valuation. The rise and fall of Bitcoin and other major cryptocurrencies directly impacts Robinhood's revenue and, subsequently, its stock price.

Future Potential: Challenges and Opportunities

While the recent growth is encouraging, several challenges remain. Increased competition in the brokerage industry, regulatory scrutiny, and the inherent volatility of the financial markets all present potential headwinds.

Challenges:

- Intense Competition: The brokerage sector is fiercely competitive, with established players and emerging fintech companies vying for market share.

- Regulatory Scrutiny: Robinhood continues to operate under regulatory scrutiny, particularly regarding its practices related to options trading and cryptocurrency.

- Market Volatility: The overall financial market's volatility remains a significant risk factor that could impact Robinhood’s stock price.

Opportunities:

- Expansion into New Markets: Further expansion into international markets presents significant growth potential.

- Technological Innovation: Continuous investment in technological innovation could further enhance the user experience and attract new customers.

- Strategic Partnerships: Strategic alliances with other financial institutions could open up new revenue streams and market access.

Conclusion: Navigating the Future

The Robinhood stock price's recent growth demonstrates a significant turnaround from previous challenges. However, investors should approach the situation with a balanced perspective, recognizing both the potential for continued growth and the inherent risks involved in investing in a volatile sector. Continued success hinges on its ability to navigate regulatory hurdles, maintain its competitive edge, and execute its strategic initiatives effectively. Monitoring its financial performance, regulatory updates, and market trends remains crucial for those considering investing in or following Robinhood's journey. Always conduct thorough research and consult a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock Price: Factors Driving Recent Growth And Future Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Multiple Cardiac Surgery Patient Deaths Lead To Police Inquiry At Nhs Facility

Jun 05, 2025

Multiple Cardiac Surgery Patient Deaths Lead To Police Inquiry At Nhs Facility

Jun 05, 2025 -

Is Nvidias Core Weave Poised To Become One Of The Most Profitable Us Businesses

Jun 05, 2025

Is Nvidias Core Weave Poised To Become One Of The Most Profitable Us Businesses

Jun 05, 2025 -

Backyard Concert Busted Police Intervene In All American Rejects Gig

Jun 05, 2025

Backyard Concert Busted Police Intervene In All American Rejects Gig

Jun 05, 2025 -

Heterosexual Woman Wins Supreme Court Case Implications For Reverse Discrimination

Jun 05, 2025

Heterosexual Woman Wins Supreme Court Case Implications For Reverse Discrimination

Jun 05, 2025 -

Glastonbury 2025 Unveiling The Artists Schedules And Hidden Performances

Jun 05, 2025

Glastonbury 2025 Unveiling The Artists Schedules And Hidden Performances

Jun 05, 2025

Latest Posts

-

Parenting Gen Z Lessons From Netflixs Adolescence

Aug 17, 2025

Parenting Gen Z Lessons From Netflixs Adolescence

Aug 17, 2025 -

Nurse Trades Scrubs For Seas A Full Time Life On Cruise Ships

Aug 17, 2025

Nurse Trades Scrubs For Seas A Full Time Life On Cruise Ships

Aug 17, 2025 -

The Heart Of The Blues Life And Music In A Mississippi Delta Community

Aug 17, 2025

The Heart Of The Blues Life And Music In A Mississippi Delta Community

Aug 17, 2025 -

Topshops Revival A High Street Return And The Challenge Of Cool

Aug 17, 2025

Topshops Revival A High Street Return And The Challenge Of Cool

Aug 17, 2025 -

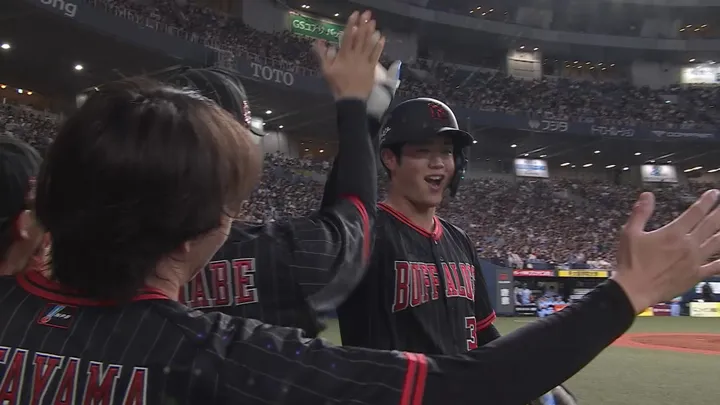

Ryo Otas Grand Slam Two Run Deficit After Eighth Bases Loaded Blast

Aug 17, 2025

Ryo Otas Grand Slam Two Run Deficit After Eighth Bases Loaded Blast

Aug 17, 2025