Robinhood's Future: Factors Influencing Stock Price And Investor Confidence

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood's Future: Factors Influencing Stock Price and Investor Confidence

Robinhood, the once-darling of the investing world, has seen its stock price fluctuate wildly since its initial public offering (IPO). While its commission-free trading platform revolutionized the brokerage industry, attracting millions of new investors, the company now faces a complex landscape impacting both its stock price and investor confidence. Understanding these factors is crucial for anyone considering investing in or following the company's trajectory.

The Rise and Fall (and Potential Rise Again?)

Robinhood's meteoric rise was fueled by its user-friendly app, gamified investing experience, and the democratization of trading. The pandemic, with its accompanying market volatility and surge in retail trading, further boosted its popularity. However, this rapid growth masked underlying vulnerabilities. The infamous GameStop saga, where Robinhood temporarily restricted trading of certain stocks, severely damaged its reputation and exposed regulatory risks. Subsequent regulatory scrutiny and increased competition have added further pressure.

Key Factors Influencing Robinhood's Stock Price:

-

Regulatory Scrutiny: Increased regulatory oversight, including investigations into its business practices and trading restrictions, creates uncertainty and can negatively impact investor sentiment. The potential for hefty fines or changes in regulations poses a significant threat.

-

Competition: The brokerage industry is fiercely competitive. Established players like Fidelity and Charles Schwab, along with newer fintech companies, offer comparable services, putting pressure on Robinhood's market share and profitability.

-

Revenue Diversification: Robinhood's heavy reliance on transaction-based revenue is a concern. Its efforts to diversify into areas like options trading, cryptocurrencies, and wealth management are crucial for long-term sustainability, but their success remains to be seen. The recent expansion into offering cash management accounts is a step in this direction.

-

User Acquisition and Retention: Attracting and retaining users is paramount. Competition for new investors is intense, and maintaining user engagement requires continuous innovation and improvement of the platform's features and user experience.

-

Market Sentiment: Broader market trends significantly influence Robinhood's stock price. Periods of market uncertainty or downturns can disproportionately impact companies perceived as higher-risk, like Robinhood.

Rebuilding Investor Confidence:

To regain investor confidence, Robinhood needs to demonstrate:

-

Improved Financial Performance: Consistent profitability and revenue growth are essential to attract long-term investors. This requires successful diversification of revenue streams and efficient cost management.

-

Enhanced Regulatory Compliance: Proactive compliance with regulatory requirements and transparent communication with regulators will help mitigate risks and restore trust.

-

Strategic Innovation: Continuous improvement of its platform and introduction of new features that cater to the evolving needs of investors are crucial for maintaining a competitive edge.

-

Strong Leadership and Communication: Effective communication with investors and stakeholders, along with a clear vision for the future, can build confidence and reduce uncertainty.

The Future Outlook:

Robinhood’s future is far from certain. While its disruptive approach to investing undeniably changed the landscape, navigating the challenges ahead requires strategic execution, strong regulatory compliance, and a consistent focus on user experience and financial performance. The company's ability to adapt and overcome these hurdles will ultimately determine its long-term success and its impact on the investing world. Investors should carefully consider these factors before making any investment decisions.

Further Reading:

- (Replace with actual link)

- (Replace with actual link)

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consider seeking advice from a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood's Future: Factors Influencing Stock Price And Investor Confidence. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Leftover Lewan Nfl Stars Awful First Pitch Goes Viral

Jun 06, 2025

Leftover Lewan Nfl Stars Awful First Pitch Goes Viral

Jun 06, 2025 -

Dramatic Rescue 22 Sailors Saved After Car Carrier Fire In North Pacific

Jun 06, 2025

Dramatic Rescue 22 Sailors Saved After Car Carrier Fire In North Pacific

Jun 06, 2025 -

New York Rangers Add David Quinn And Joe Sacco To Coaching Staff

Jun 06, 2025

New York Rangers Add David Quinn And Joe Sacco To Coaching Staff

Jun 06, 2025 -

Why Ibm Stock Is Falling A Deep Dive Into Current Market Trends

Jun 06, 2025

Why Ibm Stock Is Falling A Deep Dive Into Current Market Trends

Jun 06, 2025 -

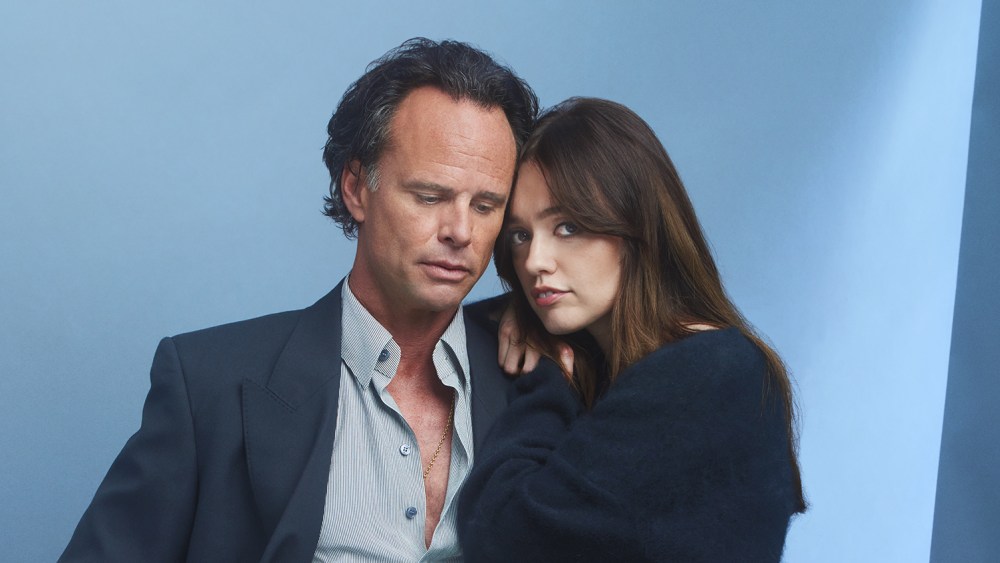

White Lotus Stars Address Fan Speculation Goggins And Wood On Instagram Unfollow And Cut Scene

Jun 06, 2025

White Lotus Stars Address Fan Speculation Goggins And Wood On Instagram Unfollow And Cut Scene

Jun 06, 2025

Latest Posts

-

Dallas Stars Fire Peter De Boer Following Disappointing Playoffs

Jun 06, 2025

Dallas Stars Fire Peter De Boer Following Disappointing Playoffs

Jun 06, 2025 -

Burka Ban Call Reform Party Chair Rejects Mps Suggestion

Jun 06, 2025

Burka Ban Call Reform Party Chair Rejects Mps Suggestion

Jun 06, 2025 -

Investigation Launched Into President Bidens Autopen Use And Recent Decisions Following Trumps Allegations

Jun 06, 2025

Investigation Launched Into President Bidens Autopen Use And Recent Decisions Following Trumps Allegations

Jun 06, 2025 -

Longtime Friend Of Cassie Ventura To Take Stand In Combs Trial

Jun 06, 2025

Longtime Friend Of Cassie Ventura To Take Stand In Combs Trial

Jun 06, 2025 -

Israeli American Hostages Killed In Gaza Joint Military Operation Recovery

Jun 06, 2025

Israeli American Hostages Killed In Gaza Joint Military Operation Recovery

Jun 06, 2025