Rome Trip For Regulators: Corporate Funding Under Scrutiny

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rome Trip for Regulators: Corporate Funding Under Scrutiny

A high-profile meeting in Rome has sparked intense debate over corporate funding and its influence on regulatory decisions. The gathering, attended by key regulators from across Europe and North America, has thrown a spotlight on the opaque nature of corporate funding for regulatory bodies and the potential for conflicts of interest. This secretive meeting, held amidst the stunning backdrop of the Italian capital, has raised serious questions about transparency and accountability within the regulatory landscape.

<h3>Concerns over Corporate Influence</h3>

The undisclosed nature of the Rome meeting has fueled concerns among transparency advocates. Critics argue that such secretive gatherings create an environment ripe for undue corporate influence on regulatory decisions. This is particularly concerning given the increasing complexity of global financial markets and the crucial role regulators play in maintaining stability. The lack of public information regarding attendees, the meeting's agenda, and the outcomes has led to calls for greater transparency and stricter regulations governing interactions between regulators and corporations.

<h3>The Need for Greater Transparency</h3>

The current system, critics contend, lacks sufficient safeguards against corporate lobbying and potential conflicts of interest. Many believe that the current regulatory framework needs a significant overhaul to ensure fairness and prevent corporate influence from undermining the integrity of regulatory decisions. This includes stricter disclosure requirements for corporate funding of regulatory bodies and greater public oversight of their activities. Several leading experts have called for independent audits of regulatory agencies to ensure compliance with ethical standards and to identify any potential conflicts of interest.

<h3>Increased Scrutiny of Regulatory Funding</h3>

This Rome meeting isn't an isolated incident. Increasingly, the funding of regulatory bodies is coming under intense scrutiny. The debate extends beyond simply questioning the source of funding; it also delves into the potential impact of funding on regulatory decisions. Are regulators subtly influenced by the financial interests of their funders? This question has prompted calls for greater independence for regulatory bodies and a complete reassessment of their funding models.

<h3>Potential Solutions and Future Outlook</h3>

Several solutions have been proposed to address these concerns. These include:

- Increased transparency: Public disclosure of all funding sources for regulatory bodies.

- Independent oversight: Establishment of independent bodies to monitor and audit regulatory agencies.

- Stricter conflict-of-interest rules: Implementation of robust rules to prevent conflicts of interest between regulators and corporations.

- Diversification of funding sources: Moving away from reliance on corporate funding towards more public or diversified funding models.

The Rome meeting serves as a crucial wake-up call for regulatory reform. The lack of transparency surrounding the event underscores the urgent need for greater accountability and oversight within the regulatory landscape. The ongoing debate promises to reshape how we view corporate influence on regulatory decisions, pushing for a more transparent and equitable system for the future. Further investigation and public discourse are vital to ensuring a regulatory system that serves the public interest, not private corporate agendas. We will continue to monitor this developing story and provide updates as they become available. Stay tuned for further analysis and developments in this crucial area of financial regulation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rome Trip For Regulators: Corporate Funding Under Scrutiny. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

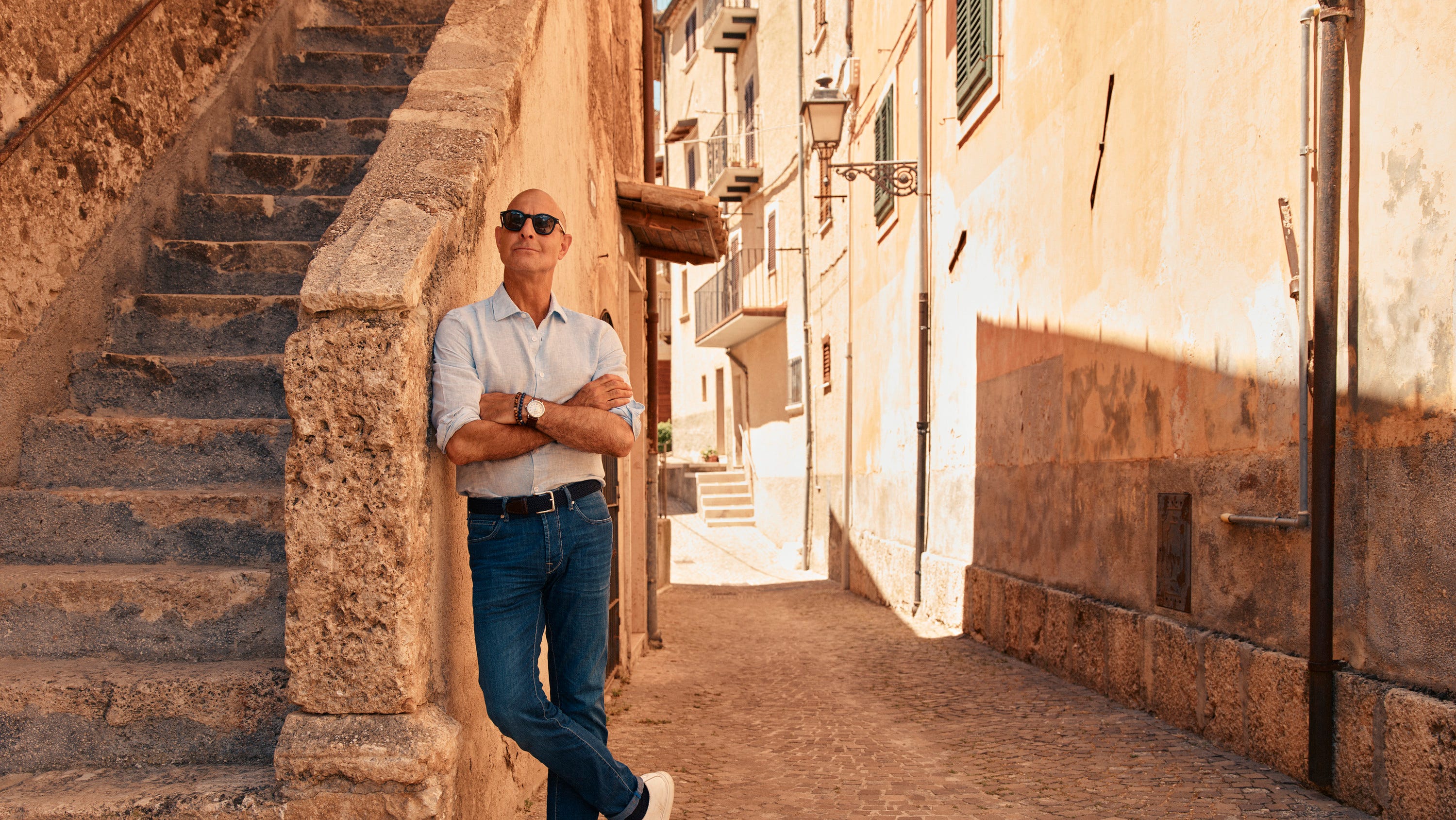

Nat Geos New Series Stanley Tucci Explores Italys Gastronomic Landscape

May 17, 2025

Nat Geos New Series Stanley Tucci Explores Italys Gastronomic Landscape

May 17, 2025 -

Bella Culley Billingham Teen Arrested In Georgia For Drug Offenses

May 17, 2025

Bella Culley Billingham Teen Arrested In Georgia For Drug Offenses

May 17, 2025 -

Uk Economy Shows Fastest Growth But Starmer Under Pressure Following Albania Controversy

May 17, 2025

Uk Economy Shows Fastest Growth But Starmer Under Pressure Following Albania Controversy

May 17, 2025 -

Game 5 Recap Dallas Stars Offense Stalls Against Winnipeg Jets

May 17, 2025

Game 5 Recap Dallas Stars Offense Stalls Against Winnipeg Jets

May 17, 2025 -

Regulators Rome Travel A Closer Look At Industry Sponsorship

May 17, 2025

Regulators Rome Travel A Closer Look At Industry Sponsorship

May 17, 2025

Latest Posts

-

Nj Transit Strike Update Engineers On Strike Commuter Rail Halted

May 18, 2025

Nj Transit Strike Update Engineers On Strike Commuter Rail Halted

May 18, 2025 -

Seven Unexpected Statistics Dominating The Mlbs Second Quarter

May 18, 2025

Seven Unexpected Statistics Dominating The Mlbs Second Quarter

May 18, 2025 -

Nat Geos Searching For Italy Stanley Tuccis Food Documentary

May 18, 2025

Nat Geos Searching For Italy Stanley Tuccis Food Documentary

May 18, 2025 -

Ohtanis Double Homer Performance Leads Dodgers To Dominant Win Against Athletics

May 18, 2025

Ohtanis Double Homer Performance Leads Dodgers To Dominant Win Against Athletics

May 18, 2025 -

Victoria Cross Recipient Ben Roberts Smith Defamation Case Appeal Dismissed

May 18, 2025

Victoria Cross Recipient Ben Roberts Smith Defamation Case Appeal Dismissed

May 18, 2025