S&P 500, Dow, And Nasdaq Rise: Market Resilience Amidst Moody's Credit Rating Action

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500, Dow, and Nasdaq Rise: Market Resilience Amidst Moody's Credit Rating Action

Wall Street defies expectations, showcasing surprising strength in the face of Moody's downgrade.

The US stock market defied expectations on Tuesday, with major indices staging a robust rally despite Moody's Investors Service downgrading the credit rating of several US banks and placing others on review for potential downgrades. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all closed higher, demonstrating a surprising resilience in the face of this significant credit rating action.

This unexpected market performance raises questions about the current state of the economy and investor sentiment. While Moody's cited concerns about the rising credit risk within the US banking sector, driven partly by increasing interest rates and persistent inflation, the market’s reaction suggests a more nuanced view.

Moody's Downgrade: A Deeper Dive

Moody's downgrade primarily targeted smaller and mid-sized US banks, citing vulnerabilities in their profitability and exposure to potential losses from commercial real estate. The agency also placed larger banks under review, signifying a potential for further credit rating adjustments in the near future. This action sent ripples through the financial sector, prompting concerns about potential contagion and a broader economic slowdown. You can find more details on Moody's rationale on their official website [link to Moody's website].

Market Resilience: Why the Unexpected Rally?

Several factors could explain the market's surprising strength:

-

Positive Earnings Reports: Stronger-than-expected earnings reports from several key companies may have boosted investor confidence, offsetting some of the negative sentiment stemming from Moody's action. Positive economic data releases also contributed to the overall positive market sentiment.

-

Market Anticipation: The market may have already priced in some of the risks associated with rising interest rates and potential banking sector vulnerabilities. Therefore, Moody's downgrade, while significant, may not have been entirely unexpected.

-

Federal Reserve's Actions: The Federal Reserve's proactive measures to stabilize the banking sector after the Silicon Valley Bank collapse earlier this year might have instilled a degree of confidence among investors. The ongoing management of interest rate hikes also plays a crucial role in market stability.

-

Bargain Hunting: Some investors may have viewed the dip as a buying opportunity, capitalizing on potentially undervalued stocks.

What Lies Ahead?

While Tuesday's rally provides a temporary reprieve, the long-term impact of Moody's downgrade remains uncertain. The coming weeks will be crucial in observing the market's response to potential further credit rating actions and the overall economic climate. Investors should continue to monitor key economic indicators, such as inflation and interest rates, for clues about the future direction of the market. Furthermore, keeping an eye on the performance of the banking sector will be critical in assessing the overall health of the economy.

Conclusion: Navigating Uncertainty

The recent market performance highlights the complexities and inherent uncertainties of the financial markets. While the rally offers some short-term reassurance, it is essential to approach the situation with caution and maintain a long-term investment perspective. Diversification remains a key strategy for managing risk in a dynamic and unpredictable market. Consult with a financial advisor to assess your individual risk tolerance and develop an investment strategy that aligns with your financial goals.

Keywords: S&P 500, Dow Jones, Nasdaq, Moody's, credit rating, stock market, market rally, US economy, banking sector, interest rates, inflation, investment strategy, financial markets, economic indicators.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500, Dow, And Nasdaq Rise: Market Resilience Amidst Moody's Credit Rating Action. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Understanding Femicide A Deep Dive Into The Causes And Prevention Strategies

May 21, 2025

Understanding Femicide A Deep Dive Into The Causes And Prevention Strategies

May 21, 2025 -

Why Cant You Kill Animals In Assassins Creed Valhalla Ubisofts Response

May 21, 2025

Why Cant You Kill Animals In Assassins Creed Valhalla Ubisofts Response

May 21, 2025 -

Emotional Reunion Parents Describe Their Sons Release From Captivity

May 21, 2025

Emotional Reunion Parents Describe Their Sons Release From Captivity

May 21, 2025 -

Water Voles In Wales A Fight For Survival With A Glittering Solution

May 21, 2025

Water Voles In Wales A Fight For Survival With A Glittering Solution

May 21, 2025 -

Pilotless Lufthansa Flight Co Pilots Fainting Triggers Safety Concerns

May 21, 2025

Pilotless Lufthansa Flight Co Pilots Fainting Triggers Safety Concerns

May 21, 2025

Latest Posts

-

Ny Ag James Trumps Legal Troubles And My Doj Investigation

May 21, 2025

Ny Ag James Trumps Legal Troubles And My Doj Investigation

May 21, 2025 -

Paedophile Parental Rights Law Change Faces Intense Scrutiny After Familys Public Condemnation

May 21, 2025

Paedophile Parental Rights Law Change Faces Intense Scrutiny After Familys Public Condemnation

May 21, 2025 -

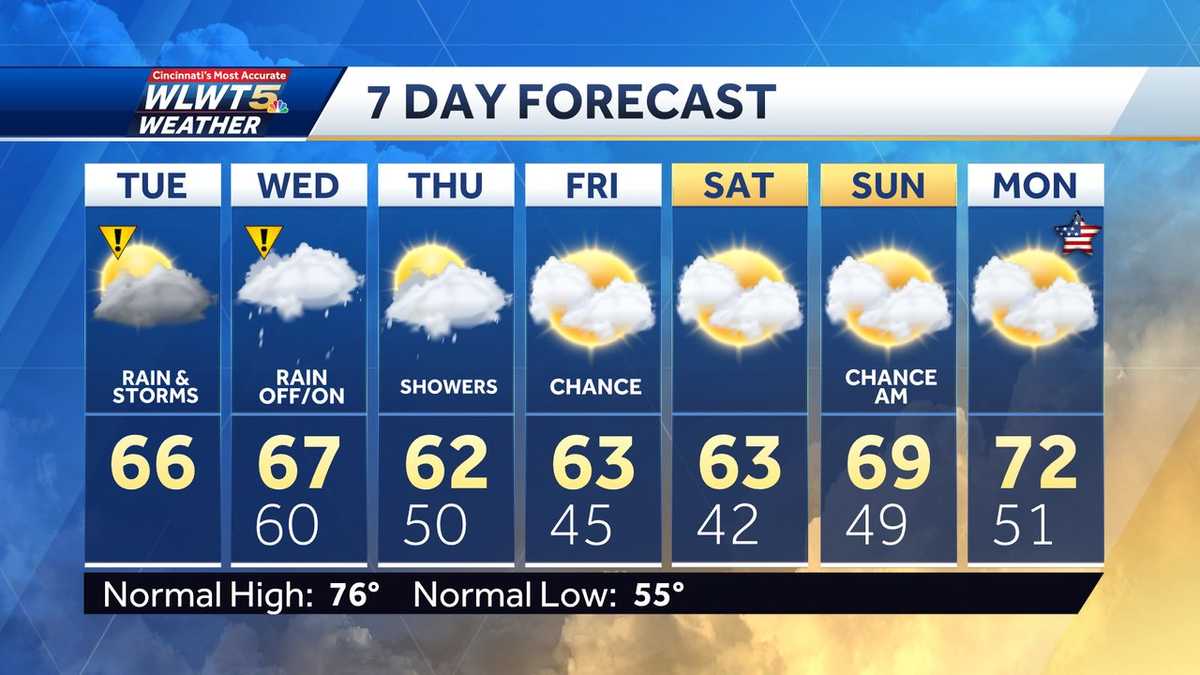

Temperature Drop And Lingering Rain Throughout The Week

May 21, 2025

Temperature Drop And Lingering Rain Throughout The Week

May 21, 2025 -

Overnight Rain And Storms Severe Weather Warning Issued For North Carolina

May 21, 2025

Overnight Rain And Storms Severe Weather Warning Issued For North Carolina

May 21, 2025 -

Protecting Children A Familys Fight Against The Proposed Changes To Paedophile Parental Rights

May 21, 2025

Protecting Children A Familys Fight Against The Proposed Changes To Paedophile Parental Rights

May 21, 2025