S&P 500, Dow, Nasdaq Rise: Positive Market Trend Persists Despite Moody's Action

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500, Dow, Nasdaq Rise: Positive Market Trend Persists Despite Moody's Downgrade

Wall Street rallies despite Moody's credit rating downgrade, defying expectations and signaling continued investor confidence in the US economy. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all closed higher on [Date of Publication], extending a recent streak of positive market performance. This surge comes as a surprise to many analysts, particularly in light of Moody's decision to downgrade the credit ratings of several small and mid-sized US banks.

The unexpected resilience of the market highlights several key factors influencing investor sentiment. While the Moody's action introduced a degree of uncertainty, other economic indicators and corporate earnings reports seem to be outweighing the negative impact.

Market Gains Across the Board

The S&P 500 gained [Percentage]% to close at [Closing Value], marking its [Nth] consecutive day of gains. The Dow Jones Industrial Average rose by [Percentage]% to [Closing Value], while the tech-heavy Nasdaq Composite added [Percentage]%, closing at [Closing Value]. This broad-based rally demonstrates a persistent positive market trend that extends beyond specific sectors.

Several key sectors drove the upward momentum. Technology stocks, which have been a focal point of recent market volatility, showed significant strength, contributing significantly to the Nasdaq's gains. Furthermore, the energy and financial sectors also performed well, reflecting positive developments in their respective industries. This diversification of positive performance underscores a robust overall market sentiment.

Moody's Downgrade and Market Reaction

Moody's recent downgrade of the credit ratings of several US banks, citing concerns about the rising interest rate environment and potential for further losses, initially sparked fears of a broader market correction. However, the market's response suggests that investors may be viewing this action as a contained issue, rather than a systemic threat to the financial system.

This measured reaction could be attributed to several factors. Firstly, the banks affected by the downgrade represent a relatively small portion of the overall US banking sector. Secondly, the Federal Reserve's recent actions to strengthen bank regulations may be contributing to investor confidence. Finally, the continued strength of the US economy, as evidenced by recent economic data, may be overriding concerns about the banking sector's creditworthiness.

Factors Contributing to the Positive Trend

Beyond the Moody's downgrade, several other factors are likely contributing to the positive market trend:

- Strong Corporate Earnings: Many companies have recently reported better-than-expected earnings, boosting investor confidence.

- Resilient Consumer Spending: Despite inflation, consumer spending remains relatively strong, indicating a robust economy.

- Federal Reserve Policy: While interest rate hikes have presented challenges, the Fed's measured approach is perceived by some as helping to navigate the economic landscape without causing a significant downturn.

What to Expect Going Forward

The long-term outlook remains uncertain. While the current market rally is encouraging, investors should remain cautious. Geopolitical risks, inflation concerns, and further potential economic headwinds could influence market performance in the coming weeks and months. Continuous monitoring of economic indicators and corporate performance will be critical for informed investment decisions.

Learn more: Stay up-to-date on market trends by following reputable financial news sources and consulting with a qualified financial advisor. Understanding the complexities of the market and diversifying your portfolio are crucial strategies for navigating economic uncertainties. [Link to a relevant financial news source or educational resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500, Dow, Nasdaq Rise: Positive Market Trend Persists Despite Moody's Action. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stream The Intense Wwi Film With Daniel Craig Cillian Murphy And Tom Hardy Today

May 21, 2025

Stream The Intense Wwi Film With Daniel Craig Cillian Murphy And Tom Hardy Today

May 21, 2025 -

Jamie Lee Curtis Opens Up About Her Bond With Lindsay Lohan Years After Freaky Friday Exclusive

May 21, 2025

Jamie Lee Curtis Opens Up About Her Bond With Lindsay Lohan Years After Freaky Friday Exclusive

May 21, 2025 -

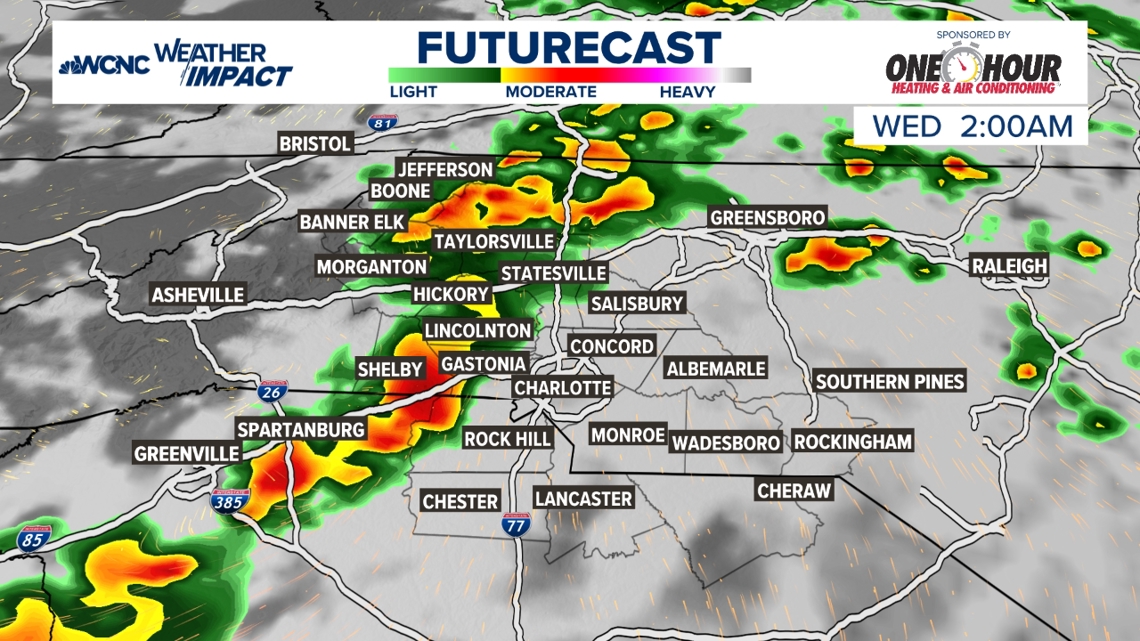

Tuesday Night Weather Slight Chance Of Intense Storms In Isolated Areas

May 21, 2025

Tuesday Night Weather Slight Chance Of Intense Storms In Isolated Areas

May 21, 2025 -

Costa Rica Prison Ingenious Cats Drug Smuggling Attempt Foiled

May 21, 2025

Costa Rica Prison Ingenious Cats Drug Smuggling Attempt Foiled

May 21, 2025 -

Peaky Blinders Returns Creator Reveals New Series And A Pivotal Twist

May 21, 2025

Peaky Blinders Returns Creator Reveals New Series And A Pivotal Twist

May 21, 2025

Latest Posts

-

League Of Legends 2025 Hall Of Famer Revealed Will The Skin Cost 430

May 21, 2025

League Of Legends 2025 Hall Of Famer Revealed Will The Skin Cost 430

May 21, 2025 -

Job Opportunities At Ubisoft Milan Work On Upcoming Rayman Title

May 21, 2025

Job Opportunities At Ubisoft Milan Work On Upcoming Rayman Title

May 21, 2025 -

Assassins Creed Shadows Ubisoft Addresses Player Concerns About Animal Killing

May 21, 2025

Assassins Creed Shadows Ubisoft Addresses Player Concerns About Animal Killing

May 21, 2025 -

Manhunt Intensifies Fourth New Orleans Inmate Captured After Da Staff Flee

May 21, 2025

Manhunt Intensifies Fourth New Orleans Inmate Captured After Da Staff Flee

May 21, 2025 -

Post Office Data Breach Victims Compensation Details Announced

May 21, 2025

Post Office Data Breach Victims Compensation Details Announced

May 21, 2025