Satoshi-Era Whale Dumps $9 Billion In Bitcoin: Market Impact Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Satoshi-Era Whale Dumps $9 Billion in Bitcoin: Market Impact Analysis

A significant tremor shook the cryptocurrency market recently as a Bitcoin whale, holding coins since the cryptocurrency's infancy, offloaded a staggering $9 billion worth of BTC. This monumental sell-off has sent ripples throughout the market, prompting questions about the future of Bitcoin's price and the overall health of the cryptocurrency ecosystem. This unprecedented event demands a detailed analysis of its potential impact.

The Magnitude of the Dump:

The sheer scale of the transaction is unprecedented. Sources tracking on-chain activity identified the movement of approximately 120,000 Bitcoin from wallets believed to belong to an early adopter – a so-called "Satoshi-era" whale. These coins, acquired during Bitcoin's nascent stages, represent a significant portion of the total Bitcoin supply and were likely acquired at incredibly low prices, resulting in a substantial profit for the seller. The timing of the sale, coupled with the already volatile market conditions, amplified the impact significantly.

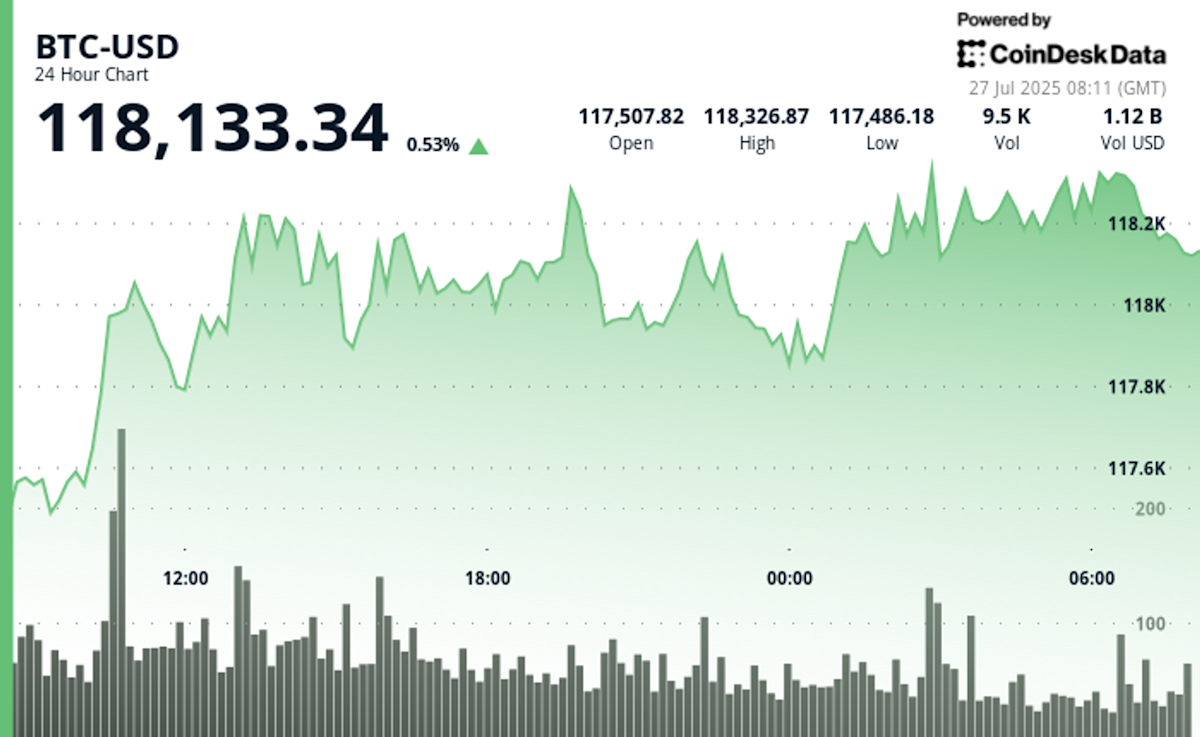

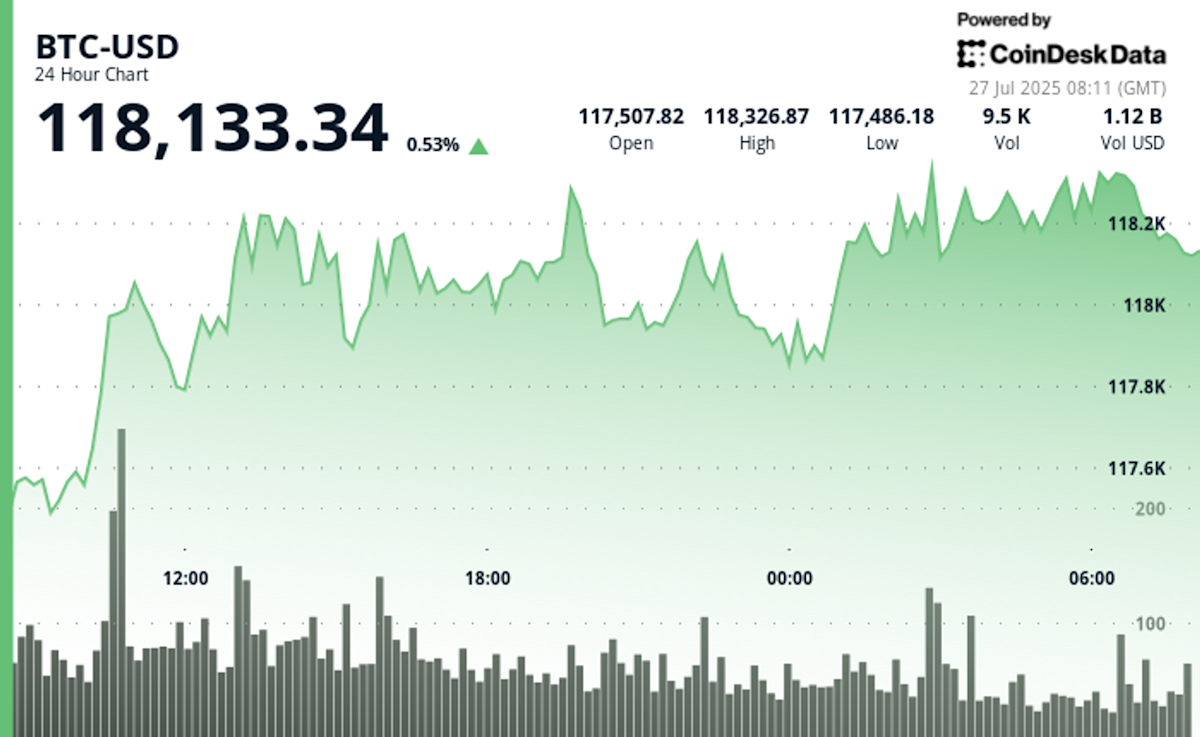

Immediate Market Reactions:

The immediate reaction was a sharp dip in Bitcoin's price. While the exact percentage drop varied across exchanges, most experienced a noticeable decline, wiping millions off the market capitalization. This rapid sell-off triggered a wave of fear among less experienced investors, contributing to further selling pressure and increasing market volatility. Many altcoins also suffered correlated losses, highlighting the interconnectedness of the crypto market.

Potential Long-Term Impacts:

The long-term impact of this massive sell-off remains to be seen. Several key factors will influence the trajectory of Bitcoin's price and the overall market sentiment:

-

Market Absorption: The ability of the market to absorb this large volume of Bitcoin without further significant price drops will be crucial. If large institutional investors step in to purchase the dumped coins, the impact could be mitigated. However, continued selling pressure could lead to prolonged bearish sentiment.

-

Regulatory Uncertainty: The ongoing regulatory scrutiny of the cryptocurrency market worldwide plays a significant role. Increased regulatory pressure could exacerbate the negative impact of the whale's actions. Conversely, clearer and more favorable regulations might help stabilize the market.

-

Investor Sentiment: The psychological impact on investor confidence is paramount. A sustained period of negative sentiment could lead to a prolonged bear market, while a swift recovery in confidence could limit the long-term damage.

-

Technological Developments: Ongoing developments within the Bitcoin network, such as the Lightning Network's adoption and scalability improvements, might ultimately offset the negative effects of this event. These advancements could attract new investors and strengthen the overall ecosystem.

Analyzing the Whale's Motivation:

Determining the precise motivation behind such a significant sell-off is challenging. Several theories exist, including:

- Profit-Taking: The simplest explanation is that the whale decided to capitalize on Bitcoin's historical high, securing substantial profits.

- Tax Obligations: The seller might be facing significant tax obligations, necessitating the liquidation of assets.

- Risk Mitigation: The whale may be seeking to diversify their portfolio or reduce their exposure to the inherent volatility of the cryptocurrency market.

Conclusion:

The $9 billion Bitcoin dump by a Satoshi-era whale marks a significant event in the history of cryptocurrency. While the immediate impact was a sharp price drop and increased market volatility, the long-term effects depend on various interacting factors. Close monitoring of market sentiment, regulatory developments, and Bitcoin's technological advancements is crucial for navigating this period of uncertainty. The situation underscores the importance of responsible investing and a thorough understanding of the inherent risks associated with the cryptocurrency market. Investors should remain informed and adapt their strategies accordingly.

Keywords: Bitcoin, Whale, Satoshi, Cryptocurrency, Market Analysis, Bitcoin Price, Crypto Market, Volatility, Bitcoin Dump, On-Chain Activity, Regulatory Uncertainty, Investor Sentiment, Lightning Network, Bear Market, Bull Market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Satoshi-Era Whale Dumps $9 Billion In Bitcoin: Market Impact Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2026 Audible Release De Von Franklins Be True Explores His Personal Transformation

Jul 30, 2025

2026 Audible Release De Von Franklins Be True Explores His Personal Transformation

Jul 30, 2025 -

Sources Confirm Baker Mayfields Buccaneers Contract Amended

Jul 30, 2025

Sources Confirm Baker Mayfields Buccaneers Contract Amended

Jul 30, 2025 -

Ueniversite Tercihinde Karar Verme Suereci Oenemli Ipuclari

Jul 30, 2025

Ueniversite Tercihinde Karar Verme Suereci Oenemli Ipuclari

Jul 30, 2025 -

Baker Mayfield Buccaneers Guaranteed 2026 Contract Details Revealed

Jul 30, 2025

Baker Mayfield Buccaneers Guaranteed 2026 Contract Details Revealed

Jul 30, 2025 -

El Mensaje De Andrea Legarreta Que Censuro Televisa En El Programa Hoy

Jul 30, 2025

El Mensaje De Andrea Legarreta Que Censuro Televisa En El Programa Hoy

Jul 30, 2025

Latest Posts

-

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025 -

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025 -

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025 -

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025 -

Starbucks Ends Six Year Gen Z Initiative A Return To Human Interaction

Aug 01, 2025

Starbucks Ends Six Year Gen Z Initiative A Return To Human Interaction

Aug 01, 2025