Saving For College: 9 Effective Strategies For Parents

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Saving for College: 9 Effective Strategies for Parents

The soaring cost of higher education is a major concern for parents across the nation. Tuition fees, room and board, and other expenses can quickly add up, leaving families feeling overwhelmed. But don't despair! With careful planning and strategic saving, you can significantly ease the financial burden of college. This article outlines nine effective strategies to help parents successfully save for their children's college education.

1. Start Early: The Power of Compound Interest

The earlier you begin saving, the more time your money has to grow through the magic of compound interest. Even small, consistent contributions can accumulate significantly over time. Consider starting a 529 plan, a tax-advantaged savings plan specifically designed for education expenses, as soon as your child is born. Learn more about the benefits of .

2. Set Realistic Goals and Create a Budget:

Before diving into saving, establish clear financial goals. Determine how much college will cost (consider using online college cost calculators), then create a realistic budget that incorporates your savings goals without compromising your current financial stability. Track your expenses meticulously to identify areas where you can cut back and allocate more funds towards college savings.

3. Explore Different Savings Vehicles:

Beyond 529 plans, explore other options like Roth IRAs (if eligible), high-yield savings accounts, and even custodial accounts. Each option offers different benefits and tax implications; consult with a financial advisor to determine the best approach for your family's unique financial situation. Understanding the nuances of is crucial for effective long-term planning.

4. Automate Your Savings:

One of the most effective ways to ensure consistent saving is through automation. Set up automatic transfers from your checking account to your college savings account on a regular basis (weekly or monthly). This approach removes the temptation to spend the money and builds a steady stream of contributions.

5. Take Advantage of Employer Matching Programs:

Many employers offer matching contributions to 401(k) or other retirement plans. If your employer offers this benefit, maximize it! This essentially provides free money towards your retirement – freeing up other funds for your child’s college fund.

6. Explore Scholarships and Grants:

Don't underestimate the power of financial aid! Start researching scholarships and grants early in your child's high school career. Numerous organizations offer financial assistance based on merit, need, or specific criteria. Websites like and are excellent resources.

7. Consider Part-Time Jobs or Side Hustles:

Supplement your savings with extra income. Parents can explore part-time jobs or freelance opportunities to accelerate their savings progress. Even small contributions add up significantly over time.

8. Involve Your Child in the Process:

Engage your child in the college savings process. Explain the importance of saving and show them how their future education is being funded. This fosters financial literacy and encourages responsible spending habits.

9. Review and Adjust Your Plan Regularly:

Your financial situation and college costs can change over time. Regularly review your savings plan, adjusting it as needed to ensure it remains aligned with your goals. Consider consulting with a financial advisor periodically for personalized guidance.

Conclusion:

Saving for college requires dedication, planning, and consistent effort. By implementing these nine effective strategies, parents can significantly increase their chances of successfully funding their child's higher education without overwhelming their finances. Remember, starting early and staying consistent are key to achieving your college savings goals. Start planning today and secure your child's future!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Saving For College: 9 Effective Strategies For Parents. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ukraines Drone Offensive A New Phase In The Conflict

Jun 03, 2025

Ukraines Drone Offensive A New Phase In The Conflict

Jun 03, 2025 -

Remembering John Brenkus The Impact Of The Sports Science Host

Jun 03, 2025

Remembering John Brenkus The Impact Of The Sports Science Host

Jun 03, 2025 -

Will Momentum Carry Mamdani To Victory Analyzing The Democratic Mayoral Race With Harry Siegel

Jun 03, 2025

Will Momentum Carry Mamdani To Victory Analyzing The Democratic Mayoral Race With Harry Siegel

Jun 03, 2025 -

Top 4 Fashion Icons Of June 2025 Showstopping Style

Jun 03, 2025

Top 4 Fashion Icons Of June 2025 Showstopping Style

Jun 03, 2025 -

Complete Nyt Spelling Bee Solution Tuesday June 3rd

Jun 03, 2025

Complete Nyt Spelling Bee Solution Tuesday June 3rd

Jun 03, 2025

Latest Posts

-

Las Cruces Natural Beauty And Delicious Food Await

Aug 03, 2025

Las Cruces Natural Beauty And Delicious Food Await

Aug 03, 2025 -

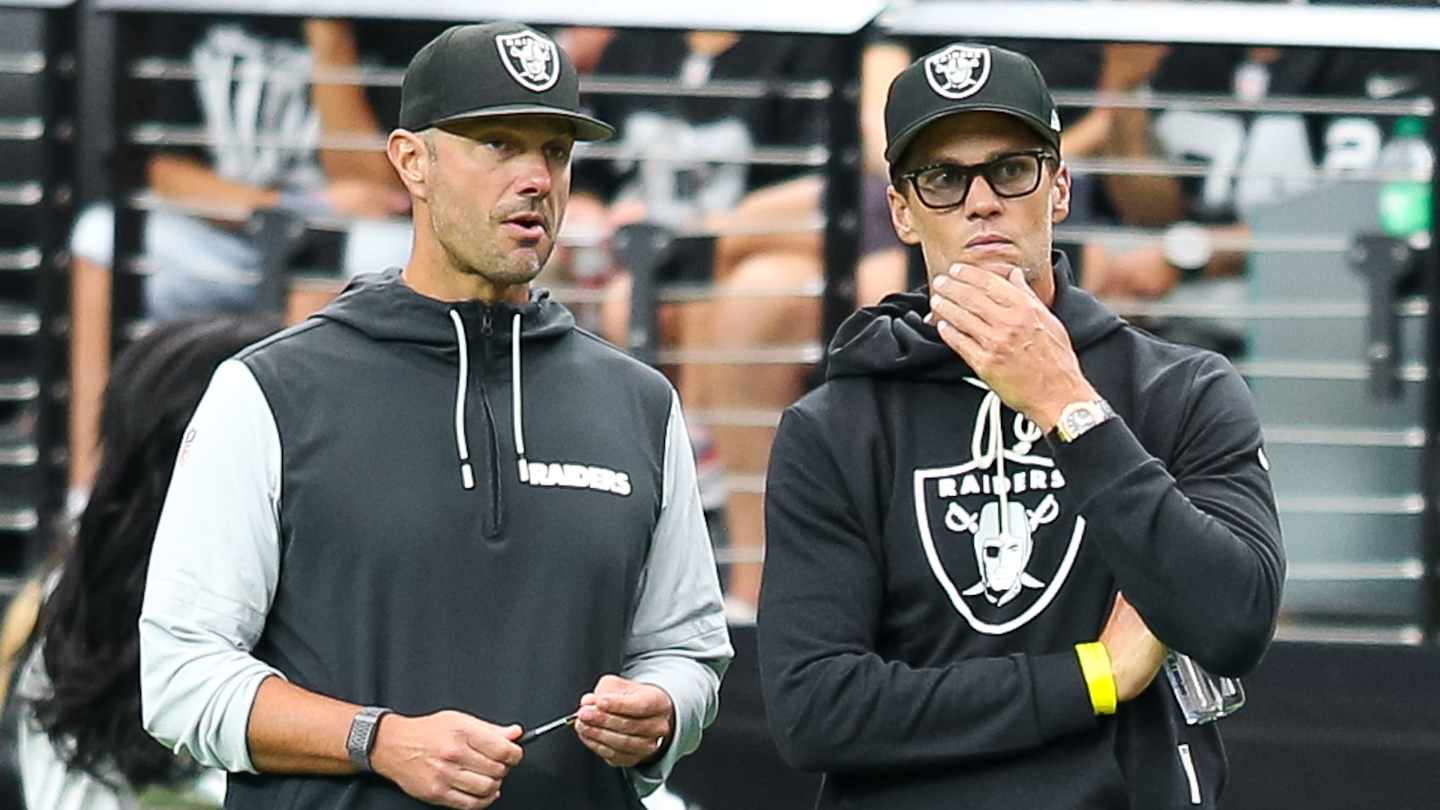

Post Scrimmage Breakdown Assessing The Las Vegas Raiders Performance

Aug 03, 2025

Post Scrimmage Breakdown Assessing The Las Vegas Raiders Performance

Aug 03, 2025 -

Health Scare At Stathern Lodge Criminal Charges Laid After Children Fall Ill At Summer Camp

Aug 03, 2025

Health Scare At Stathern Lodge Criminal Charges Laid After Children Fall Ill At Summer Camp

Aug 03, 2025 -

Vatican Pizza Delivery An American Story Cnn News

Aug 03, 2025

Vatican Pizza Delivery An American Story Cnn News

Aug 03, 2025 -

Trump Orders Nuclear Submarine Repositioning After Provocative Russian Remarks

Aug 03, 2025

Trump Orders Nuclear Submarine Repositioning After Provocative Russian Remarks

Aug 03, 2025