SBET Stock: Examining The Market Forces Behind Its Explosive 1000% Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SBET Stock: Examining the Market Forces Behind its Explosive 1000% Growth

The small-cap stock market has witnessed a meteoric rise of SBET, a company whose share price has skyrocketed by an astonishing 1000% in recent months. This unprecedented growth has captivated investors and sparked intense speculation about the underlying forces driving this remarkable surge. But is this a sustainable trend, or is SBET a classic case of a speculative bubble? Let's delve into the market dynamics fueling this explosive growth and explore the potential risks and rewards for investors.

Understanding SBET's Business Model: Before analyzing the market forces, it's crucial to understand SBET's core business. [Insert a concise description of SBET's business model here. Include relevant keywords like the company's industry, products/services, target market, and competitive advantage. If possible, link to their official website.] This understanding will provide context for the subsequent analysis of the market factors influencing its stock price.

Key Factors Driving SBET's 1000% Growth: Several interconnected factors contribute to SBET's explosive growth:

1. Increased Investor Interest and Speculative Trading: The surge in SBET's stock price is partly attributed to increased investor interest, amplified by social media discussions and online forums. This heightened interest, fueled by speculation and potentially driven by "meme stock" dynamics, has led to a significant increase in trading volume. [Link to a reputable financial news source discussing meme stock trends]. This speculative element, however, presents inherent risks.

2. Positive Financial Performance and Growth Prospects: While speculation plays a role, SBET's remarkable growth is not solely based on hype. The company has likely demonstrated strong financial performance, perhaps exceeding expectations in recent quarters. [Include specific financial data – revenue growth, earnings, etc. – if available, citing the source]. Furthermore, positive future growth projections, based on innovative products, market expansion, or strategic partnerships, could further bolster investor confidence.

3. Industry Tailwinds and Favorable Market Conditions: The broader economic environment and industry trends also play a significant part. [Discuss relevant industry trends, market conditions, and regulatory changes impacting SBET's sector. For example, are there positive shifts in consumer demand, technological advancements, or government policies benefiting the company?]. These external factors can significantly impact a company's growth trajectory.

4. Strategic Acquisitions and Partnerships: Has SBET undertaken any significant acquisitions or forged key partnerships recently? Such strategic moves can unlock new revenue streams, expand market reach, and boost investor sentiment. [Detail any such strategic initiatives if available].

Risks and Considerations for Investors:

Despite the impressive growth, investors should remain cautious. The explosive growth could indicate a speculative bubble, prone to rapid corrections. Key risks include:

- Overvaluation: The current stock price may not accurately reflect SBET's intrinsic value.

- Market Volatility: Small-cap stocks are inherently more volatile than larger, established companies.

- Dependence on Speculation: The substantial price increase is partly driven by speculation, making the stock vulnerable to shifts in market sentiment.

- Competition: Increased competition within the industry could impact SBET's future growth.

Conclusion:

SBET's 1000% growth is a compelling story, but it's crucial to approach it with a balanced perspective. While strong financial performance and positive industry trends contribute to this impressive growth, the significant speculative component warrants caution. Investors should conduct thorough due diligence, carefully consider the inherent risks, and diversify their portfolios before investing in SBET or any other small-cap stock exhibiting such rapid growth. Remember, past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you could lose money. Always conduct thorough research and seek professional advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SBET Stock: Examining The Market Forces Behind Its Explosive 1000% Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Como Organizar Uma Festa Portuguesa Um Guia Pratico E Detalhado

May 30, 2025

Como Organizar Uma Festa Portuguesa Um Guia Pratico E Detalhado

May 30, 2025 -

Sheinelle Jones Husband Uche Ojeh Passes Away Todays Announcement

May 30, 2025

Sheinelle Jones Husband Uche Ojeh Passes Away Todays Announcement

May 30, 2025 -

Viral Video Passengers Struggle To Catch Birds On Delta Flight

May 30, 2025

Viral Video Passengers Struggle To Catch Birds On Delta Flight

May 30, 2025 -

Receitas E Ideias Para Uma Festa Portuguesa Tradicional Celebre A Cultura Lusa

May 30, 2025

Receitas E Ideias Para Uma Festa Portuguesa Tradicional Celebre A Cultura Lusa

May 30, 2025 -

Planning Your Trip 2025 Detroit Grand Prix Events Weather And Roadblocks

May 30, 2025

Planning Your Trip 2025 Detroit Grand Prix Events Weather And Roadblocks

May 30, 2025

Latest Posts

-

Court Case Paul Doyle Charged In Liverpool Fc Parade Incident

May 31, 2025

Court Case Paul Doyle Charged In Liverpool Fc Parade Incident

May 31, 2025 -

The Wests Unintended Role In Financing Russias Aggression Against Ukraine

May 31, 2025

The Wests Unintended Role In Financing Russias Aggression Against Ukraine

May 31, 2025 -

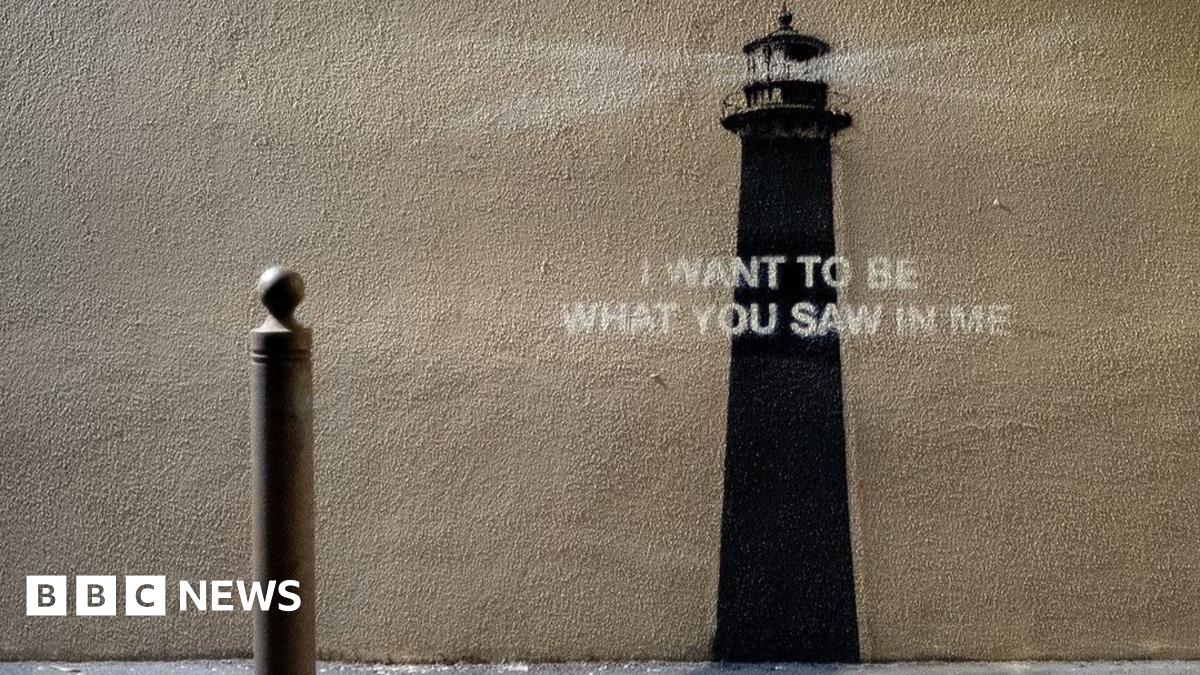

The Latest Banksy A Location Riddle

May 31, 2025

The Latest Banksy A Location Riddle

May 31, 2025 -

Rhode Skin Acquired E L F Cosmetics Billion Dollar Bet On Celebrity Skincare

May 31, 2025

Rhode Skin Acquired E L F Cosmetics Billion Dollar Bet On Celebrity Skincare

May 31, 2025 -

Wilkes Barre Water Main Installation Road Work Ahead

May 31, 2025

Wilkes Barre Water Main Installation Road Work Ahead

May 31, 2025