SBET Stock's 1000% Jump: Investment Implications And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SBET Stock's 1000% Jump: Investment Implications and Future Outlook

SBET stock has experienced a meteoric rise, soaring over 1000% in recent months. This unprecedented surge has captivated investors and sparked intense speculation about the company's future and the implications for those considering investing. But what fueled this dramatic increase, and is it a sustainable trend or a fleeting bubble? Let's delve into the details.

What Drove SBET's Astonishing Growth?

The dramatic increase in SBET's stock price isn't attributable to a single factor. Instead, a confluence of events and market dynamics contributed to this phenomenal growth. These include:

-

[Specific Company Announcement/Product Launch]: Mention a specific product launch, groundbreaking technology, or positive company announcement (e.g., a successful clinical trial, a major partnership, or a significant regulatory approval) that acted as a catalyst for the stock price surge. Be specific and cite sources. For example: "The release of their innovative AI-powered [product name] in Q3 2023 significantly boosted investor confidence, leading to a sharp increase in trading volume."

-

Increased Market Demand: Analyze the overall market conditions and the demand for the company's products or services. Is there a growing need for what SBET offers? Are there any macroeconomic factors contributing to the heightened demand? For instance: "The growing global demand for [relevant industry/product] has created a favorable environment for SBET, positioning them as a key player in the market."

-

Positive Analyst Ratings and Forecasts: Refer to any positive analyst reports or upgrades that influenced investor sentiment. Mention specific analysts or firms if possible, and link to relevant financial news sources. Example: "Several prominent analysts, including [Analyst Name] at [Financial Institution], have upgraded their rating on SBET stock, citing strong growth potential and a robust financial outlook."

-

Short Squeeze: Did a short squeeze contribute to the price jump? Explain this phenomenon clearly for readers who may be unfamiliar with it. Example: "A significant short position on SBET stock may have contributed to the rapid price increase as short sellers rushed to cover their positions, exacerbating the upward momentum."

Investment Implications and Risks:

While the 1000% jump is undeniably impressive, it's crucial to approach SBET stock with caution. Such dramatic growth often comes with inherent risks:

-

Overvaluation: A stock price can become significantly detached from its intrinsic value. Analyze whether SBET's current valuation is justified based on its fundamentals. Consider using metrics like Price-to-Earnings ratio (P/E) or Price-to-Sales ratio (P/S) to support your analysis.

-

Volatility: Expect significant price fluctuations in the future. The stock is likely to be highly volatile, meaning significant gains or losses are possible in short periods. This is especially true for stocks experiencing such rapid growth.

-

Market Corrections: The current market conditions may not be sustainable. A market correction could lead to a substantial drop in SBET's stock price.

Future Outlook: A Balanced Perspective

Predicting the future of any stock is inherently speculative. However, based on the information available, a balanced outlook on SBET's future might include:

-

Continued Growth Potential: If the company continues to execute its strategy successfully and the market demand remains strong, further growth is possible.

-

Consolidation Phase: After such a significant surge, a period of consolidation (a period of sideways price movement) is likely before any further substantial upward movement.

-

Risk of Correction: As mentioned earlier, a market correction or a negative event could lead to a significant price drop.

Conclusion: Due Diligence is Key

The 1000% jump in SBET stock presents a compelling narrative, but investors must conduct thorough due diligence before making any investment decisions. Understanding the factors driving the growth, assessing the risks involved, and developing a long-term investment strategy are crucial steps. This analysis should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.

(Note: Replace the bracketed information with specific details about SBET. Conduct thorough research using reputable financial news sources to gather accurate and up-to-date information.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SBET Stock's 1000% Jump: Investment Implications And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Against All Odds De Jongs Unbelievable Roland Garros Win Over Passaro

May 30, 2025

Against All Odds De Jongs Unbelievable Roland Garros Win Over Passaro

May 30, 2025 -

Fewer Buyers More Sellers A 12 Year Low In Buyer Demand Impacts Housing Market

May 30, 2025

Fewer Buyers More Sellers A 12 Year Low In Buyer Demand Impacts Housing Market

May 30, 2025 -

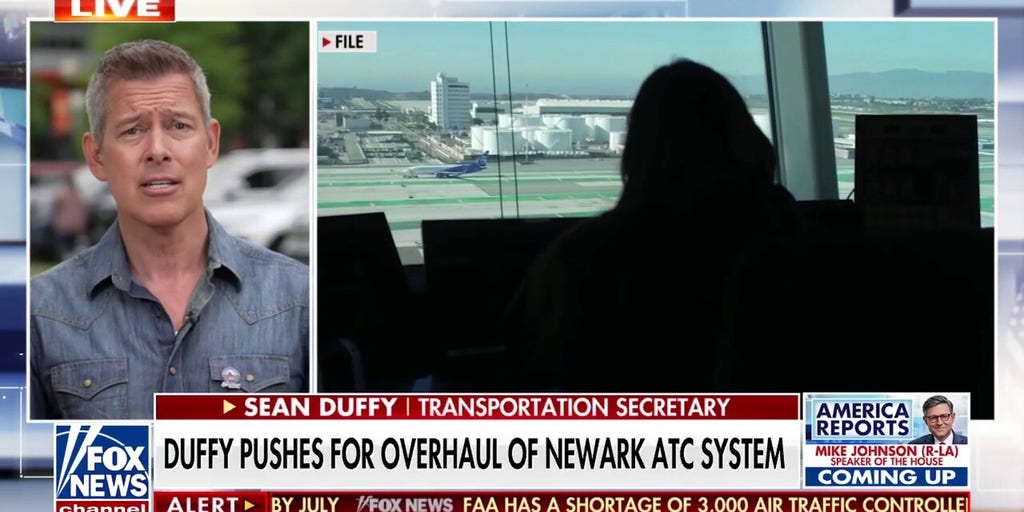

Newark Airport Slowdowns Sec Duffys Air Traffic Control Overhaul Push

May 30, 2025

Newark Airport Slowdowns Sec Duffys Air Traffic Control Overhaul Push

May 30, 2025 -

Ellen De Generess Television Legacy Understanding The End Of Her Popular Show

May 30, 2025

Ellen De Generess Television Legacy Understanding The End Of Her Popular Show

May 30, 2025 -

New Sanctions On Russia Trumps Anger At Putin Fuels Speculation

May 30, 2025

New Sanctions On Russia Trumps Anger At Putin Fuels Speculation

May 30, 2025

Latest Posts

-

Hegseth On Chinas Taiwan Strategy A Call To Arms For Asian Allies

Jun 02, 2025

Hegseth On Chinas Taiwan Strategy A Call To Arms For Asian Allies

Jun 02, 2025 -

Massive Pride Flag Kicks Off Philadelphias Pride Month Celebrations

Jun 02, 2025

Massive Pride Flag Kicks Off Philadelphias Pride Month Celebrations

Jun 02, 2025 -

Barcelona Qualifying Aston Martin Team Report Spanish Grand Prix

Jun 02, 2025

Barcelona Qualifying Aston Martin Team Report Spanish Grand Prix

Jun 02, 2025 -

Dinner Party Etiquette Ina Garten On Gift Giving Don Ts And Dos

Jun 02, 2025

Dinner Party Etiquette Ina Garten On Gift Giving Don Ts And Dos

Jun 02, 2025 -

Catania Port Disrupted Norwegian Epic Passengers Await Reboarding After Breakdown

Jun 02, 2025

Catania Port Disrupted Norwegian Epic Passengers Await Reboarding After Breakdown

Jun 02, 2025