SBET Stock's Meteoric Rise: Analyzing The Factors Contributing To Its 1000% Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SBET Stock's Meteoric Rise: Analyzing the Factors Contributing to its 1000% Growth

SBET stock has experienced an unprecedented surge, skyrocketing over 1000% in a remarkably short period. This phenomenal growth has captivated investors and sparked intense debate about the underlying factors driving this meteoric rise. While such dramatic increases always carry inherent risk, understanding the contributing elements can offer valuable insights for both seasoned investors and newcomers. This article delves into the key factors fueling SBET's astonishing performance.

What is SBET? (brief, factual description of the company and its business model - replace with accurate details)

Before analyzing the reasons behind SBET's growth, it's crucial to understand the company itself. SBET is a [Company Description - e.g., a technology company specializing in… a gaming company focused on… a biotech firm developing…]. Their core business model revolves around [brief explanation of business model]. This understanding provides context for the following analysis.

Key Factors Driving SBET's 1000% Growth:

Several interconnected factors have contributed to SBET's extraordinary performance:

1. Innovative Product/Service: SBET's success is largely attributed to its [Specific product/service name] which has disrupted the [Industry] sector. This [product/service description – e.g., innovative technology, groundbreaking approach, unique market offering] has resonated strongly with consumers, leading to significant market share gains.

2. Strong Market Demand: The company is operating within a rapidly expanding market segment characterized by high demand and limited competition. This favorable market environment has fueled significant revenue growth and provided a fertile ground for SBET’s expansion.

3. Strategic Partnerships and Acquisitions: SBET has demonstrated shrewd business acumen through strategic partnerships with key players in the [Industry] sector. These collaborations have opened new markets and enhanced the company's technological capabilities, boosting its overall growth trajectory. Furthermore, strategic acquisitions have allowed SBET to expand its product portfolio and solidify its market position.

4. Effective Marketing and Branding: The company has implemented a highly effective marketing strategy, successfully building a strong brand reputation and cultivating a loyal customer base. This robust brand recognition has translated into increased sales and brand loyalty, contributing significantly to the stock's growth.

5. Positive Financial Performance: Consistently strong financial results, including increasing revenue, expanding profit margins, and strong cash flow, have instilled investor confidence in SBET's long-term growth prospects. This positive performance narrative has been a major driver of the stock's price appreciation.

Risks Associated with High-Growth Stocks:

It's important to acknowledge that while SBET's growth is impressive, high-growth stocks often carry significant risks. These risks include:

- Overvaluation: The current stock price might not accurately reflect SBET's intrinsic value, leading to potential corrections.

- Market Volatility: The stock's price is susceptible to market fluctuations, and sudden downturns are possible.

- Competition: New competitors could emerge, challenging SBET's market dominance.

- Regulatory Changes: Changes in regulations could negatively impact SBET's operations.

Conclusion:

SBET's 1000% growth is a testament to the company's innovative approach, strong market position, and effective execution. However, investors should always conduct thorough due diligence and understand the inherent risks associated with such dramatic growth before making any investment decisions. Further research and consideration of market trends are crucial for a comprehensive understanding of SBET’s future trajectory. Remember to consult with a financial advisor before making any investment decisions.

(Optional) CTA: Learn more about SBET's latest financial reports by visiting [link to company website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SBET Stock's Meteoric Rise: Analyzing The Factors Contributing To Its 1000% Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Newark Airports Air Traffic Control System A Slower Than Expected Upgrade

May 30, 2025

Newark Airports Air Traffic Control System A Slower Than Expected Upgrade

May 30, 2025 -

Glacier Collapse In Switzerland Extensive Damage To Blatten

May 30, 2025

Glacier Collapse In Switzerland Extensive Damage To Blatten

May 30, 2025 -

New York Knicks Ending The Doldrums Pursuing Glory

May 30, 2025

New York Knicks Ending The Doldrums Pursuing Glory

May 30, 2025 -

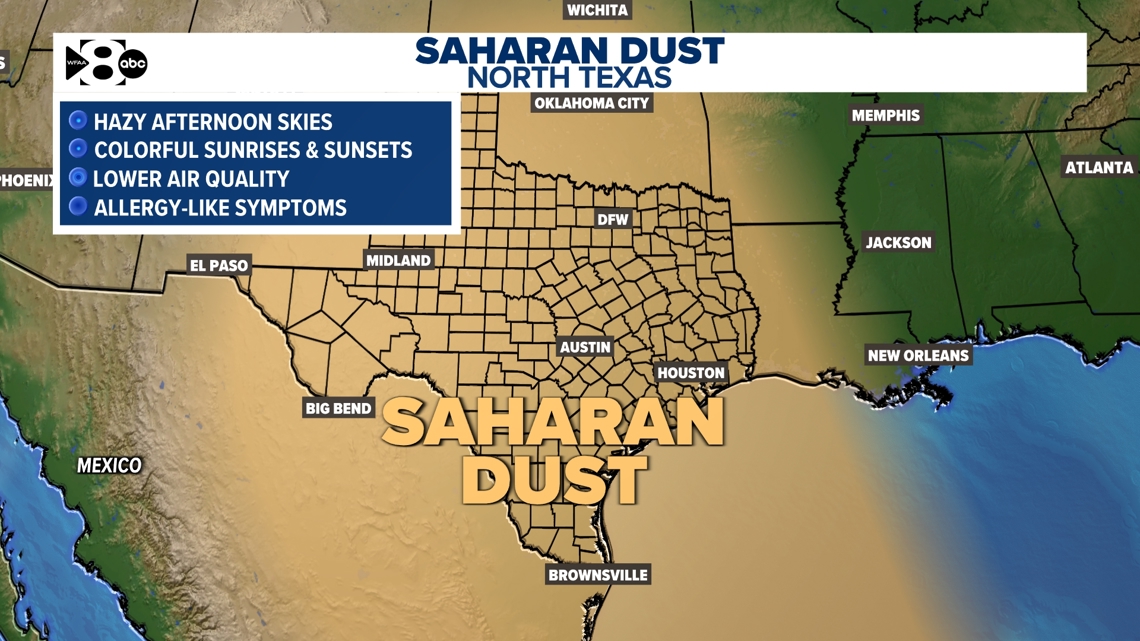

North Texas Skies Clouded Understanding The Saharan Dust Intrusion

May 30, 2025

North Texas Skies Clouded Understanding The Saharan Dust Intrusion

May 30, 2025 -

Repatriation Demand Indigenous Groups Seek Return Of Sacred Objects From Vatican

May 30, 2025

Repatriation Demand Indigenous Groups Seek Return Of Sacred Objects From Vatican

May 30, 2025

Latest Posts

-

Women Are Farmers Too A Powerful Message From Clarksons Show

Jun 01, 2025

Women Are Farmers Too A Powerful Message From Clarksons Show

Jun 01, 2025 -

Scheduled Road Work In Wilkes Barre For Essential Water Main Upgrade

Jun 01, 2025

Scheduled Road Work In Wilkes Barre For Essential Water Main Upgrade

Jun 01, 2025 -

Bidding Opens Nancy Astors Diamond Tiara At Bonhams Auction

Jun 01, 2025

Bidding Opens Nancy Astors Diamond Tiara At Bonhams Auction

Jun 01, 2025 -

Major Water Line Upgrades Coming To Pittsburgh A 7 5 M Investment From Pa American Water

Jun 01, 2025

Major Water Line Upgrades Coming To Pittsburgh A 7 5 M Investment From Pa American Water

Jun 01, 2025 -

Sloane Stephens How Upper Body Burnout Left Her Feeling Weak And Exhausted

Jun 01, 2025

Sloane Stephens How Upper Body Burnout Left Her Feeling Weak And Exhausted

Jun 01, 2025