School Choice Expansion: Trump's Tax Credit Plan For National School Vouchers Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

School Choice Expansion: Trump's Tax Credit Plan for National School Vouchers Explained

The debate surrounding school choice is heating up again, with renewed focus on potential national school voucher programs. A key proposal gaining traction centers around a tax credit plan, similar to those previously championed by figures like former President Donald Trump. This plan aims to significantly expand school choice options for families across the nation, but what exactly does it entail, and what are the potential implications?

Understanding the Tax Credit Approach to School Vouchers

Unlike direct government funding of vouchers, a tax credit system operates by offering tax breaks to individuals who contribute to private school tuition. This approach leverages private funding to support school choice, shifting some of the financial burden from the government to individual taxpayers. The mechanics typically involve a refundable tax credit, meaning families can receive the credit even if they don't owe federal taxes. This makes the program more accessible to low- and middle-income families, a crucial aspect for ensuring equitable access to school choice.

Trump's Proposed Plan: Key Features and Potential Impact

While the specifics of any proposed national voucher plan can vary, a common thread is the use of a substantial tax credit to incentivize private school enrollment. Trump's past proposals focused on creating a significant tax credit, potentially making private school education more affordable for a wider range of families. This would likely lead to:

- Increased competition among schools: With more families choosing private schools, public schools would face increased pressure to improve their offerings to remain competitive.

- Greater parental choice: Parents would have more autonomy in selecting the educational environment they believe is best suited to their child's needs.

- Potential for increased educational inequality: Critics argue that such programs could exacerbate existing inequalities, potentially benefiting wealthier families more than lower-income families, even with refundable tax credits.

Arguments For and Against National School Vouchers

Proponents argue that school choice empowers parents and improves educational outcomes by fostering competition and innovation within the education sector. They highlight the potential for increased parental satisfaction and improved student achievement in a more diverse range of school environments.

Opponents, however, raise concerns about the potential for increased segregation, diverting funds from public schools, and the lack of accountability mechanisms for private schools receiving indirect public funding through tax credits. They also express worry about the potential for religious discrimination and the draining of resources from already underfunded public schools.

The Ongoing Debate and Future of School Choice

The debate surrounding national school vouchers remains highly contentious. The question of funding, equitable access, and potential negative impacts on public schools are central to the discussion. While a national tax credit approach offers a potential pathway to expanding school choice, it's crucial to carefully consider the potential consequences and ensure any implementation addresses concerns about equity and accountability. Further research and analysis are necessary to fully understand the potential long-term effects of such programs.

Further Reading:

- [Link to a relevant article on school choice from a reputable news source]

- [Link to a research paper on the effectiveness of school voucher programs]

This ongoing debate is a crucial one for the future of education in America, requiring careful consideration of the multifaceted implications of expanding school choice options. The discussion should continue, encompassing diverse viewpoints and aiming for solutions that benefit all children.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on School Choice Expansion: Trump's Tax Credit Plan For National School Vouchers Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gaza Aid Site Massacre Eyewitness Testimony And Investigative Reports

Jun 08, 2025

Gaza Aid Site Massacre Eyewitness Testimony And Investigative Reports

Jun 08, 2025 -

M And S Ceo Targeted Hackers Deliver Ransom Demand And Abuse

Jun 08, 2025

M And S Ceo Targeted Hackers Deliver Ransom Demand And Abuse

Jun 08, 2025 -

Finfluencer Arrests A Sign Of Increased Regulatory Scrutiny

Jun 08, 2025

Finfluencer Arrests A Sign Of Increased Regulatory Scrutiny

Jun 08, 2025 -

From South Sudan To The Runway The African Nations Impact On High Fashion

Jun 08, 2025

From South Sudan To The Runway The African Nations Impact On High Fashion

Jun 08, 2025 -

Get Your Nhs Test Results Faster New App Expansion For England

Jun 08, 2025

Get Your Nhs Test Results Faster New App Expansion For England

Jun 08, 2025

Latest Posts

-

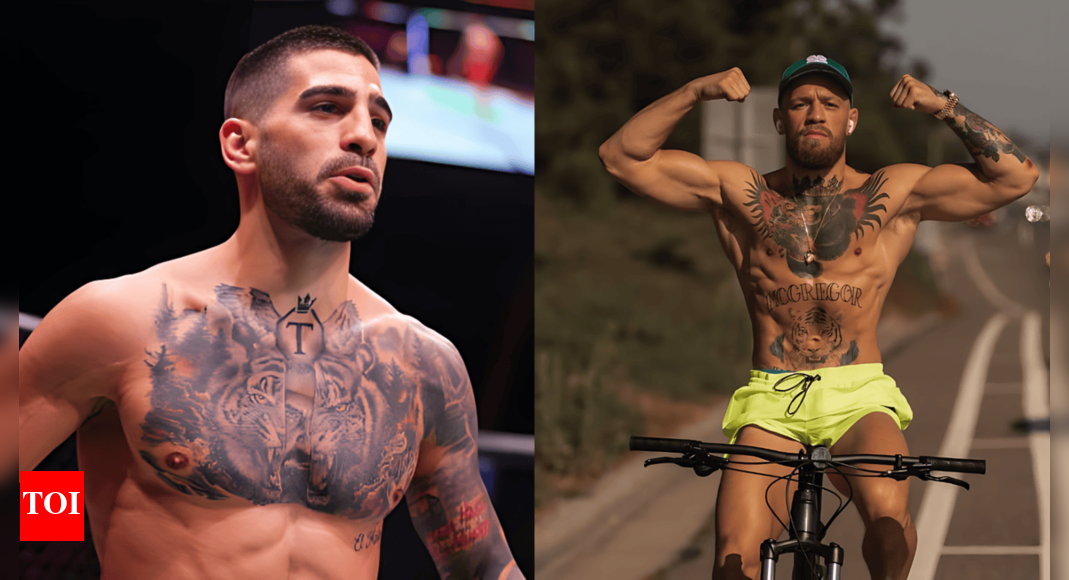

Ilia Topuria Presidential Run Inspired By Conor Mc Gregor

Sep 14, 2025

Ilia Topuria Presidential Run Inspired By Conor Mc Gregor

Sep 14, 2025 -

Bad Bunny Explains Absence Of Us Dates On His Tour

Sep 14, 2025

Bad Bunny Explains Absence Of Us Dates On His Tour

Sep 14, 2025 -

Coldplay Exceeds Expectations With Historic Wembley Show

Sep 14, 2025

Coldplay Exceeds Expectations With Historic Wembley Show

Sep 14, 2025 -

Nato Deploys Eastern Sentry Operation To Counter Russian Drones

Sep 14, 2025

Nato Deploys Eastern Sentry Operation To Counter Russian Drones

Sep 14, 2025 -

Starmer And Mandelson The Unfolding Epstein Email Scandal

Sep 14, 2025

Starmer And Mandelson The Unfolding Epstein Email Scandal

Sep 14, 2025