Secure Your Child's Education: A Comprehensive Guide To 529 Plans

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Secure Your Child's Education: A Comprehensive Guide to 529 Plans

Planning for your child's future is a top priority for many parents, and a significant part of that planning revolves around financing their education. College costs are soaring, making it crucial to start saving early. One of the most powerful tools available to families is the 529 plan, a tax-advantaged savings plan designed specifically for education expenses. This comprehensive guide will walk you through everything you need to know about 529 plans, helping you secure your child's educational future.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan that allows you to invest money for qualified education expenses. These expenses include tuition, fees, room and board, and even some books and supplies at eligible institutions, including colleges, universities, vocational schools, and even some K-12 educational expenses. The beauty of a 529 plan lies in its tax benefits: earnings grow tax-deferred, and withdrawals are tax-free when used for qualified education expenses.

Types of 529 Plans:

There are two main types of 529 plans:

- State-sponsored plans: These plans are offered by individual states and often offer residents certain benefits or incentives. The investment options and fees can vary significantly between states. [Link to a resource comparing state 529 plans]

- Private plans: These plans are managed by private investment companies and are available to residents of any state. They typically offer a wider range of investment options.

Key Benefits of 529 Plans:

- Tax Advantages: As mentioned, earnings grow tax-deferred, and qualified withdrawals are tax-free. This is a significant advantage compared to other savings vehicles.

- Flexibility: You can change beneficiaries, allowing you to adapt the plan to changing circumstances, such as if your child decides not to go to college or if you have another child.

- Investment Growth Potential: 529 plans offer various investment options, allowing you to tailor your investment strategy to your risk tolerance and time horizon.

- Gifting Capabilities: You can make larger contributions in a single year without incurring gift tax penalties through the use of five-year gifting. [Link to IRS information on gifting]

Choosing the Right 529 Plan:

Selecting the right 529 plan requires careful consideration of several factors:

- Investment Options: Look for a plan that offers a diverse range of investment choices to match your risk tolerance and investment goals.

- Fees: Compare the expense ratios of different plans, as even small differences can significantly impact your returns over time.

- State Benefits: If you are a resident of a state offering tax deductions or other incentives for using its 529 plan, consider taking advantage of these benefits.

How to Open a 529 Plan:

Opening a 529 plan is a straightforward process. You can typically do so online through the plan's website. You'll need to provide some personal information and choose your investment options.

Beyond the Basics: Advanced Strategies for 529 Plans:

For more advanced planning, consider strategies like:

- Utilizing the 529 Plan for Non-College Expenses: While less common, some 529 plans now allow withdrawals for K-12 expenses (though check with your plan).

- Strategic Asset Allocation: Adjusting the investment mix as your child gets closer to college.

Conclusion:

Securing your child's education is a significant investment, and 529 plans offer a powerful tool to help you achieve this goal. By understanding the benefits, types, and selection process of 529 plans, you can make informed decisions to build a strong financial foundation for your child's future. Start planning today and give your child the gift of a brighter tomorrow.

Call to Action: Research the 529 plans available in your state and start saving for your child's education today! Don't delay – the sooner you start, the more time your investments have to grow.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Secure Your Child's Education: A Comprehensive Guide To 529 Plans. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alcaraz Sinners French Open Performances Spur My Drive

Jun 04, 2025

Alcaraz Sinners French Open Performances Spur My Drive

Jun 04, 2025 -

Inflation Tariffs And The Rise Of Discount Retailers Like Dollar General

Jun 04, 2025

Inflation Tariffs And The Rise Of Discount Retailers Like Dollar General

Jun 04, 2025 -

England Vs West Indies 3rd Odi Delayed Traffic Chaos

Jun 04, 2025

England Vs West Indies 3rd Odi Delayed Traffic Chaos

Jun 04, 2025 -

Alexander Bubliks Las Vegas Success Fuels French Open 2025 Run

Jun 04, 2025

Alexander Bubliks Las Vegas Success Fuels French Open 2025 Run

Jun 04, 2025 -

Police Raid Backyard Concert All American Rejects Unofficial Gig Interrupted

Jun 04, 2025

Police Raid Backyard Concert All American Rejects Unofficial Gig Interrupted

Jun 04, 2025

Latest Posts

-

Rangers Coaching Staff Expands Quinn And Sacco On Board

Jun 06, 2025

Rangers Coaching Staff Expands Quinn And Sacco On Board

Jun 06, 2025 -

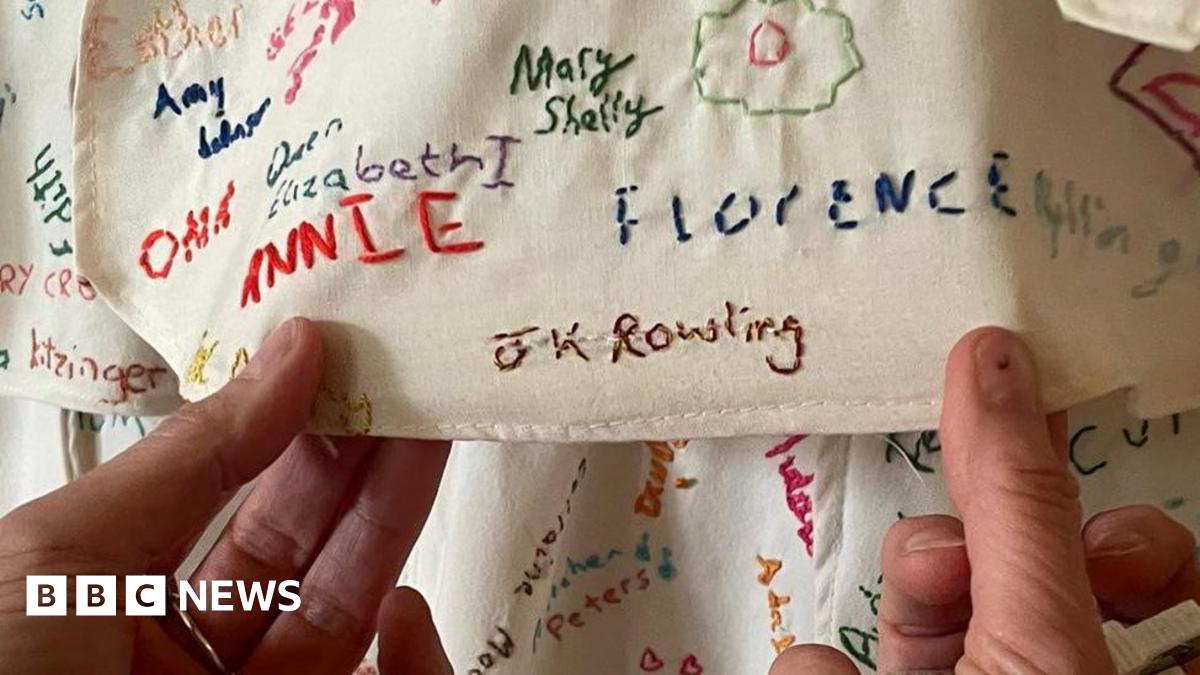

National Trust Investigation Damaged Artwork Featuring J K Rowling In Derbyshire

Jun 06, 2025

National Trust Investigation Damaged Artwork Featuring J K Rowling In Derbyshire

Jun 06, 2025 -

Impact Of Supreme Court Decision On Reverse Discrimination Claims In Employment

Jun 06, 2025

Impact Of Supreme Court Decision On Reverse Discrimination Claims In Employment

Jun 06, 2025 -

Robinhood Hood Stock Performance 6 46 Increase On June 3rd Causes And Implications

Jun 06, 2025

Robinhood Hood Stock Performance 6 46 Increase On June 3rd Causes And Implications

Jun 06, 2025 -

Us Economy Slows Dismal May Jobs Report Reveals 37 000 Private Sector Job Additions

Jun 06, 2025

Us Economy Slows Dismal May Jobs Report Reveals 37 000 Private Sector Job Additions

Jun 06, 2025