Self-Directed Gold IRA: A Retirement Planning Guide

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Self-Directed Gold IRA: A Retirement Planning Guide

Are you looking for a way to diversify your retirement portfolio and protect your savings from market volatility? Investing in a Self-Directed Gold IRA (SDIRA) might be the solution you've been searching for. This guide explores the benefits, risks, and considerations of using gold as part of your retirement strategy.

What is a Self-Directed Gold IRA?

A Self-Directed Gold IRA is a retirement account that allows you to invest in precious metals, primarily gold, silver, platinum, and palladium, in addition to traditional IRA assets. Unlike traditional IRAs managed by financial institutions, a SDIRA gives you greater control over your investments. You can choose which gold-related assets to purchase, providing a level of autonomy not found in standard retirement plans.

Why Choose a Self-Directed Gold IRA?

Several reasons make a Self-Directed Gold IRA an attractive option for retirement planning:

-

Diversification: Gold often acts as a hedge against inflation and market downturns. Including it in your portfolio can reduce overall risk and potentially increase returns. This diversification strategy is crucial for long-term retirement security.

-

Inflation Hedge: Unlike paper assets that lose value during inflationary periods, gold historically retains its value or even increases in worth. This makes it an appealing asset for protecting your retirement savings from the erosive effects of inflation.

-

Control: You have complete control over your investment decisions. You're not limited to the options offered by a traditional IRA provider. This control is a significant advantage for investors who prefer a hands-on approach to managing their retirement funds.

-

Tangible Asset: Gold is a tangible asset, offering a sense of security and peace of mind that some investors find lacking in paper assets. Knowing you own a physical asset can be psychologically comforting.

How to Set Up a Self-Directed Gold IRA:

Setting up a Self-Directed Gold IRA involves several steps:

-

Choose a Custodian: Select a reputable custodian specializing in Self-Directed IRAs. They'll hold and manage your assets according to IRS regulations. Research carefully and compare fees and services.

-

Fund Your Account: Transfer existing retirement funds or contribute new funds to your SDIRA. Contribution limits are subject to IRS guidelines and may change annually. Check the current IRS limits before contributing.

-

Purchase Gold: Once your account is funded, you can purchase gold through approved dealers. It's crucial to ensure the dealer adheres to IRS guidelines for acceptable gold purity and storage.

-

Storage: Secure storage of your gold is vital. Your custodian may offer storage options, or you might need to find a reputable, IRS-approved depository.

Risks and Considerations:

While offering significant advantages, SDIRAs also present certain risks:

-

Market Volatility: Gold prices, like any commodity, fluctuate. While it acts as a hedge, it's not immune to market forces.

-

Storage Costs: Storage fees can add to your overall expenses.

-

IRS Regulations: Strict IRS regulations govern Self-Directed Gold IRAs. Non-compliance can result in severe penalties. Thorough understanding of these regulations is crucial.

Conclusion:

A Self-Directed Gold IRA offers a compelling avenue for retirement planning, providing diversification, inflation protection, and control over your investments. However, careful planning, understanding the risks, and selecting a reputable custodian are crucial for successful implementation. Remember to consult with a qualified financial advisor before making any investment decisions. They can help you determine if a Self-Directed Gold IRA aligns with your overall financial goals and risk tolerance. This information is for educational purposes only and does not constitute financial advice.

Further Reading:

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Self-Directed Gold IRA: A Retirement Planning Guide. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nyt Spelling Bee Hints And Spangram For June 3rd

Jun 04, 2025

Nyt Spelling Bee Hints And Spangram For June 3rd

Jun 04, 2025 -

Lorenzo Musettis Breakthrough First Top 10 Win At A Grand Slam

Jun 04, 2025

Lorenzo Musettis Breakthrough First Top 10 Win At A Grand Slam

Jun 04, 2025 -

Trumps Presidency Spurs American Emigration

Jun 04, 2025

Trumps Presidency Spurs American Emigration

Jun 04, 2025 -

Industry Headwinds Cause Significant Financial Strain For Energy Storage Provider Powin

Jun 04, 2025

Industry Headwinds Cause Significant Financial Strain For Energy Storage Provider Powin

Jun 04, 2025 -

High Tech Project Failure Causes Consequences And Lessons Learned

Jun 04, 2025

High Tech Project Failure Causes Consequences And Lessons Learned

Jun 04, 2025

Latest Posts

-

May Jobs Report Shows Significant Slowdown 37 000 Private Sector Jobs Added

Jun 06, 2025

May Jobs Report Shows Significant Slowdown 37 000 Private Sector Jobs Added

Jun 06, 2025 -

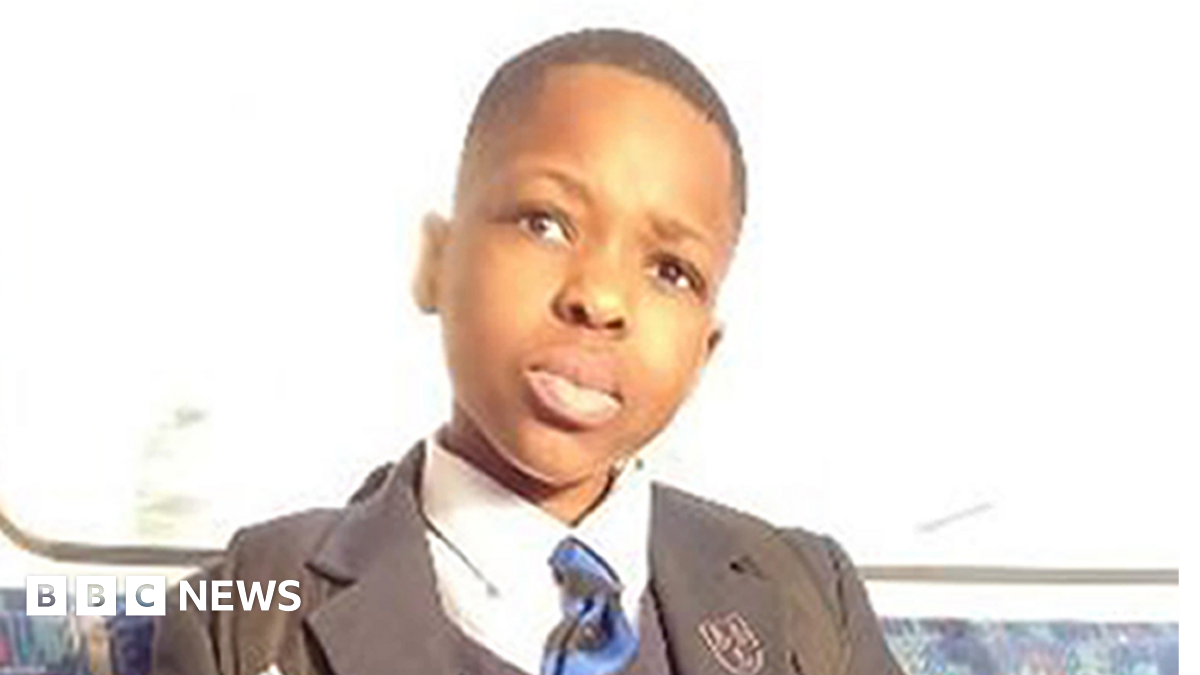

Court Testimony Details Marcus Monzos Alleged Plot To Kill Daniel Anjorin

Jun 06, 2025

Court Testimony Details Marcus Monzos Alleged Plot To Kill Daniel Anjorin

Jun 06, 2025 -

2026 Patriot League Expansion Villanova Footballs New Home

Jun 06, 2025

2026 Patriot League Expansion Villanova Footballs New Home

Jun 06, 2025 -

Impact Of Villanovas Departure Reshaping The Future Of Caa Football

Jun 06, 2025

Impact Of Villanovas Departure Reshaping The Future Of Caa Football

Jun 06, 2025 -

Core Weaves Potential Could It Rival Nvidias Success

Jun 06, 2025

Core Weaves Potential Could It Rival Nvidias Success

Jun 06, 2025