Self-Directed IRA Report Released: Optimizing Retirement With Gold & Precious Metals

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Self-Directed IRA Report Released: Optimizing Retirement with Gold & Precious Metals

Are you looking for ways to diversify your retirement portfolio and potentially protect your savings from market volatility? A new report highlights the growing trend of investing in gold and precious metals through Self-Directed IRAs (SDIRAs). This strategy offers unique opportunities for retirement planning, but understanding the regulations and potential benefits is crucial.

The recent report, [insert report name and link if available, otherwise remove this sentence], sheds light on the advantages and considerations of using a Self-Directed IRA to invest in precious metals. It explores how this alternative asset class can complement traditional retirement investments, potentially mitigating risks associated with stocks and bonds.

What is a Self-Directed IRA?

A Self-Directed IRA (SDIRA) provides investors with greater control over their retirement funds compared to traditional IRAs. Unlike traditional plans that limit investment choices to a pre-selected range of options, a SDIRA allows you to invest in a wider array of assets, including:

- Real Estate: Properties, REITs, and other real estate investments.

- Private Equity: Investing in startups and other private companies.

- Precious Metals: Gold, silver, platinum, and palladium.

- Tax Liens & Deeds: Investing in tax-delinquent properties.

This increased flexibility can be particularly appealing to those seeking alternative investment strategies to potentially boost their retirement savings.

Why Gold and Precious Metals in Your SDIRA?

Gold and other precious metals have historically served as a hedge against inflation and economic uncertainty. Investing in them through a SDIRA offers several key potential benefits:

- Diversification: Precious metals can reduce portfolio risk by diversifying away from traditional assets. This is especially important in times of market volatility.

- Inflation Hedge: Gold has often held its value or even increased in value during inflationary periods, potentially protecting your retirement savings from the erosion of purchasing power.

- Tangible Asset: Unlike stocks or bonds, precious metals are tangible assets you can physically possess, offering a sense of security to some investors.

- Tax Advantages: Depending on your individual circumstances and tax laws, investing in precious metals within a SDIRA may offer tax advantages compared to holding them outside of a retirement account. Consult with a qualified tax advisor to understand the implications.

Understanding the Regulations

While the flexibility of a SDIRA is attractive, it's vital to understand the IRS regulations governing these accounts. Incorrect handling can lead to significant penalties. Key regulations concerning precious metals in SDIRAs include:

- IRS-approved custodians: You must use a custodian approved by the IRS to hold your precious metals.

- Eligible metals: Only certain types of gold, silver, platinum, and palladium are eligible for IRA investment. The report details specifics on acceptable forms and purity.

- Storage requirements: Regulations dictate where your precious metals can be stored. Typically, they must be held in an IRS-approved depository.

Getting Started with Precious Metals in Your SDIRA

Before investing in gold and precious metals through your SDIRA, it's essential to:

- Research reputable custodians: Find a custodian that specializes in SDIRAs and offers precious metals storage solutions.

- Consult a financial advisor: Discuss your investment goals and risk tolerance with a qualified financial advisor specializing in alternative investments.

- Understand the costs: Factor in storage fees, custodian fees, and any transaction costs associated with buying and selling precious metals.

Disclaimer: This article is for informational purposes only and should not be considered financial or tax advice. Consult with a qualified financial advisor and tax professional before making any investment decisions.

This detailed exploration of Self-Directed IRAs and precious metals investment aims to provide valuable insights for readers considering this strategy to optimize their retirement planning. Remember to always conduct thorough research and seek professional guidance before making any significant financial decisions. Learn more about [link to relevant resources, e.g., government websites, financial planning organizations].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Self-Directed IRA Report Released: Optimizing Retirement With Gold & Precious Metals. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

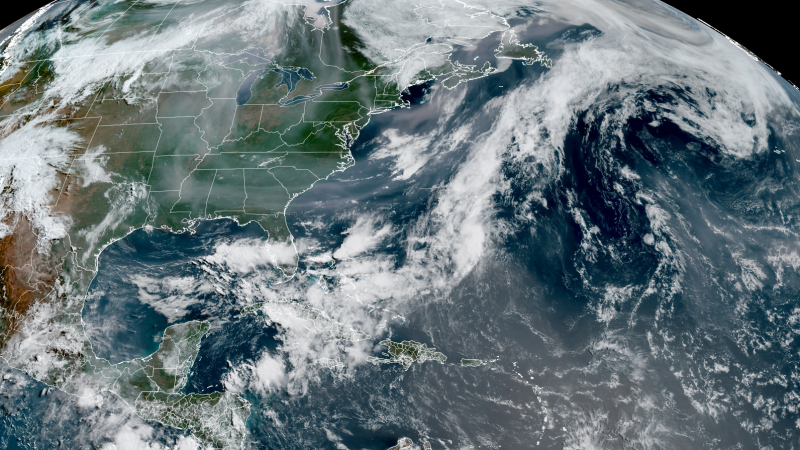

Air Quality Warning Canadian Wildfire Smoke And African Dust Cloud To Impact Southern Us

Jun 05, 2025

Air Quality Warning Canadian Wildfire Smoke And African Dust Cloud To Impact Southern Us

Jun 05, 2025 -

Inside The Mind Of Alexander Bublik Normalcy And The Elite Athlete

Jun 05, 2025

Inside The Mind Of Alexander Bublik Normalcy And The Elite Athlete

Jun 05, 2025 -

Will Karen Read Testify Defense Filing Hints At Silence In Retrial

Jun 05, 2025

Will Karen Read Testify Defense Filing Hints At Silence In Retrial

Jun 05, 2025 -

The Oxford Cambridge Railway Navigating Its Classification Within England And Wales

Jun 05, 2025

The Oxford Cambridge Railway Navigating Its Classification Within England And Wales

Jun 05, 2025 -

Government Reverses Course Winter Fuel Payment Changes Explained

Jun 05, 2025

Government Reverses Course Winter Fuel Payment Changes Explained

Jun 05, 2025

Latest Posts

-

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025 -

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025 -

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025 -

Understanding The Trump Putin Alaska Summit Five Crucial Points

Aug 17, 2025

Understanding The Trump Putin Alaska Summit Five Crucial Points

Aug 17, 2025 -

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025