Selling The Agenda: How The Trump Administration Is Focusing On Tax Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Selling the Agenda: How the Trump Administration Focused on Tax Cuts

The Trump administration's economic policy was largely defined by its aggressive pursuit of tax cuts, a cornerstone of its "America First" agenda. This strategy, while celebrated by some as a crucial engine for economic growth, faced significant criticism regarding its impact on income inequality and the national debt. Understanding the administration's approach requires examining its core arguments, the legislative process, and the resulting economic consequences.

The Core Argument: Trickle-Down Economics and Stimulating Growth

The central justification for the 2017 Tax Cuts and Jobs Act (TCJA) was the theory of trickle-down economics. The administration argued that significant tax cuts for corporations and high-income earners would incentivize investment, job creation, and ultimately, benefit the entire economy. This promised a boost to wages, increased economic activity, and a stronger American position on the global stage. The administration frequently highlighted projected economic growth as a key selling point, using optimistic forecasts to justify the considerable reduction in federal revenue.

Legislative Push and Political Maneuvering:

The passage of the TCJA was a significant political achievement for the Trump administration. Despite facing unified Democratic opposition and some Republican reservations, the bill was passed with only Republican votes in both the House and Senate. This required skillful political maneuvering, including utilizing the budget reconciliation process to avoid a filibuster in the Senate. The swift passage demonstrated the administration's prioritization of this legislative agenda and its ability to navigate partisan divides within Congress. This rapid passage, however, also fueled accusations of a lack of transparency and insufficient public debate.

Key Provisions of the TCJA:

The TCJA implemented several key changes:

- Corporate Tax Rate Reduction: The most significant change was the reduction of the corporate tax rate from 35% to 21%. This was a central element of the administration's plan to attract businesses and investment back to the United States.

- Individual Income Tax Rate Cuts: Individual income tax rates were also reduced across the board, though the benefits were disproportionately skewed towards higher-income earners.

- Standard Deduction Increases: The standard deduction was significantly increased, simplifying tax filing for many individuals but also reducing the number of taxpayers who itemized deductions.

Economic Impact and Long-Term Consequences:

The economic consequences of the TCJA remain a subject of ongoing debate. While some economists pointed to a short-term boost in economic activity, others highlighted concerns about:

- Increased National Debt: The tax cuts significantly reduced federal revenue, leading to a substantial increase in the national debt. This raised concerns about the long-term fiscal sustainability of the nation.

- Income Inequality: Critics argued that the tax cuts disproportionately benefited the wealthy, exacerbating income inequality. The lack of significant wage growth for low and middle-income earners further fueled this criticism.

- Lack of Sustainable Growth: While initial economic growth was observed, critics questioned whether the growth was sustainable and whether it justified the long-term fiscal costs.

Conclusion: A Legacy of Debate

The Trump administration's focus on tax cuts represents a significant chapter in American economic policy. Its legacy remains a subject of intense debate, with proponents pointing to positive economic indicators and opponents highlighting the negative consequences on income inequality and the national debt. Further research and analysis are crucial to fully understand the long-term impact of the TCJA on the American economy. Analyzing the data over the coming years will provide a clearer picture of its overall success or failure. What is clear is that the TCJA fundamentally reshaped the American tax code, leaving a lasting impact on the country's fiscal trajectory and economic landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Selling The Agenda: How The Trump Administration Is Focusing On Tax Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Ukraine War Chinas Position And Potential Influence

Aug 23, 2025

The Ukraine War Chinas Position And Potential Influence

Aug 23, 2025 -

Vrabels Outrage Patriots Coach Slams Ja Lynn Polk Report

Aug 23, 2025

Vrabels Outrage Patriots Coach Slams Ja Lynn Polk Report

Aug 23, 2025 -

Selling The Agenda How The Trump Administration Plans To Use Tax Cuts To Sway Voters

Aug 23, 2025

Selling The Agenda How The Trump Administration Plans To Use Tax Cuts To Sway Voters

Aug 23, 2025 -

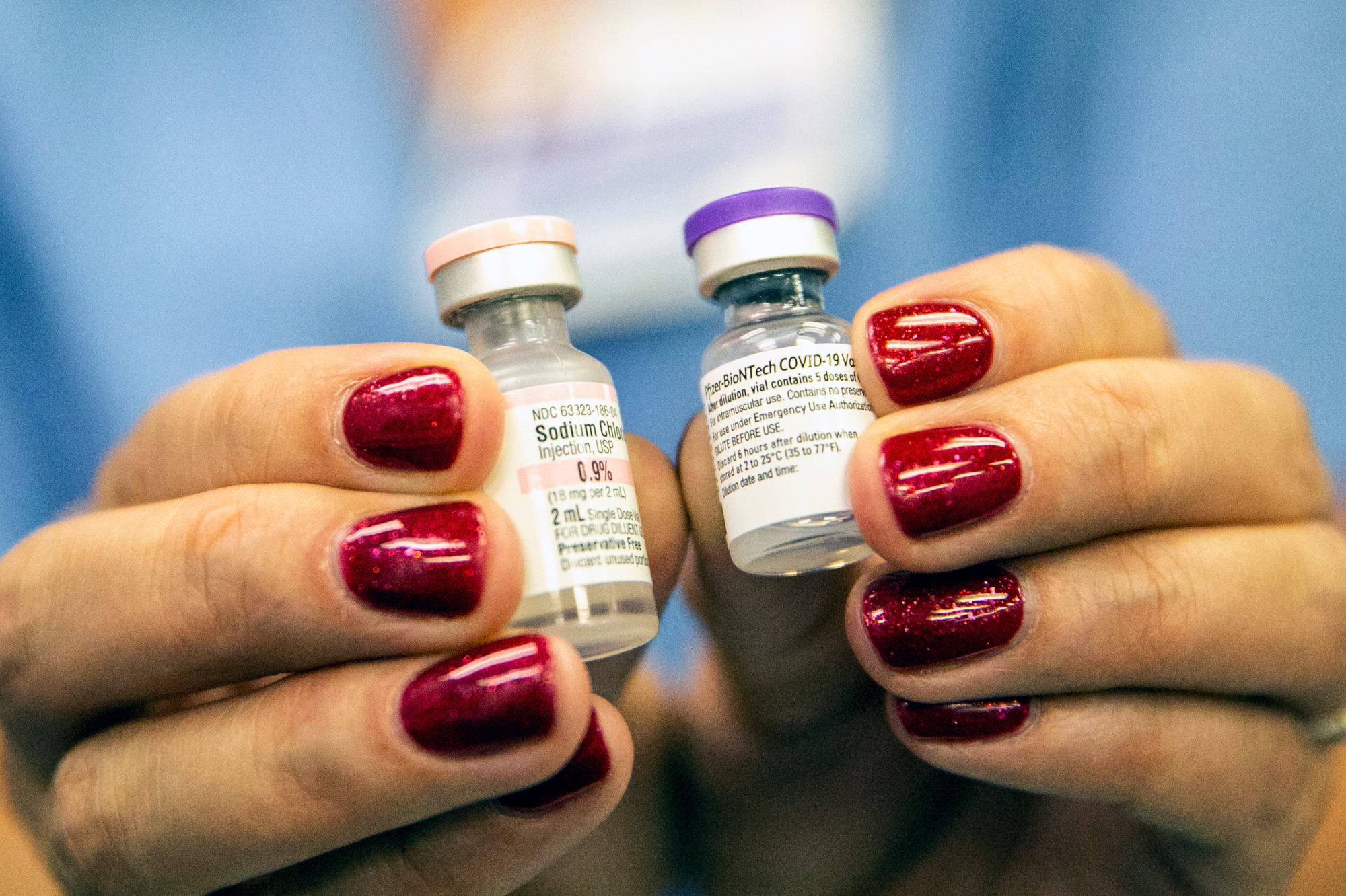

Colorado Doctor Recommends Fall 2024 Vaccines

Aug 23, 2025

Colorado Doctor Recommends Fall 2024 Vaccines

Aug 23, 2025 -

False Claims Debunked Tanzania Addresses Concerns Over Kenyan Ticket Purchases For Taifa Stars Matches

Aug 23, 2025

False Claims Debunked Tanzania Addresses Concerns Over Kenyan Ticket Purchases For Taifa Stars Matches

Aug 23, 2025

Latest Posts

-

Irate Parents Sue Over Deceptive Toddler Milk Marketing Practices

Aug 23, 2025

Irate Parents Sue Over Deceptive Toddler Milk Marketing Practices

Aug 23, 2025 -

No Coverage For Fall Covid Boosters What You Need To Know About Vaccination Costs

Aug 23, 2025

No Coverage For Fall Covid Boosters What You Need To Know About Vaccination Costs

Aug 23, 2025 -

Wild Card Contenders How Strength Of Schedule Affects Yankees And Rangers

Aug 23, 2025

Wild Card Contenders How Strength Of Schedule Affects Yankees And Rangers

Aug 23, 2025 -

Race Hate Post Leads To Prison Release For Lucy Connolly

Aug 23, 2025

Race Hate Post Leads To Prison Release For Lucy Connolly

Aug 23, 2025 -

Sweet Support Jim Curtiss Behind The Scenes Role In Jennifer Anistons Latest Project

Aug 23, 2025

Sweet Support Jim Curtiss Behind The Scenes Role In Jennifer Anistons Latest Project

Aug 23, 2025