Shared Ownership: A Cautionary Tale Of Broken Promises

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Shared Ownership: A Cautionary Tale of Broken Promises

The dream of homeownership, once seemingly attainable only through traditional mortgages, has been tantalizingly offered to a new generation through shared ownership schemes. But behind the glossy brochures and enticing low deposits lurks a potential nightmare: broken promises and a complex web of financial pitfalls. This article delves into the growing concerns surrounding shared ownership, highlighting the experiences of those who have found themselves trapped in a system that hasn't lived up to its initial appeal.

What is Shared Ownership?

Shared ownership, also known as part-buy part-rent, allows individuals to purchase a share of a property while renting the remaining share from a housing association or similar organization. This reduces the initial deposit required, making homeownership seemingly accessible to those who might otherwise struggle to afford it. However, the reality often differs significantly from the marketing materials.

The Allure and the Allure's Downside:

The appeal is undeniable: a smaller deposit, the chance to get onto the property ladder sooner, and the prospect of eventually owning the property outright through "staircasing"—buying additional shares over time. But this seemingly simple solution often becomes entangled in a complex maze of regulations, hidden fees, and unexpected costs.

Hidden Costs and Unexpected Fees:

Many shared ownership schemes come with significant hidden costs. These can include:

- Service charges: These fees, often significantly higher than those associated with traditional homeownership, cover maintenance, repairs, and insurance. Unexpected increases in service charges can severely impact household budgets.

- Ground rent: Similar to service charges, ground rent can also rise unexpectedly, putting further financial strain on homeowners.

- Staircasing costs: The process of buying additional shares (staircasing) often involves substantial fees and legal costs, which can be prohibitive for some.

- Restrictions on renovations: Shared ownership often comes with restrictions on renovations and improvements, limiting the homeowner's ability to personalize their property.

Broken Promises and Legal Battles:

Numerous reports highlight instances where shared ownership agreements haven't been honored. These include:

- Unrealistic staircasing timelines: Housing associations may make promises about the speed and ease of staircasing, only to delay or refuse applications.

- Unexpected service charge increases: Significant and unjustified increases in service charges have left many homeowners struggling financially.

- Lack of transparency: A lack of transparency around fees and regulations has led to frustration and legal battles for homeowners.

Seeking Legal Advice and Protecting Yourself:

If you are considering shared ownership, seeking independent legal and financial advice is crucial. Thoroughly review all contracts and agreements, ensuring you understand all associated costs and potential risks. Don't hesitate to challenge any unclear or unfair terms.

Alternatives to Shared Ownership:

For those seeking more affordable pathways to homeownership, consider exploring alternatives such as:

- Help to Buy schemes: Government-backed schemes can provide financial assistance for first-time buyers. (Link to relevant government website here)

- Affordable housing initiatives: Local authorities often offer affordable housing options for those on low incomes. (Link to relevant local authority website here - replace with example)

Conclusion:

Shared ownership can be a viable option for some, but it's essential to approach it with caution. The alluring promise of homeownership shouldn't overshadow the potential risks and pitfalls. Thorough research, expert advice, and a realistic understanding of the financial implications are paramount to avoid becoming another cautionary tale in the shared ownership saga. Remember to always seek independent advice before signing any contracts.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Shared Ownership: A Cautionary Tale Of Broken Promises. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Caitlin Clarks Shooting Prowess A Basketball Legends Reaction

Jun 18, 2025

Caitlin Clarks Shooting Prowess A Basketball Legends Reaction

Jun 18, 2025 -

Top 5 Wnba Bets And Player Props For Tuesday June 17 2025

Jun 18, 2025

Top 5 Wnba Bets And Player Props For Tuesday June 17 2025

Jun 18, 2025 -

Israels Technological Edge Countering Irans Larger Armed Forces

Jun 18, 2025

Israels Technological Edge Countering Irans Larger Armed Forces

Jun 18, 2025 -

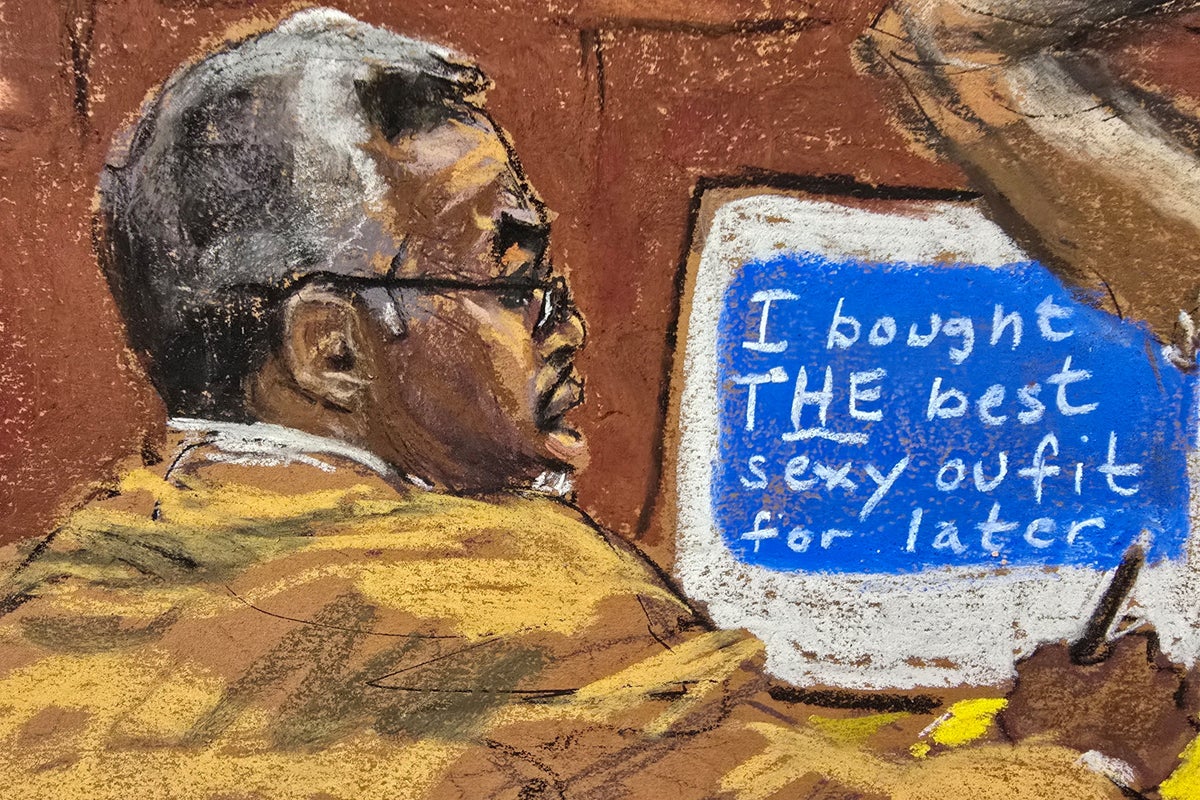

Diddy Trial Jurors View More Explicit Videos

Jun 18, 2025

Diddy Trial Jurors View More Explicit Videos

Jun 18, 2025 -

Mouth Tape For Sleep Fact Vs Fiction A Critical Review Of Its Effectiveness And Cost

Jun 18, 2025

Mouth Tape For Sleep Fact Vs Fiction A Critical Review Of Its Effectiveness And Cost

Jun 18, 2025

Latest Posts

-

Fatal Devon Skydive Man And Woman Identified By Police

Jun 18, 2025

Fatal Devon Skydive Man And Woman Identified By Police

Jun 18, 2025 -

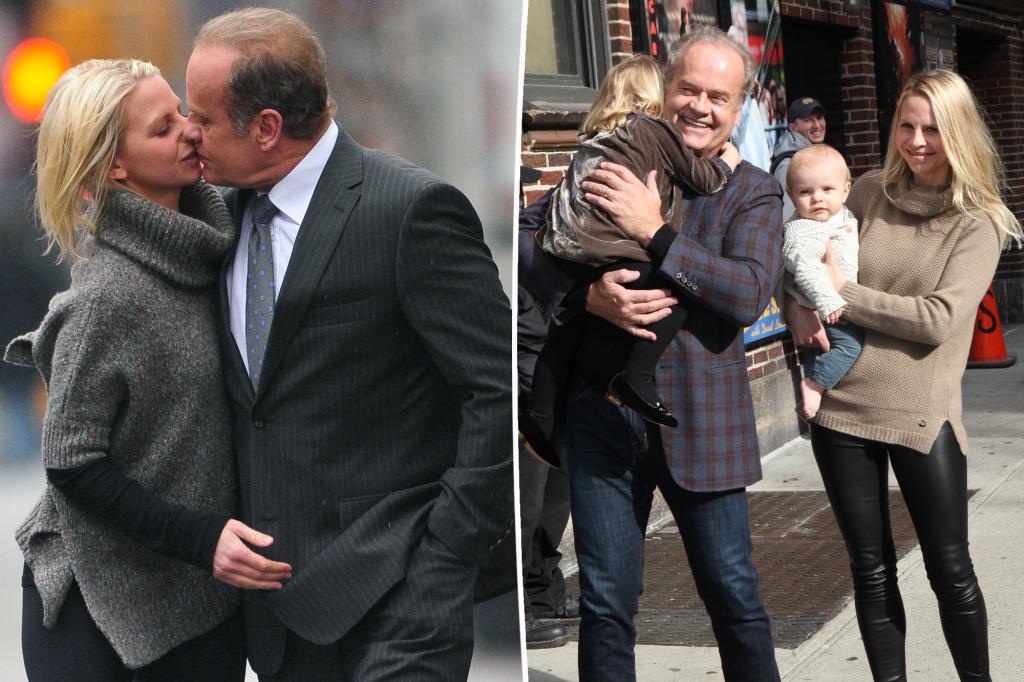

Actor Kelsey Grammer Expecting Baby Number Eight At Age 70

Jun 18, 2025

Actor Kelsey Grammer Expecting Baby Number Eight At Age 70

Jun 18, 2025 -

Diddys Trial Key Text Messages Examined As Court Adjourns For The Day

Jun 18, 2025

Diddys Trial Key Text Messages Examined As Court Adjourns For The Day

Jun 18, 2025 -

Post Injury Comeback Clarks Strong Showing Against Liberty

Jun 18, 2025

Post Injury Comeback Clarks Strong Showing Against Liberty

Jun 18, 2025 -

Kelsey Grammer To Become Father Again At 70 Wife Kayte Walsh Pregnant

Jun 18, 2025

Kelsey Grammer To Become Father Again At 70 Wife Kayte Walsh Pregnant

Jun 18, 2025